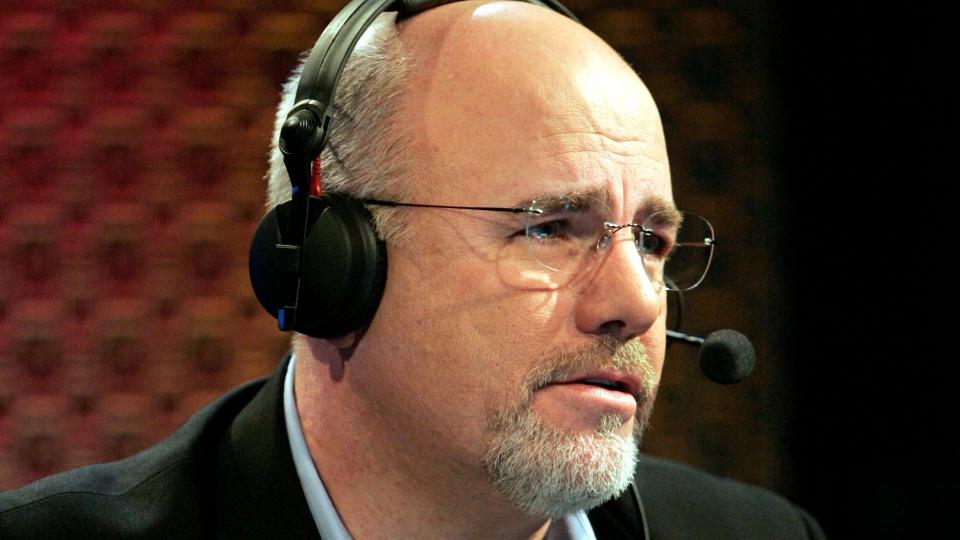

Dave Ramsey is a personal finance guru, national bestselling author and host of “The Ramsey Show,” where he talks about crushing debt, saving for emergencies and building wealth. He is known for telling his callers to do things like eat rice and beans for a stretch of time to get out of debt.

I’m a Financial Expert: Always Buy the Cheapest Version of These 10 Things

Also: 3 Things You Must Do When Your Savings Reach $50,000

Although you may not want to go on a rice-and-beans diet, here are nine frugal habits Dave Ramsey swears by that can help you meet your financial goals.

Sponsored: The Results Are In: Is your bank one of the best of the year?

Buy Generic Products

If you’ve ever tried them, you know that generic products can be hit or miss. However, did you know that many name-brand items are exactly the same as generic ones? The difference is that the brand name pays more money for marketing, so it’s sold at a higher price.

Ramsey recommends trying out generics when it comes to staple food items, medicine, cleaning supplies and paper products.

Cancel Unused Subscriptions and Memberships

If you are subscribing to more than one TV streaming service, pick one and cancel the rest, Ramsey says. Then, evaluate the rest of your subscriptions or memberships by asking yourself whether each one adds value to your life or changes it in some way. If not, cancel it.

Living Frugally: Adopting Lessons From the Great Depression

Reduce Energy Expenses

To easily reduce energy expenses at home, Ramsey suggests taking shorter showers, washing clothes in cold water, turning off lights when you leave a room and fixing running toilets. He says you’ll be shocked at how these small changes can really add up.

Take Your Lunch to Work

On average, people spend $3,639 per year — $300 per month — on food away from home, according to the U.S. Bureau of Labor Statistics Consumer Expenditures. You can save by taking your lunch to work. Take leftovers or meal plan to make it easy. Ramsey says brown-bagging your lunch is a great way to save money and eat healthier.

Stop Eating Out at Night and on Weekends

Eating out is part of the thousands of dollars you spend on food away from home. Ramsey suggests not doing it. In fact, eating out is the first thing he tells indebted people to cut out of their budgets. Create your own takeout-inspired meals at home to help you feel like you’re not being totally deprived.

Switch Your Cell Phone Plan

If you haven’t shopped for a cell phone plan lately, Ramsey suggests seeing how much you can save if you switch providers. Once you get the information, contact your current provider and see whether it will offer you a comparable deal to stay. If not, and if your contract will allow, make the switch to a cheaper provider.

Try a No-Spend Month

If you’re trying to pay off debt or save money, Ramsey says, every month should be a no-spend month. If you spend only on what you need and cut out all of the extra fluff, you might be surprised at how much you can save in 30 days. To help you succeed, Ramsey says to make sure you know what you will and won’t buy from Day 1.

Do-It-Yourself When You Can

Seriously consider whether you can do something before hiring someone else to do it for you. Projects such as installing a backsplash, building a bench or putting in a new floor might be well within your capabilities. If you think you can do it, remember that YouTube is your friend.

Stay Away From Stores That Tempt You

When you’re trying to crush debt or save money, steer clear of stores that tempt you to spend, Ramsey says. For some, the store could be Home Depot; for others, it could be Home Goods.

Be honest with yourself and avoid “that” store at all costs, he says. Instead, choose to do other fun things that won’t cause you to spend a bunch of money, like playing a board game with your family or cooking a meal at home.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 9 Frugal Habits Dave Ramsey Swears By

Credit: Source link