Christopher Comparato, the CEO of Toast Inc, has recently made a significant move by selling 58,000 shares of the company on November 29, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can often provide valuable insights into a company’s financial health and future prospects.

Who is Christopher Comparato?

Christopher Comparato is the Chief Executive Officer of Toast Inc, a cloud-based, end-to-end technology platform purpose-built for the entire restaurant community. Comparato has been at the helm of Toast since February 2015, leading the company through substantial growth phases, including its initial public offering (IPO). Under his leadership, Toast has expanded its product offerings and market presence, becoming a key player in the restaurant and hospitality technology industry.

About Toast Inc

Toast Inc (NYSE:TOST) is a company that operates at the intersection of technology and hospitality. It provides a comprehensive suite of software as a service (SaaS) products, including point-of-sale (POS) systems, front-of-house, back-of-house, and guest-facing technology for restaurants. Toast’s platform is designed to streamline operations, increase revenue, and deliver amazing guest experiences. The company’s innovative solutions have made it a favorite among small and medium-sized eateries as well as larger restaurant chains.

Analysis of Insider Buy/Sell and Relationship with Stock Price

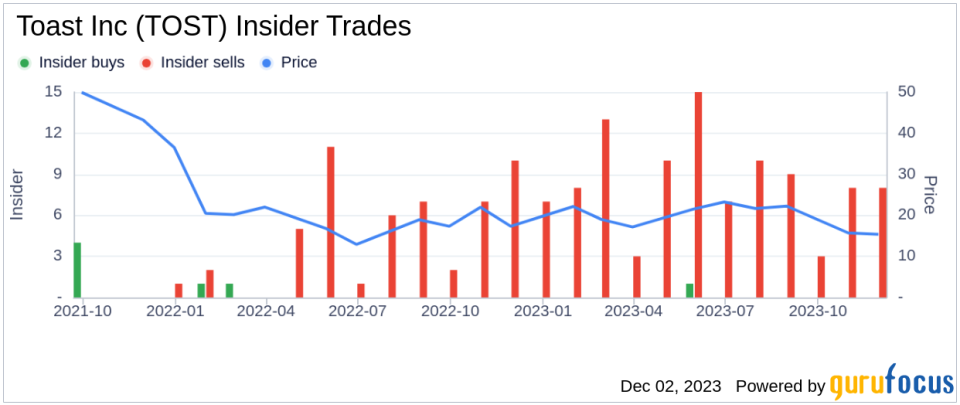

Insider transactions are closely monitored by investors as they can provide clues about a company’s internal perspective on its stock’s value. In the case of Toast Inc, the insider transaction history over the past year shows a significant imbalance between buys and sells, with only 1 insider buy compared to 101 insider sells. This could be interpreted as a lack of confidence among insiders in the company’s stock price appreciation potential or may simply reflect personal financial decisions by the insiders.

Christopher Comparato’s recent sale of 58,000 shares is part of a larger pattern of divestment by the CEO. Over the past year, the insider has sold a total of 1,345,635 shares and has not made any purchases. This consistent selling activity could raise questions among investors about the long-term value of the stock. However, it is important to consider that insiders may sell shares for various reasons, such as diversifying their portfolio, tax planning, or personal financial needs, which are not necessarily related to their outlook on the company’s performance.

On the day of Comparato’s recent sale, Toast Inc’s shares were trading at $15.29, giving the company a market cap of $8.276 billion. The stock price and market cap provide a snapshot of the company’s valuation at a single point in time and can be influenced by a multitude of factors, including market sentiment, industry trends, and overall economic conditions.

It is also crucial to analyze the timing and context of insider transactions. If a sale occurs after a significant run-up in the stock price, it might be seen as a logical move to realize gains. Conversely, if the sale happens during a period of declining stock prices, it might be perceived as a lack of confidence in the company’s ability to rebound. For Toast Inc, the broader market context and the company’s performance relative to its peers would be important factors to consider when interpreting these insider transactions.

When analyzing insider trends, it is beneficial to look at the overall pattern of insider behavior over time. The provided insider trend image can offer a visual representation of this activity:

This image can help investors identify whether the recent sales by Christopher Comparato are part of a longer-term trend or if they represent a deviation from the norm. Additionally, comparing the volume and frequency of insider sales to the company’s stock price movements can offer insights into potential correlations or causations.

Conclusion

Christopher Comparato’s recent sale of 58,000 shares of Toast Inc is a significant event that warrants attention from investors and market analysts. While insider sales can be influenced by various personal and market factors, they are always worth investigating to gain a deeper understanding of the company’s internal perspective. For Toast Inc, the disparity between insider buys and sells over the past year suggests a trend that could be indicative of the insiders’ collective outlook on the stock’s future performance. Investors should consider this information alongside other financial data and market analysis when making investment decisions regarding Toast Inc.

As with any insider transaction, it is essential to consider the broader context, including the company’s financial health, competitive position, and market conditions, before drawing conclusions. By keeping an eye on insider activity and understanding its potential implications, investors can make more informed decisions and better assess the risks and opportunities associated with Toast Inc’s stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link