Note: A version of this post first appeared on TKer.co.

Stocks ticked lower last week, with the S&P 500 declining 0.7% to close at 4,288.05. Down 4.9% in September, it was the worst month for the S&P since December. The index is now up 11.7% year to date, up 19.9% from its October 12 closing low of 3,577.03, and down 10.6% from its January 3, 2022 record closing high of 4,796.56.

It’s difficult to truly know what’s moving markets in a given day, week, or month.

One thing that’s for sure is there’s always a long list of reasons to be worried and dump stocks. So during those stretches when markets are down, it’s pretty easy to just back into a narrative that seems to make sense.

But have there ever been periods where there wasn’t much for market participants to be worried about?

Two times the market didn’t seem worried

I can recall two times in recent memory when the market environment seemed pretty comfortable.

In the fall of 2017, everything in the economy seemed to be moving in the right direction while the stock market was trading at all-time highs. And consumers took notice. From the University of Michigan’s November 2017 consumer sentiment survey (via Myles Udland, emphasis added):

“What has changed recently is the degree of certainty with which consumers hold their economic expectations. In contrast to the media buzz about approaching cyclical peaks and an aging expansion, with the implication of greater uncertainty about future economic trends, consumers have voiced greater certainty about their expectations for income, employment, and inflation. Inflation expectations have shown the smallest dispersion on record, and increased certainty about future income and job prospects has become a key factor that has supported discretionary purchases.”

When’s the last time you’ve heard the word “certainty” used so frequently in the context of the markets or the economy?

Early 2020 was another period where things seemed to only be looking up. Consumer confidence was even higher then compared to late 2017. Here’s a sampling of what Wall Street strategists were saying that February (again via Myles):

“We’ve postulated that the most compelling bull case right now is that there is no credible bear case at the moment, especially with evidence mounting that global economic momentum is improving — virus disruption aside.” – David Lefkowitz, UBS Wealth Management“We stay ‘irrationally bullish’ in [the first quarter].” – Michael Hartnett, Bank of America

Of course, the market would prove cruel.

The period of certainty in the fall of 2017 was followed 2018, one of the rare years when the stock market ended the year lower.

And Myles’ piece in February 2020 almost perfectly marked the prepandemic market peak.

There’s no shortage of things to be worried about today

Irony certainly isn’t not lost on the market. This summer’s stock market slump was preceded by a period during which economists scaled back recession expectations and strategists revised up their stock market forecasts.

To be fair, there’s a lot to be worried about these days: Interest rates are rising, oil prices are up, the dollar has been strengthening, monetary policy is tight, and debt delinquency rates are normalizing. There’s also China’s slowing economy, the restart of student loan payments, ongoing labor strikes, and the ever-present threat of a U.S. government shutdown.

Most of these issues have been brewing for weeks if not months. So, the intensity of some of the recent daily market moves have arguably been a bit surprising.

After Tuesday’s ugly 1.5% tumble in the S&P, DataTrek Research co-founder Nicholas Colas pondered what could’ve catalyzed that day’s move.

He acknowledged the past week’s developments in the economic data, interest rates, currencies, and energy prices among other things. But he also argued that none of the developments were exactly breaking news.

“With no clear suspects for [Tuesday’s] sharp decline, we are left with the explanation that their collective influence was enough to tip markets over and have them cascade lower, even if their individual influence was negligible,” Colas wrote.

“In one sense, this is good news,” he added. “There is no crisis in the offing, just a set of troublesome market signals that should eventually wash out.”

That’s the kind of level-headed assessment you get from someone who’s been doing this a long time.

And to be clear, it’s not all bad news. Consumer spending continues to be healthy, and personal consumption represents 69% of GDP. Business investment order activity remains strong, which is bullish because this is an indicator of future growth. And inflation rates continue to cool, which is great news for consumer spending power and it means the Federal Reserve’s effort to cool prices is working. Updates on all this in the review of macro crosscurrents below.

The big picture

When certainty is high, it’s possible we may just be on the brink of a period of heightened uncertainty during which markets move lower. When uncertainty is high, it’s possible that things get worse and markets go lower.

So the temptation will always be high to make lots of short-term trades in an effort to minimize losses during downturns and maximize gains during upswings. It all speaks to the difficulty of trying to time the market.

Unfortunately, everyone who trades like this believes they have it right, when in reality few can generate above-market returns doing so.

For investors in the stock market, the time-tested move is to give it time with the understanding that prices can be volatile over the short-term. The longer you’re able to hold, the higher your likelihood that you have better returns.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

Government shutdown averted. The U.S. government is not shutting down… until at least November 17.

Inflation is cooling. The personal consumption expenditures (PCE) price index in August was up 3.5% from a year ago, down from the 3.4% increase in July. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 3.9% during the month after coming in at 4.3% higher in the prior month.

On a month over month basis, the core PCE price index was up 0.14%, the lowest level since late 2020. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 2.2% and 3.0%, respectively.

It’s more great news as inflation rates continue to trend towards the Federal Reserve’s target rate of 2%.

“We want to see that these good inflation readings that we’ve been seeing for the last three months, we want to see that it’s more than just three months,” Fed Chair Jerome Powell said on September 20.

Business investment remains strong. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — rose 0.9% to $73.92 billion in August.

Consumer spending ticked higher. According to BEA data, personal consumption expenditures increased 0.4% month over month in August to a record annual rate of $18.7 trillion.

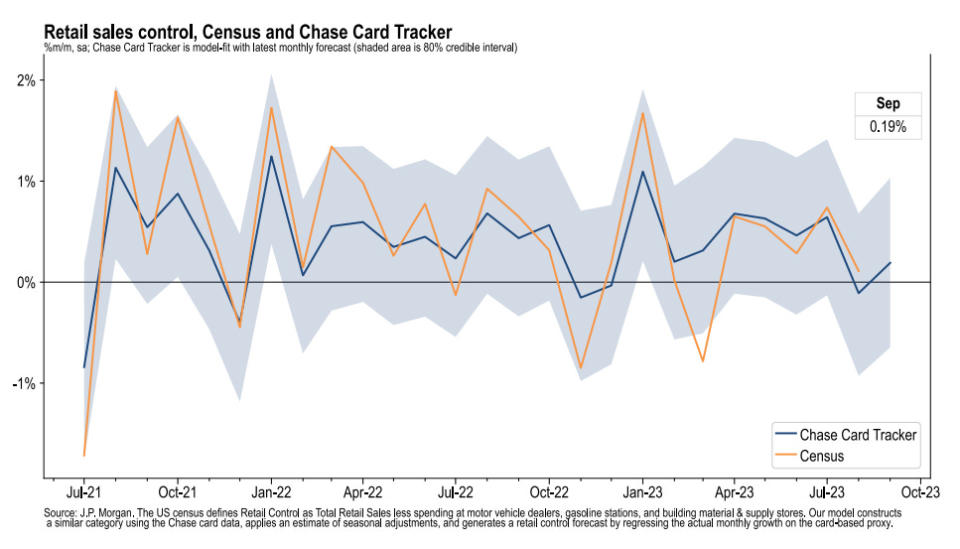

Spending is holding up, according to September card data. From JPMorgan Chase: “As of 24 Sep 2023, our Chase Consumer Card spending data (unadjusted) was 0.6% above the same day last year. Based on the Chase Consumer Card data through 24 Sep 2023, our estimate of the US Census September control measure of retail sales m/m is 0.19%“

Consumers spend more on gas and interest. From Bloomberg: “Consumer spending on gasoline and interest combined accounted for 4.7% of US disposable income last month, the most since August 2014, according to Bureau of Economic Analysis figures published Friday. Interest payments alone, at 2.5% of disposable income, were the highest since September 2008.“

Gas prices tick lower. From AAA: “Despite tepid demand with fewer drivers visiting the pump, the national average for a gallon of gas only fell three cents since last week to reach $3.83. The slow descent is due to the high cost of oil, which is acting like a drogue chute on falling gas prices.“

Consumer confidence falls. On Tuesday, we learned The Conference Board’s Consumer Confidence Index in August fell as expectations deteriorated. From the firm’s Dana Peterson: “Expectations for the next six months tumbled back below the recession threshold of 80, reflecting less confidence about future business conditions, job availability, and incomes. Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise—making big-ticket items more expensive. Expectations for interest rates declined in September after surging in the prior month, but the outlook for stock prices continued to fall. Notably, average 12-month inflation expectations have held steady over the past three months despite ongoing complaints about higher prices…”

“…Still, the measure of expected family financial situation, six months hence (not included in the Expectations Index) worsened further.“

Labor market confidence improves slightly but trend reflects cooling. From The Conference Board’s September Consumer Confidence survey: “40.9% of consumers said jobs were “plentiful,” up from 39.9% in August. But 13.6% of consumers said jobs were “hard to get,” up from 13.2% last month.“

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential), and it’s been reflecting a cooling labor market.

Unemployment claims tick up. Initial claims for unemployment benefits increased to 204,000 during the week ending September 13, up from 202,000 the week prior.While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

New home sales fall. Sales of newly built homes fell 8.7% in August to an annualized rate of 675,000 units.

Home prices rise. According to the S&P CoreLogic Case-Shiller index, home prices rose 1% month-over-month in July. From SPDJI’s Craig Lazzara: “We have previously noted that home prices peaked in June 2022 and fell through January of 2023, declining by 5.0% in those seven months. The increase in prices that began in January has now erased the earlier decline, so that July represents a new all-time high for the National Composite. Moreover, this recovery in home prices is broadly based.“

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 4.9% rate in Q3.

Putting it all together

We continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity, given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this post first appeared on TKer.co.

Credit: Source link