For the past three decades, there have been no shortages of next-big-thing investment trends to captivate the attention of Wall Street and investors. Everything from the advent of the internet to game-changing applications such as genome mapping has changed the course of innovation.

At the moment, there’s no next-big-thing investment trend hotter than artificial intelligence (AI).

AI involves using software and systems to oversee tasks that would generally be handled by humans. What makes AI such a game changer is machine learning, which allows these systems to “learn” over time and become more efficient at their tasks. AI has applications in virtually every sector and industry, which is likely why the researchers at PwC believe it can add up to $15.7 trillion to global gross domestic product by 2030.

Nvidia is the face of the artificial intelligence revolution

Though there are dozens of publicly traded companies that can benefit from the AI revolution, none has been a hotter commodity for investors than semiconductor stock Nvidia (NASDAQ: NVDA).

The company has rapidly become the infrastructure backbone of the AI movement. Its A100 and H100 graphics processing units (GPUs) allow for split-second decisions to be made by AI systems in high-compute data centers. In July, analysts at Citigroup opined that Nvidia could account for “at least 90%” of AI-accelerated data-center GPU share.

It’s an especially exciting time for Nvidia, given that its production of A100 and H100 chips should meaningfully grow in the current calendar year (Nvidia’s fiscal year ends in late January). Specifically, a sizable ramp up in chip-on-wafer-on-substrate capacity by chip-fab giant Taiwan Semiconductor Manufacturing should help Nvidia meet more of its customers’ demands in fiscal 2025.

The proof is in the pudding that Nvidia has been the AI stock to own. Shares have surged a whopping 367% and added well over $1.3 trillion in market value since the start of 2023. Nvidia’s sales are expected to climb from a reported $27 billion in fiscal 2023 to an estimated $93.7 billion by the end of fiscal 2025.

Yet despite this jaw-dropping ascent, all I see are a growing number of reasons Nvidia will disappoint investors. Though the company’s stock has proven me wrong thus far, here are seven reasons to sell Wall Street’s hottest artificial intelligence stock.

1. Nvidia is about to become its own worst enemy

Perhaps one of the most logical reasons to sell shares of Nvidia is the irony that increasing output of its A100 and H100 chips will almost certainly weigh on its gross margin.

During the first half of Nvidia’s fiscal 2024, the company’s cost of revenue declined as data center sales soared. What this tells investors is that the entirety of Nvidia’s data center gains were derived from a substantial increase in pricing power predicated by AI-focused GPU scarcity. Even by the end of the company’s fiscal third quarter, the cost of revenue had risen only modestly on a year-over-year basis.

With Nvidia now able to meet more of its customers’ demands, the price of its A100 and H100 chips will fall. Although revenue is undoubtedly headed higher, we’ve likely seen a peak in the company’s gross margin.

2. External competition is heating up

This probably goes without saying, but Nvidia’s overwhelming success in high-compute data centers will encourage aggressive competition from businesses itching to get their piece of the pie.

In June, Advanced Micro Devices (NASDAQ: AMD) introduced its MI300X AI-GPU, which will be a direct competitor to Nvidia. AMD CEO Lisa Su views these AI-accelerating chips as a more than $150 billion addressable opportunity by 2027. Though AMD launched the MI300X last year, it’ll really begin ramping up production in 2024.

Likewise, Intel (NASDAQ: INTC) plans to go head-to-head with Nvidia. This past December, Intel introduced its Gaudi3 generative AI software chip, which is expected to ship sometime this year. Gaudi3 will be a direct competitor to Nvidia’s H100 chip. In other words, Nvidia’s days as the lone wolf in AI-accelerated data centers are over.

3. Internal competition is ramping up, too

Perhaps what’s even more worrisome than external competition is that many of Nvidia’s biggest customers have ambitions of developing AI-accelerated chips of their own.

For example, social media company Meta Platforms (NASDAQ: META) is one of Nvidia’s largest customers by total revenue. Meta, which has its sights set on becoming a key player in virtual and augmented reality, intends to deploy a second-generation version of an in-house AI-GPU chip into its data centers this year. In-house developed infrastructure is designed to lessen Meta’s reliance on Nvidia over time.

Similarly, Microsoft (NASDAQ: MSFT), which is Nvidia’s largest customer by total revenue, unveiled its own custom AI chip for large language models (LLMs) last year. Microsoft’s Azure Maia AI chip will compete directly with Nvidia’s H100 GPUs targeted at generative AI software. Like Meta, Microsoft’s in-house-developed AI chips are being launched in 2024.

4. Regulatory restrictions put a ceiling on Nvidia’s growth potential

A fourth reason to sell shares of Nvidia is the increasing pressure the company is facing from U.S. regulators.

In response to initially announced export restrictions of AI-driven GPUs to China, Nvidia developed slower versions of its top chips. The company’s goal with its A800 and H800 chips was to capture billions of dollars in preorder demand from China, which is a key market for the company’s success.

In October 2023, the U.S. Department of Commerce announced a second round of export curbs that would restrict the specifically developed A800 and H800 chips to China. Although Nvidia isn’t the only chip developer impacted by these export restrictions, they could ultimately cost the hottest name in AI billions of dollars in potential sales each quarter.

5. Insiders aren’t buying — why should you?

Another reason to steer clear of Nvidia or bid its stock adieu is that executives and board members have done nothing but sell their shares for more than three years.

To be fair, there are a lot of reasons for insiders to sell stock, and some of them are completely benign. For example, options have to be exercised within a defined time frame, otherwise they expire. Executives and directors may receive a significant portion of their compensation in stock and stock options. Shares may be regularly sold to have capital handy to cover their federal tax bills.

But there’s only one reason insiders buy stock: They believe shares are undervalued. No insider has purchased shares of Nvidia stock since Chief Financial Officer Colette Kress added a mere 200 shares in December 2020. If insiders won’t buy, why should you?

6. History isn’t on its side

Nvidia and the artificial intelligence movement are also squaring off against history, which is thus far undefeated.

As I pointed out earlier, there have been an assortment of next-big-thing trends that have garnered plenty of attention on Wall Street over the past 30 years. Unfortunately, every single one of these trends endured an early-stage bubble. This is to say that the uptake or acceptance of new innovations or technologies didn’t match investors’ lofty expectations.

While many of these next-big-thing trends worked out well for select businesses over the long run, the short term can be bumpy. AI is unlikely to be an exception to what’s seemingly the rule.

7. It’s priced for perfection in an imperfect industry

Last but not least, Nvidia is priced for perfection in an industry that’s full of unknowns.

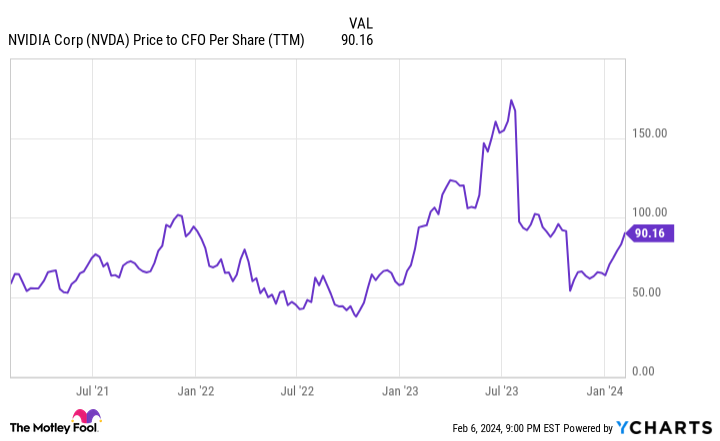

Based on Wall Street’s cash-flow consensus for fiscal 2024 (the company has yet to release its fourth-quarter operating results), Nvidia is valued at a jaw-dropping 63X cash flow. It’s also trading at 90X trailing-12-month cash flow. It’s almost hard to believe that Nvidia was regularly valued at less than 20X cash flow as recently as 2014, 2015, and 2018.

Given the factors described above, I’d expect gross margin erosion to take shape in fiscal 2025 and for increasing external and internal competition to lower Nvidia’s sales ceiling and taper its growth rate.

There are considerably smarter ways to take advantage of the AI revolution than buying or holding Nvidia stock.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Intel and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

7 Reasons to Sell Nvidia, Wall Street’s Hottest Artificial Intelligence (AI) Stock was originally published by The Motley Fool

Credit: Source link