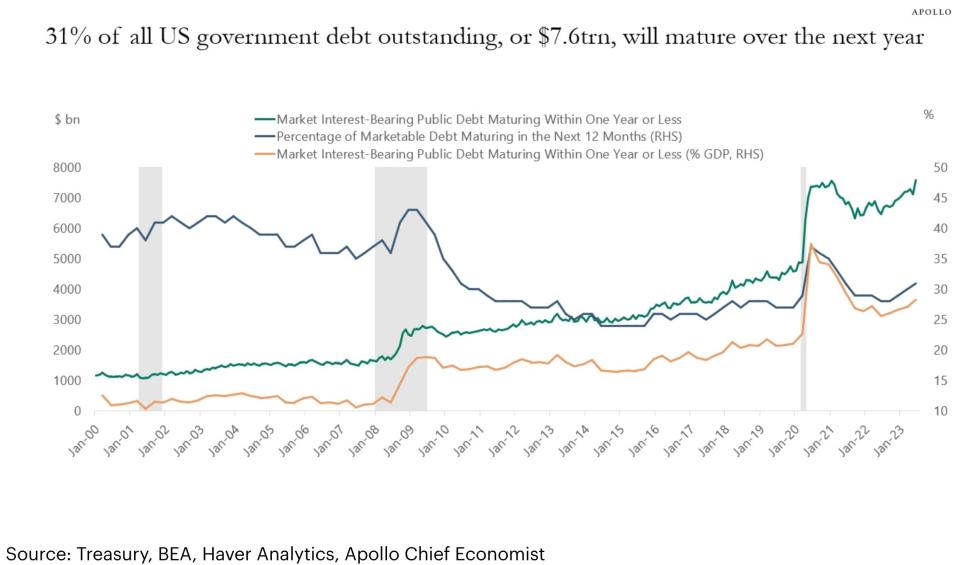

A whopping $7.6 trillion in interest-bearing US public debt will mature within a year, Apollo’s chief economist said.

That represents 31% of all outstanding US government debt, adding upward pressure on rates.

That’s still below 2020, when debt maturing within a year made up a significantly larger share.

Nearly a third of all outstanding US government debt is set to mature in the next 12 months, according to an analysis from asset management firm Apollo.

A chart from Chief Economist Torsten Sløk shows that the share of US public debt set to mature in a year or less has steadily risen toward pandemic-era levels and is now at 31%. In terms of dollar amount, that’s $7.6 trillion, a high not seen since early 2021.

In addition, public debt maturing in the near term accounts for more than a quarter of US GDP. However, this is below its 2020 peak, when it made up a significantly larger share.

Still, Sløk said the $7.6 trillion coming due is one source of upward pressure on US rates.

The estimate comes as federal deficits have exploded in recent years, sharply elevating the trajectory of US debt. The Treasury Department has already auctioned $1 trillion in bonds just within this quarter.

Meanwhile, borrowing costs have soared in the last year and a half as the Federal Reserve embarked on an aggressive tightening campaign, raising the government’s debt-servicing costs.

As of Friday afternoon, the 10-year Treasury yield stood at 4.25%, and three-month yield was 5.47%.

Rates have also been under pressure from the Fed’s quantitative tightening program, which removed a top buyer from the bond market.

The central bank has allowed about $1 trillion of its debt holdings to run off its balance sheet. Though yields have climbed in recent months, the overall impact of QT on the marketplace has been limited so far, as the Treasury has found ample buyers among money market funds and private traders.

But according to a St. Louis Fed research paper from late August, money market fund participation in recent T-bill auctions has begun flattening out.

Read the original article on Business Insider

Credit: Source link