Few companies are as proven and durable as food and beverage giant PepsiCo (NASDAQ: PEP). The company has performed for decades, showering investors with dividends and building wealth over generations. The stock has steadily faded in recent weeks and is approaching 52-week lows.

Years of inflation have consumers grappling with higher grocery prices, and sentiment is dropping. Investors have already seen companies like McDonald’s cite weaker consumer spending as a headwind to their business.

So, should investors stay away, or is now the time to buy the stock?

Here are four reasons long-term investors should buy the stock like there’s no tomorrow.

1. Best-in-class brands

PepsiCo’s world-class food and beverage brands have been its pillar of strength, creating decades of growth and wealth for its shareholders. The stock price has appreciated more than 10,000% over its lifetime, and the dividend has grown over 5,300%. PepsiCo’s brands include beverage headliners like Pepsi, Mountain Dew, Gatorade, and Lipton, while its food products include names like Doritos, Cheetos, Lay’s, Quaker, and many more.

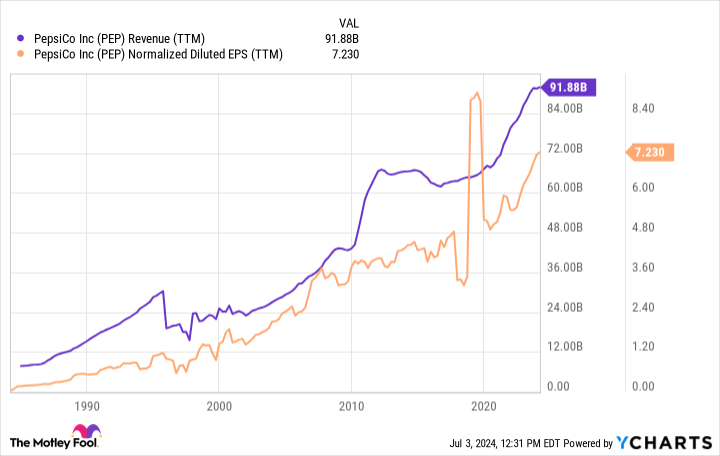

Dominating the grocery aisle means that PepsiCo products get top-tier shelf space in supermarkets and pricing power because consumers generally will buy what they know and love. Additionally, food and beverage products are small ticket items; PepsiCo can get away with bumping the price a few cents because it doesn’t dramatically impact consumers’ budgets. Decades of population growth and price increases have steadily driven revenue to over $91 billion annually.

2. Still an excellent dividend grower

PepsiCo is a dividend dynamo because it offers yield and growth. Investors buying today get a solid starting yield of 3.3%. On top of that, PepsiCo has raised its dividend by an average of 6.6% for the past five years. Its most recent 7.1% increase shows that management is confident in the company’s outlook. Remember, PepsiCo has raised its dividend for 52 consecutive years (a Dividend King), so to maintain inflation-beating dividend growth after all this time is impressive.

Notably, the dividend is well secured by a payout ratio that’s 66% of PepsiCo’s estimated 2024 earnings. Profits are high enough that PepsiCo can comfortably afford the dividend and still invest in the business or repurchase shares. This consistent growth outpacing inflation is how the stock has performed so well for so long.

3. Solid growth outlook

What is most important for investors is whether PepsiCo can continue to grow at this pace. After all, this company, which sells snacks and bottled beverages, is now a $225 billion behemoth. Fortunately, PepsiCo’s growth formula still seemingly has mojo left.

The beauty of PepsiCo is its many growth levers. It chugs along as it raises prices, sells more products to a growing global population, and acquires and launches new product brands. Some of PepsiCo’s recent hits include newer beverage brands such as Bubly and Starry. It has also invested in the energy drink industry by acquiring Rockstar in 2020 and entering into a major collaboration with Celsius in 2022.

Management is currently guiding for 4% year-over-year organic revenue growth in 2024 and a 7% increase in earnings per share over 2023. Analysts looking further out expect more of the same. Consensus estimates call for earnings growth averaging over 7% annually for three to five years.

4. Stellar business at a fair price

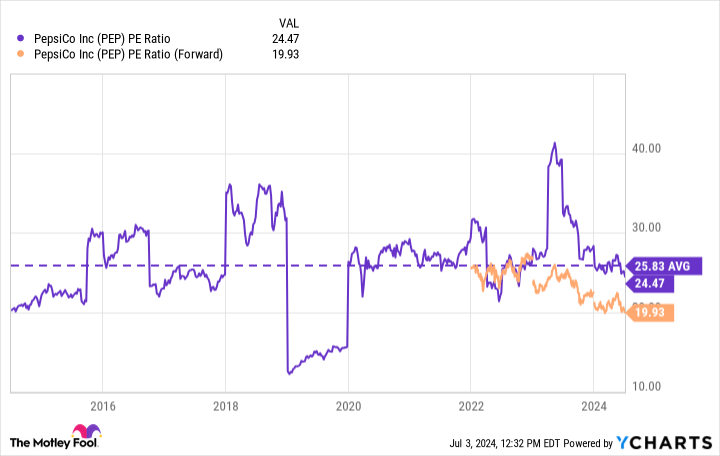

The market does silly things sometimes. Weaker consumer spending could put some pricing pressure on PepsiCo, and the stock market is seemingly pricing that into the stock. Shares have now fallen over 17% from their high. PepsiCo has averaged a P/E ratio of almost 26 over the past decade, and shares have now fallen below 20 times this year’s estimated earnings:

Does the stock deserve to be traded at a discount? While PepsiCo might feel some pressure while consumers are struggling, it’s hard to argue that the business is fundamentally worse, especially when the outlook remains consistent with the company’s past performance. Do you want to discount the stock? That’s already happened. Barring an unexpectedly bad collapse in the business, PepsiCo stock seems like a fantastic business trading at a fair price today.

To apply Buffett’s advice, investors shouldn’t hesitate to buy a wonderful business like PepsiCo at a fair price.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.

4 Reasons to Buy PepsiCo Stock Like There’s No Tomorrow was originally published by The Motley Fool

Credit: Source link