Over the past three years, the semiconductor arena cooled as the 5G upgrade cycle ended, shipments of new PCs declined in a post-pandemic market, and economic headwinds throttled the growth of the enterprise and industrial sectors. Rising interest rates also compressed their valuations and drove investors toward more conservative stocks.

However, a lot of chip stocks stayed strong through that slowdown as investors focused on their cyclical recoveries. That’s why the Philadelphia Semiconductor Index rallied 57% over the past 12 months as the S&P 500 advanced only 22%. Some investors might be reluctant to buy more chip stocks after those big gains, but I think it’s still safe to buy Taiwan Semiconductor (NYSE: TSM), AMD (NASDAQ: AMD), and Micron (NASDAQ: MU) before more bulls rush in and drive their stocks to new all-time highs.

1. Taiwan Semiconductor

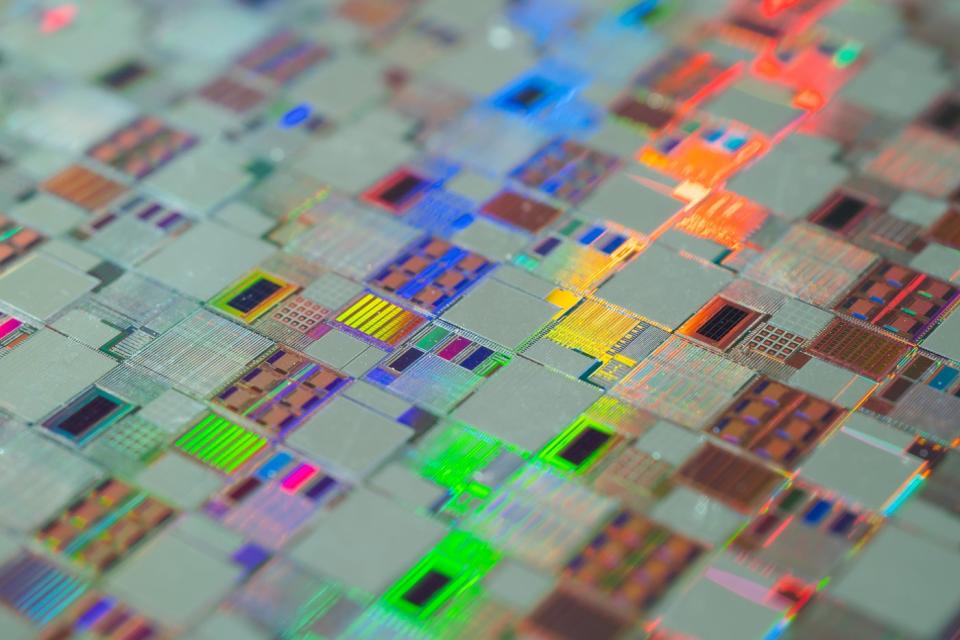

Taiwan Semiconductor, or TSMC, the world’s most advanced contract chipmaker, recently predicted its revenue would rise in the “low to mid 20%” range in U.S. dollar terms for 2024. That matches analysts’ expectations for 21% growth and would represent an acceleration from its 9% decline in 2023 — which was caused mainly by the broader slowdown of the semiconductor market.

TSMC expects those headwinds to dissipate in 2024 as the company ramps up production of its latest 3nm chips, continues to sell high-end 5nm chips to a wide range of markets, and benefits from the rapid expansion of the artificial intelligence (AI) market. Analysts expect its earnings per American depositary share to grow 21% in USD terms. Those are remarkable growth rates for a stock that trades at just 18 times forward earnings.

TSMC remains one to two chip generations ahead of Intel (NASDAQ: INTC) in the process race to manufacture smaller, denser, and more power-efficient chips, so TSMC should remain the linchpin of the semiconductor market for the foreseeable future. That makes it one of the simplest ways to invest in the sector’s long-term growth.

2. AMD

One of TSMC’s top customers is Intel’s rival, AMD. Unlike Intel, which manufactures most of its own chips at its own foundries, AMD outsources the production of its chips to TSMC — and that relationship enabled it to pull ahead of Intel with more advanced chips over the past several years.

AMD more than doubled its share of the x86 CPU market from 17.8% to 36.3% between the fourth quarters of 2016 and 2023, according to PassMark Software, as Intel’s share fell from 82.2% to 61%.

Analysts expect AMD’s revenue to dip 4% in 2023 as it laps its acquisition of programmable chipmaker Xilinx and struggles with slower PC sales. But in 2024, they expect its revenue and earnings to rise 18% and 44%, respectively, as the PC market recovers, it sells more Instinct GPUs for data centers to counter Nvidia in the AI market, and it launches the next-gen Ryzen 8000 chips for PCs.

AMD’s stock isn’t cheap, at 47 times forward earnings after its recent rally, but it remains a promising long-term play on the growth of the PC, data center, and AI markets.

3. Micron

Micron is one of the world’s leading producers of DRAM and NAND memory chips. It controls a smaller share of the memory market than Samsung and SK Hynix, but it produces denser and more power-efficient chips than the two Korean chipmakers. That’s why premium device makers such as Apple use its chips.

Micron’s revenue plunged 49% in fiscal 2023, which ended last August, as the economic headwinds intensified, its core markets cooled and some its chips were banned from key infrastructure projects across China. The company also racked up a net loss for the full year. That slowdown caused the memory chip shortage — which had lasted throughout most of 2020 and 2022 — to become a supply glut throughout 2023.

But for fiscal 2024, analysts expect Micron’s revenue to rise 46% as the company significantly narrows its net loss. The company expects the PC market to stabilize and the expansion of generative AI to drive that growth.

For fiscal 2024, analysts expect Micron’s revenue to grow 41% as it returns to profitability. Based on those expectations, Micron still seems like a bargain at 13 times its fiscal 2025 earnings — and the company is well poised to profit from the market’s insatiable appetite for more advanced memory chips across a wide range of industries.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 16, 2024

Leo Sun has positions in Apple. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

3 Semiconductor Stocks to Buy Before the Bulls Rush Back was originally published by The Motley Fool

Credit: Source link