In early February, PayPal (NASDAQ: PYPL) Chief Financial Officer Jamie Miller revealed that the company plans to buy back about $5 billion of its own stock in 2024. With a market cap of only $65 billion, the repurchases would represent nearly 8% of the company’s equity value.

This is a huge bet for PayPal. Now trading at a depressed valuation, buying back stock could prove a genius move. But if history is any indication, PayPal could end up rapidly destroying shareholder value.

The company has already spent $15 billion in share repurchases since going public in 2015. Most of those stock buybacks ended up destroying shareholder value given the repurchase prices were much higher than today’s valuation.

Is this time different? Here are three reasons the company is optimistic.

1. PayPal stock is clearly cheap

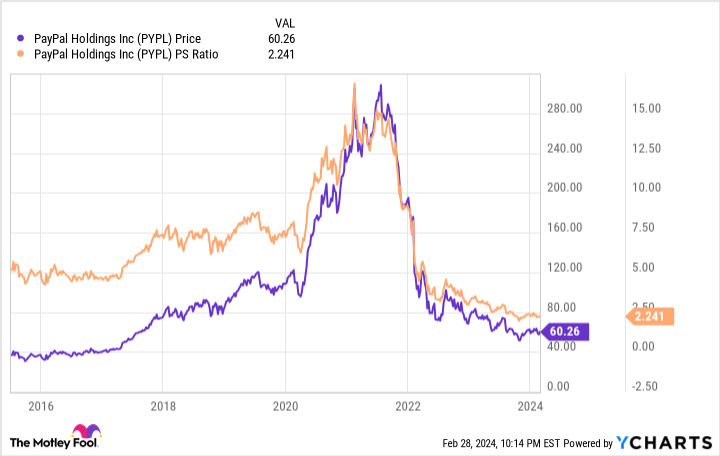

PayPal may have spent billions of dollars on share repurchases in the past, but 100% of those buyback programs were executed at a higher valuation than today.

When the company went public in 2015, PayPal stock traded at roughly 5 times sales. During the pandemic bull market that pushed up the share prices of nearly every tech company, PayPal stock was valued as high as 15 times sales.

Today, PayPal stock trades at an all-time low valuation of just 2.2 times sales. There are plenty of reasons for this depressed valuation. From 2015 to 2020, PayPal’s quarterly revenue growth averaged between 15% and 20%. In recent quarters, that growth rate has slowed to about 8%.

There are also concerns that the company could be underinvesting in its future. In 2020, the company spent roughly 12% of its revenue on research and development. Today, that figure is around 10%. It’s not a huge dip, but when growth begins to slow, the last thing a company can afford to do is neglect research and development efforts that can help reverse the trend.

There are more positive reasons management believes now is the time to buy back $5 billion in stock. But there’s no doubt that negative events and trends during the past year or two have created arguably the best conditions in company history to buy back shares.

2. PayPal is a free-cash-flow machine

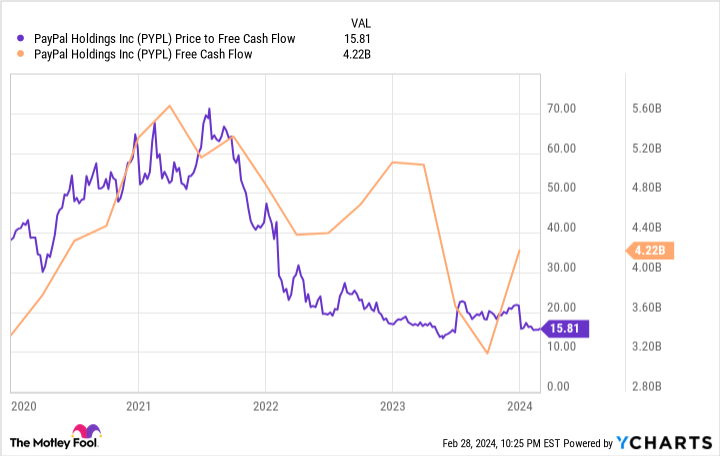

Despite a slowdown in revenue growth, PayPal has continue to generate huge sums of reliable cash flow. The shares now trade at a free-cash-flow yield of 6.3%, the highest yield in company history thanks to more than $4 billion in free cash flow generated during the past 12 months.

Historically, the company has spent a good chunk of this money on share repurchases. More than $11 billion, meanwhile, has been directed toward acquisitions.

The recent slowdown in growth suggests that perhaps PayPal should have allocated more funds to research and development. Still, management has to figure out something to do with its excess cash. The company now sits on a record $9.1 billion in cash, a figure that will only continue to grow if management fails to spend inbound cash flow.

It’s not the greatest rationale in the world, but a big reason PayPal continues to buy back stock is because there is cash burning a hole in its pocket. If acquisitions and a dividend aren’t on the table, investing in itself becomes the only option.

Strategically, it seems as if PayPal executives prefer additional buybacks versus a boost in internal innovation.

3. New tech could boost growth

PayPal is underinvesting in research and development compared to its past, but that doesn’t mean it isn’t capable of innovation.

Last fall, the company unveiled a suite of new services and features, all meant to reverse the declining growth trend. One innovation in particular shows not only the company’s established market power, but also where it could find a new growth engine.

PayPal calls this innovation “Fastlane.” The pitch is simple: PayPal has 400 million active users, meaning it can recognize a huge percentage of visitors to retail sites. With Fastlane, potential buyers can check out without entering any additional information. According to the company, this technology can reduce checkout times by up to 40%.

No one feature will return PayPal to its former growth rates, but features like Fastlane appear promising. Currently, the overall e-commerce market is growing faster than PayPal. If the company can find ways to more deeply integrate itself into the global e-commerce market, a rising tide could provide a much needed lift.

PayPal executives know the stock is historically cheap. They’re also well aware of how much free cash flow the company is generating. By promising to buy back so much stock this year, they’re almost certainly betting on new innovations like Fastlane to reverse its growth trajectory, a scenario that would likely result in a sizable valuation bump for PayPal shares.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

3 Reasons PayPal Is Betting $5 Billion on Its Own Stock was originally published by The Motley Fool

Credit: Source link