Artificial intelligence (AI) is captivating the investment community right now. Aside from the “Magnificent Seven” stocks, investors are seeking other opportunities that may provide similarly lucrative returns. However, with so many tech sector executives touting the term “AI” on their earnings calls or during media interviews, it can be challenging to discern which companies may actually be emerging as leaders in the space.

ServiceNow (NYSE: NOW) is a lesser-known name among AI businesses. The company specializes in automation solutions for information technology (IT) services and is quietly building a leading AI infrastructure. An analysis of the stock relative to its peers suggests that now would be a terrific time to scoop up shares.

Leading the digital transformation revolution

ServiceNow is led by Bill McDermott, who was formerly the CEO of enterprise software provider SAP. Since taking the reins at ServiceNow in 2019, McDermott has consistently used a specific phrase to describe the company’s disruptive agenda: digital transformation. But what exactly does that mean?

Businesses are relying more than ever on data — lots and lots of data — to make informed, efficient decisions. Furthermore, larger enterprises tend to use combinations of different software tools and platforms to house their data. Often, these systems do not easily communicate with one another — leaving decision-makers in a tough spot.

ServiceNow helps businesses digitize operations and connect their data.

ServiceNow is putting on a master class in sales

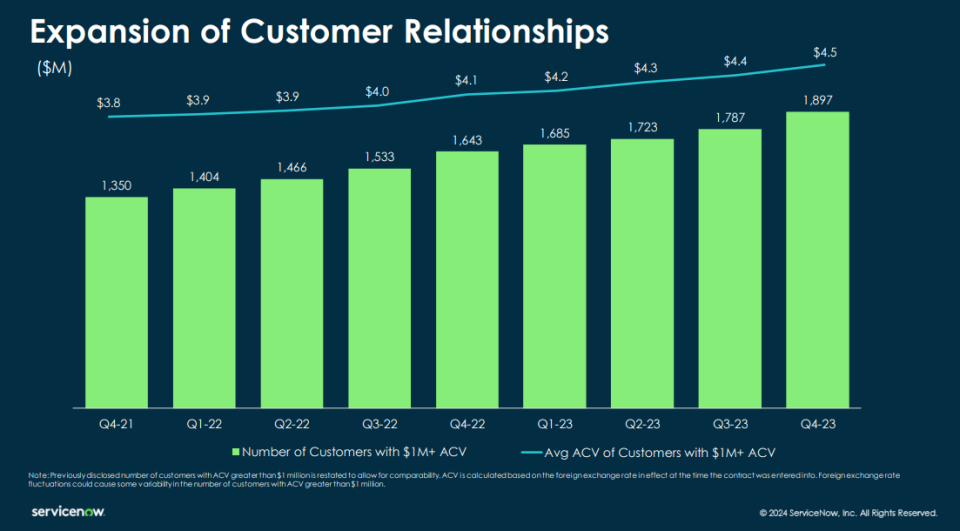

The chart below illustrates how ServiceNow has consistently grown the number of customers paying at least $1 million in annual contract value. These same customers are also spending more with ServiceNow each year, indicating customers like its suite of products.

One of the ways that ServiceNow has been able to generate this growth is through newly developed AI-powered solutions. For example, during the fourth quarter, ServiceNow’s generative AI products drove the largest net new annual contract value contribution of any new product. The company boasts global accounting firm EY and payments leader Visa as notable customers of its AI tools.

Is ServiceNow stock a buy now?

AI has many different applications. As it relates to ServiceNow, trends in IT spending are critical to analyze. On the company’s fourth-quarter earnings call in late January, McDermott said:

Gartner estimates $5 trillion in tech spending in 2024, growing to $6.5 trillion by 2027. That means that spending will grow another $1 trillion in only two years, accelerating from the decade-plus it took for us to get to $5 trillion. For the first time in a decade, IT services will become bigger than communication services in 2024. Gartner estimates that by 2027, nearly all of the growth in worldwide IT spending will come from software and IT services.

What McDermott is emphasizing is that while tech spending at large is expected to grow, software and IT services specifically are forecast to be major beneficiaries sooner rather than later. Looked at a different way, while ServiceNow is growing its enterprise customers at a healthy clip, its best days may be ahead.

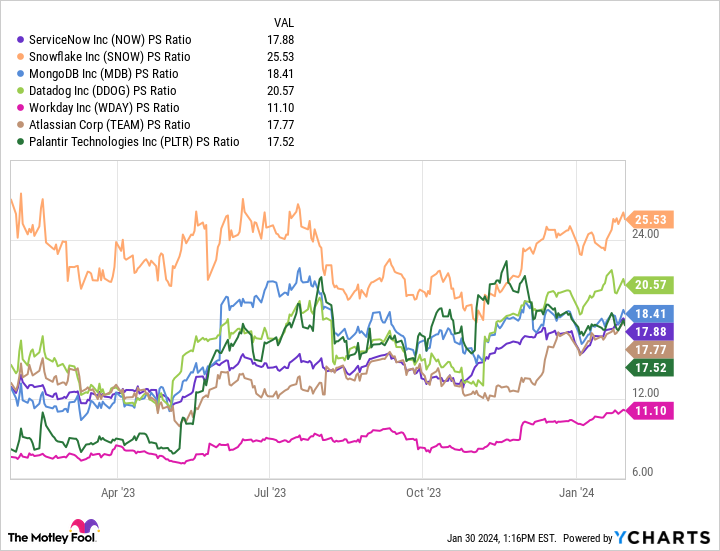

With a price-to-sales ratio of 18, ServiceNow stock trades in the middle of the pack among leading enterprise software developers specializing in workplace automation services.

ServiceNow could very well be an undervalued growth stock, overshadowed by its larger competitors. Make no mistake, McDermott and his team are laying the foundations at the intersection of generative AI and IT software today so that ServiceNow can enjoy the tailwinds of increased IT spending over the next several years.

To me, ServiceNow represents a unique opportunity in the AI landscape. While the company may not attract the same amount of attention as other leading software providers, the trends in its customer base combined with the overall evolution of its total addressable market create a compelling investment opportunity.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and ServiceNow made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of January 29, 2024

Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Atlassian, Datadog, MongoDB, Palantir Technologies, ServiceNow, Snowflake, Visa, and Workday. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

1 Unstoppable Artificial Intelligence (AI) Stock to Buy Hand Over Fist in 2024 was originally published by The Motley Fool

Credit: Source link