Even if you’re not an investor that regularly swings for the fences, you’ve likely dreamed of hitting a proverbial grand slam that gets your portfolio over the seven-figure hump.

The thing is, such trades aren’t as uncommon as you might think. You just have to find the right company in the right business at the right moment. Time will take care of the rest.

On that note, there’s one particular technology stock that’s not only already turned many patient investors into millionaires, but can continue doing so in the future. That’s Nvidia (NASDAQ: NVDA). Here’s a closer look at why it’s been such a winner thus far, and why it’s poised to continue minting millionaires going forward.

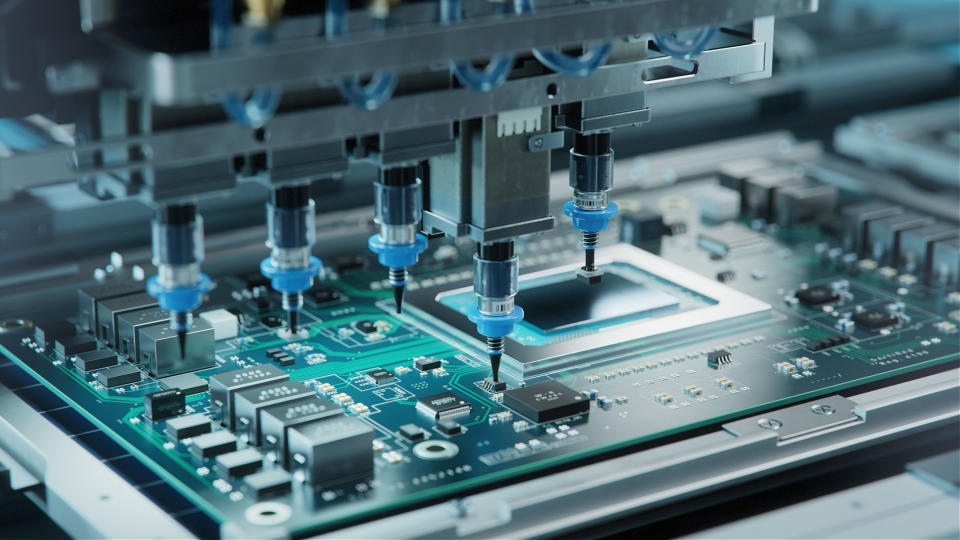

Nvidia, up close and personal

You’ve probably already familiar with the company, but Nvidia hasn’t always been the titan it is today. It has, however, always been a successful cutting-edge technology player.

The company was founded back in 1993… just when the personal computer era was just getting started. It wasn’t until 1995, however, when it changed the landscape of the PC business forever. That’s when Nvidia debuted the world’s first-ever mainstream consumer-oriented graphics processing card. This tech made personal computers much more engaging, largely by making them high-powered video gaming consoles. The rest, as they say, is history. Leveraging its leading position in the graphics card space, Nvidia has since grown from its relatively small 1999 public offering to the $1.5 trillion powerhouse it is today. From back then to now, Nvidia stock’s soared to the tune of 150,000%. Wow!

Granted, most investors likely didn’t stick with the stock that whole time. The company’s been through ups and downs which would have shaken several of even the staunchest of shareholders out.

Nevertheless, any shareholders able to stick with their positions in the stock for any meaningful length of time during the company’s existence have done very, very well for themselves. Certainly many of them have become millionaires with some help from Nvidia.

But, the party’s not over yet.

Artificial intelligence is the next big growth engine

Nvidia’s first couple of decades were all about graphics processing cards. The next couple, however, won’t be. Artificial intelligence is its next big growth engine and will remain so for a long while.

As it turns out, the same basic computer architecture used in graphics cards is perfectly suited for AI applications. It doesn’t have to handle highly complex calculations. It just needs to simultaneously handle mountains and mountains of digital data very rapidly. Recognizing this, in 2012 Nvidia began experimenting with purpose-built AI processors using its graphics card tech. The 2016 release of its DGX-1 system marked the world’s first-ever deep-learning supercomputer, dropping the company right into the heart of the then-brewing artificial intelligence evolution. It was a brilliant move too. AI now accounts for around three-fourths of the organization’s revenue and is responsible for the lion’s share of its revenue growth.

The artificial intelligence party is just getting started though. Institutions are only just now starting to see the full potential of owning their own AI platforms. UIPath‘s CEO Robert Enslin recently opined that “Companies need to think about how to apply AI and automation to all parts of their business,” for instance, concluding that “All companies need to be tech companies.”

The companies he’s speaking of don’t seem to disagree either. Even cosmetics brand L’Oreal‘s chief executive Nicolas Hieronimus believes “We are a tech company. We are a beauty company, but we are a tech company,” as he explained at this year’s annual Consumer Electronics Show held earlier this month.

In this vein, Precedence Research expects the AI hardware business to grow at a yearly pace of more than 24% between now and 2030, reaching a value of $250 billion in the final year of that stretch. The software sliver of the artificial intelligence market — which Nvidia also serves — is projected to swell from around $200 billion per year now to more than $1 trillion in 2032, again according to Precedence Research.

Already in control of the vast majority of the artificial intelligence hardware market, Nvidia is positioned to capture its fair share of the market’s growth.

Just settle in for the long haul

The backdrop is bullish to be sure. Nvidia’s the leading name in one of the market’s hottest long-term growth opportunities, after all. Risk is low and the potential reward is high.

There is one footnote to add to the Nvidia story though. That is, Nvidia is a popular, well-watched stock that dishes out a great deal of volatility. Shares also tend to be priced at a rich valuation, exacerbating that volatility. And these aren’t limited to short-term swings. Nvidia stock can really ebb and flow for a while, even when things are clearly going well for the company.

Most veteran investors understand, however, they’ll need to remain plugged into mega-trends for years on end if they want to become millionaires. This truth isn’t going to change for Nvidia’s shareholders anytime soon either.

The thing is, it’s worth the wait.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 22, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and UiPath. The Motley Fool has a disclosure policy.

1 Technology Stock That Has Created Millionaires, and Will Continue to Make More was originally published by The Motley Fool

Credit: Source link