It wasn’t long ago that nearly every electric vehicle (EV) stock was soaring in value. In 2021, for example, industry hype was at a fever pitch. Several EV companies — including Rivian Automotive and Lucid Group — debuted on the public markets with great fanfare, while conventional automakers were boasting about plans to aggressively expand their EV lineups.

A lot has changed since then. And after a steep industry sell-off, it’s time to go bargain shopping. One iconic EV stock in particular should be capturing your attention right now.

Is this famous EV stock finally a bargain?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade ago. It’s taken for granted by some today, but it had to prove to a skeptical consumer base that EVs could be beautiful, reliable, and downright fun.

Its multibillion-dollar investments into its charging network, meanwhile, spurred global demand for a vehicle category that, at least at the time, still had a higher total ownership cost than conventional internal-combustion alternatives.

Tesla’s early mover advantage gave it a strong foothold in an industry that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up production rapidly just as EV demand started to take off. From 2018 to 2022, for instance, sales grew by an astounding 357%.

But then a curious thing happened. EV sales in the U.S. continued to climb, but slower than expected. This put a huge dent in the premium valuations the market had formerly assigned to EV stocks.

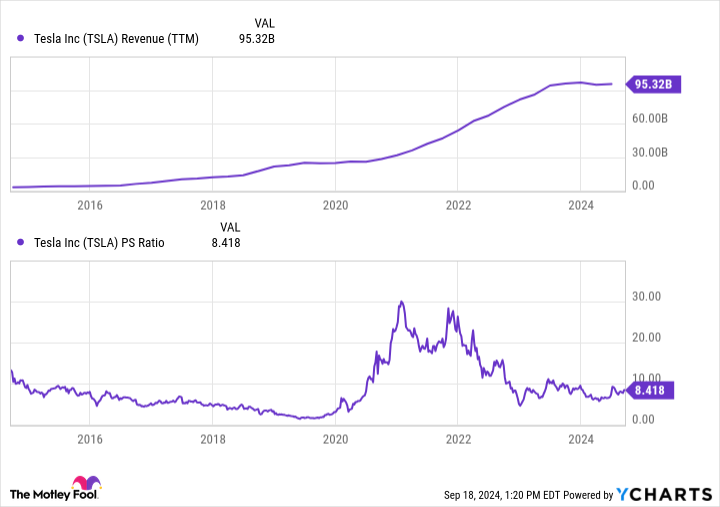

From 2022 to 2024, for example, Tesla’s valuation fell from nearly 30 times sales to under 10 times sales — a two-thirds reduction over 24 months. Other EV makers like Rivian and Lucid saw similar valuation declines.

More recently, Tesla’s revenue base has not only flattened, but has also declined in certain quarters. To be fair, the stock is still relatively expensive at 8.4 times sales. But if you have been waiting to buy into this iconic EV stock, this could be your chance. One statistic in particular should get you excited.

Tesla is still the king of EVs

While Tesla is involved in other business ventures, including solar energy and battery storage, more than 90% of its revenue base is still tied up in its automotive segment. Its future will be made or broken based on the success of this business, and most of its valuation is related to its fate.

It’s important to keep in mind that it still commands a dominant share of the U.S. EV market. Various estimates peg it with a 50% to 80% market share.

And demand for EVs continues to grow despite a reduction in forecasts. Over the next five years, domestic EV sales are now expected to grow by more than 10% annually, with industry revenue for EVs in the U.S. surpassing $150 billion by 2029.

Globally, EV sales are expected to top $1 trillion by 2029. That’s good news considering Tesla has a projected 39.4% market share globally, greater than the next eight competitors combined.

Put simply, the EV market is still Tesla’s to lose. It has more capital, more brand-name recognition, and more manufacturing capacity than any other competitor. And right now, several conventional automakers are pulling back on their EV plans, potentially allowing the company to maintain its dominant industry position for years to come.

We might look back at 2024 as a clear outlier in Tesla’s long-term growth trajectory. Sales are expected to decline by 8.2% this year. But in 2025, analysts are expecting a rebound, with revenue jumping by 15.8%.

Is the stock still expensive at 8.4 times sales? Absolutely. But its long-term promise remains intact, and the current valuation is a relative bargain compared to years past.

If you believe in EVs long term, it’s hard not to bet on the current industry leader, even if there are some near-term challenges on the road ahead. It would be a speculative bet, but investors who have been eyeing Tesla for years while waiting for a pullback should consider a small investment. If shares continue to decline, it could be a prime opportunity for dollar-cost averaging.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now was originally published by The Motley Fool

Credit: Source link