The arguments for simply buying and holding a basket of blue chip stocks like those in the Dow Jones Industrial Average (DJINDICES: ^DJI) are solid to be sure. This group of stocks is inherently well diversified, for instance, in addition to being market stalwarts. Standard & Poor’s also regularly updates the Dow’s 30 stocks. Perhaps best of all, a long-term investment in an instrument like the SPDR Dow Jones Industrial Average ETF Trust (NYSEMKT: DIA) is simple, and it doesn’t require any real maintenance or monitoring.

If you’d like to beat the Dow’s long-term performance, however, there’s another equally simple exchange-traded fund (or ETF) that’s up for the job. And, it’s probably not the one you think.

This ETF regularly beats the DIAmonds, and the SPYders

There was a time when the Dow Jones Industrial Average was the only meaningful market barometer. Even after the S&P 500 index (SNPINDEX: ^GSPC) was created in its current form back in 1957, however, the Dow remained an important indicator of the overall market’s health; it’s only been in the modern era that the Dow began lagging the S&P 500’s performance, mostly because it holds relatively fewer growth stocks. Well, that, and the fact that the cap-weighted S&P 500 is now overwhelmingly dominated by some of the market’s fastest-growing companies (and their fastest-rising stocks) like Microsoft, Apple, Nvidia, Alphabet, and Amazon. These five names alone account for nearly one-fourth of the S&P 500’s value! The same is true of the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), which is the go-to option for most investors who just want to plug into the broad market’s overall performance.

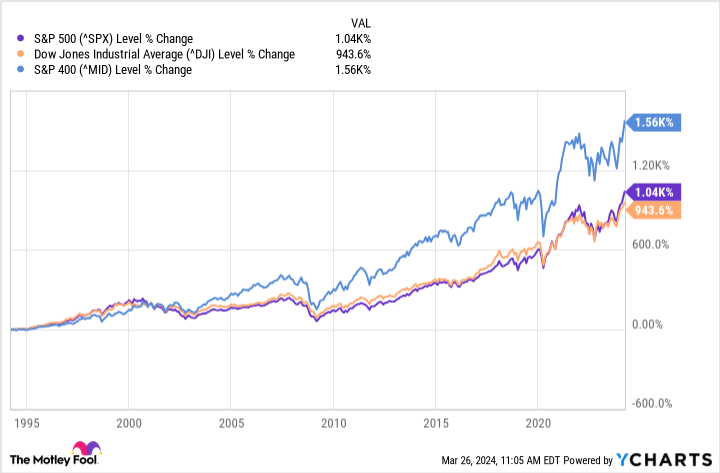

Investors have been slightly rewarded for choosing the SPDR S&P 500 ETF Trust (or SPYders) over the SPDR Dow Jones Industrial Average ETF Trust (or DIAmonds).

Owners of either exchange-traded fund haven’t achieved the sort of returns they could have with a slightly different pick though. Over the past 30 years, the S&P 400 MidCap Index (SNPINDEX: ^MID) and its corresponding ETF, the SPDR S&P MidCap 400 ETF Trust (NYSEMKT: MDY), have performed about 50% better than either the Dow or the S&P 500.

What gives?

See, midsize companies are in the sweet spot of their existence. They are past their wobbly small-cap stage, but not yet in their large-cap phase where companies start running out of room to grow.

Take the red-hot Super Micro Computer as an example. It was recently added to the S&P 500, but it was first added to the S&P 400 back in 2022. It grew its way beyond being part of the mid-cap index. Etsy is another name that first earned a spot within the S&P 400 before graduating to the S&P 500 back in 2020. Both of these now-large-cap companies saw their fastest growth while they were mid-caps.

The underlying indexing strategy is still the same

There are arguable downsides to owning a stake in the SPDR S&P MidCap 400 ETF Trust rather than an exchange-traded fund based on the Dow Jones Industrial Average, to be fair. As you can guess, stocks of midsize companies tend to be a little more volatile than their bigger brothers.

Except, outside of the market’s most extreme scenarios, these stocks aren’t as collectively volatile as you might imagine. The mid-cap ETF’s beta score (a measure of volatility compared to the S&P 500’s) is a modest 1.03, meaning it’s only about 3% more erratic than the large-cap index is, on average. It’s possible that mid caps are minimally volatile given their smaller size specifically because — unlike so many bigger companies — the whole world isn’t constantly watching and trading these tickers.

Whatever the reason(s) for this modest degree of volatility, it’s a fair trade-off for the much bigger gains that mid-caps as a group are clearly capable of producing.

This might help make things easier: Just because you’re a believer in the idea of owning index funds rather than picking individual stocks doesn’t mean you can only own one index fund. It’s perfectly fine for you to hold a stake in the SPDR S&P MidCap 400 ETF Trust and also the SPDR S&P 500 ETF Trust. For that matter, you could grab a piece of the SPDR Dow Jones Industrial Average ETF Trust as well.

That being said, don’t fall into the trap you could easily set for yourself by owning multiple index funds. These still aren’t instruments to be regularly swapped out in search of the next great hot trade. All index funds should be bought and held with the intention and willingness to sit on them indefinitely, recognizing that the point of owning any of them is to sidestep the risk of picking individual stocks and trying to time your entries and exits.

Should you invest $1,000 in SPDR S&P MidCap 400 ETF Trust right now?

Before you buy stock in SPDR S&P MidCap 400 ETF Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR S&P MidCap 400 ETF Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Etsy, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

You Can Do Better Than the Dow Jones. Buy This ETF Instead. was originally published by The Motley Fool

Credit: Source link