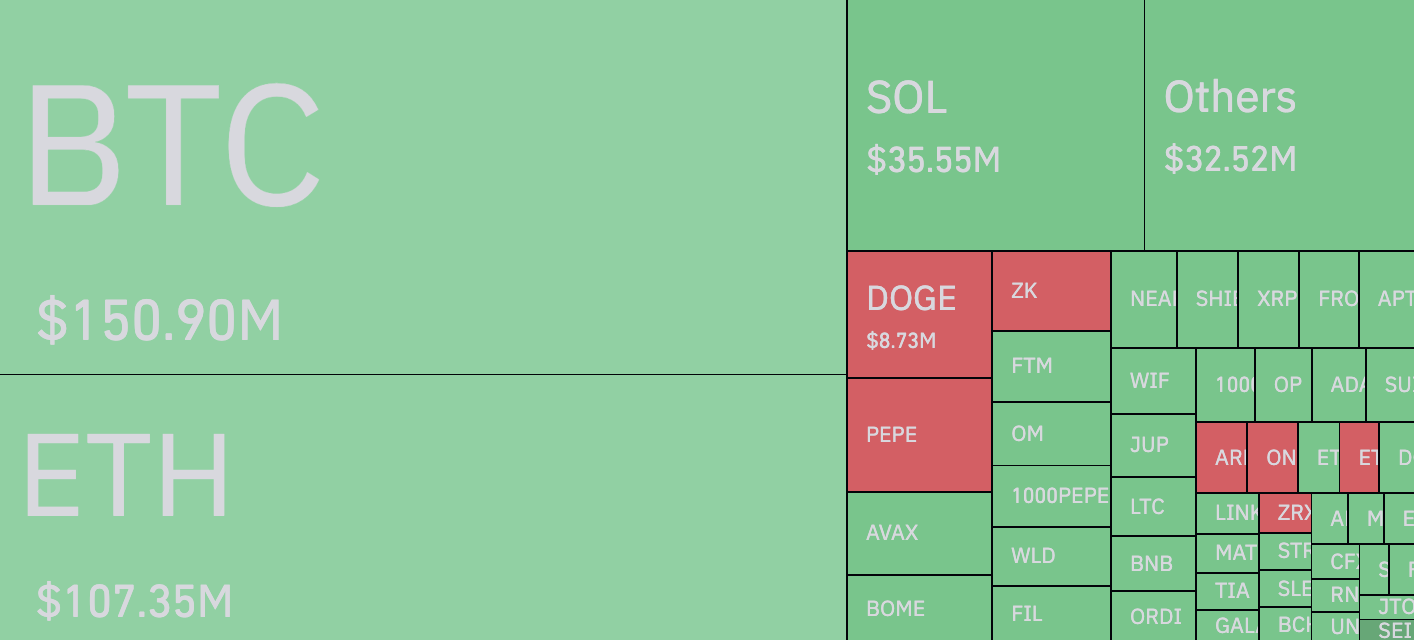

The cryptocurrency market has experienced a significant downturn in the past 24 hours, with liquidations totaling nearly half a billion dollars, according to data from CoinGlass. Among the casualties of this market turmoil were long positions, representing the majority of the $455 million in liquidations.

Analysis indicates that over 60% of long positions on the crypto market were liquidated following an 8% decline, equating to more than $263 billion, according to the TOTAL index. Consequently, the overall capitalization of the cryptocurrency market, inclusive of major assets like Bitcoin, Ethereum and various altcoins, dropped to $2.3 trillion.

XRP, SHIB and Bitcoin

Among the most “angry” cryptocurrencies that have caused the greatest damage to traders are Bitcoin, XRP and Shiba Inu (SHIB). Thus, the main cryptocurrency took a third of the volume of all liquidations against the background of an 8.4% drop in its price over the past day.

Interestingly, however, the ratio of long and short positions with Bitcoin liquidated is not very high – 54.5% versus 45.5% – which rather indicates how the price action of Bitcoin managed to deceive both sellers and buyers who did not get into the timing and apparently made overly emotional decisions.

As for the other two popular cryptocurrencies – XRP and SHIB – there are fewer liquidations, but the ratio of longs to shorts is more interesting. Thus, according to the data, XRP liquidations of purchases are 3.5 times higher than sales with a total figure of $ 2.78 million. The Shiba Inu token has a total liquidation rate of $2.56 million over the past 24 hours, but only $300,000 more long positions were lost.

The beginning of the week on the crypto market cannot be called anything but a bloodbath.

Credit: Source link