Summary of key points: –

- Latest ISM survey results in the US throw a spanner in the works for the weaker US dollar outlook

- Interest rate differentials stand as the determining variable for the NZD/USD rate

- Will we see a resurgence of capital inflows into New Zealand

- As an export-led economy, why are we so under-performing?

Latest ISM survey results in the US throw a spanner in the works for the weaker US dollar outlook

The US dollar appreciated to six-month highs of 105 in the USD Dixy Index last week on the back of stronger than forecast US ISM manufacturing and services survey results.

Hiring and pricing intentions were stronger in both surveys leading to USD buying as some market participants anticipate that the Fed will need to lift interest rates higher again from the current 5.50% level, despite actual inflation and employment data over recent months coming in below expectations. Just why business firms should be more positive in these August ISM surveys is somewhat hard to fathom, however the recent 24% increase in crude oil prices from US$70/b to US$87/b (WTI) may be spooking the survey participants about their costs, and therefore their product/service pricing intentions. It seems everyone is ganging up on the US currently, with OPEC (the Saudis and the Russians) restricting oil supply to drive the price up and the Chinese squeezing the US on rare earth mineral supply.

US interest rate market pricing for another 0.25% Fed interest rate hike on 20 September remains low at 12% probability, however some are now expecting a “hawkish pause” from the Fed i.e. they leave interest rates unchanged but threaten more hikes if the economic data continues to be stronger. The be fair, over recent times the Fed have been making decisions on backward-looking actual inflation and employment data, rather than forward-looking data such as the ISM survey. Over the last three months both inflation and employment results have been weaker than forecast, therefore we are at the point of the Fed signalling an end to their monetary tightening cycle. However, the Fed will not be as categorical as Adrian Orr at the RBNZ or the Bank of England message last week that they will not be increasing interest rates any further. However, only a marginal change in the Fed’s language from previous statements in this respect will (in the author’s view) be sufficient to convert US dollar buyers into USD sellers. We remain firmly of the view that the USD will weaken when the Fed signals the end of raising rates and the markets start to price-in interest rate cuts from mid-2024. The interest rate advantage that the US dollar has had over other currencies over the last 15 months will now start to reverse and that is why the weaker USD forecast must stay in place.

The next important piece in the jigsaw for the Fed will be US CPI inflation data this coming Wednesday 13th September. The increase in the headline inflation rate for the month is expected to be a higher 0.40% (due to gasoline price increases), lifting the headline annual rate to 3.40% from 3.20%. However, the increase in “core” inflation (excluding food and energy) for the month is forecast to be a more subdued 0.20%, reducing the annual core rate from 4.70% to 4.50%. The Fed focus on the core rate of inflation and that will still be trending down. The core inflation rate is also poised to decline a lot further to below 3.00% over coming months as the delayed/lagged rents reduce in price.

The latest bout of USD strength has not allowed the Kiwi dollar to recover back up to 0.6000, however the NZD/USD exchange rate is displaying some resilience just below 0.5900 and has not fallen away to lower levels as many anticipated.

Interest rate differentials stand as the determining variable for the NZD/USD rate

Earlier this year, some global investment banks were espousing a strong view that the US dollar would strengthen further in 2023 as the world economy slumped into recession and history was telling them that the USD always gains when that happens. That reason for a weaker USD is no longer promulgated as it has become obvious that the US is avoiding an economic recession and China (although weaker in recent months) is still growing at well over 4% this year. The global recession is just not happening.

A recent currency report from global bank, HSBC is now stating that the USD will strengthen further in 2024 against the NZD and AUD because New Zealand and Australian interest rates will be reducing sharply next year, alongside the expected decreases in US interest rates. Therefore, in their view, there will be no interest rate advantage for the NZD and AUD. The HSBC analysis fails to factor in the underlying and critical difference in the inflation rates in the US and New Zealand. US inflation has reduced in 2023 as fast as it went up in 2022, therefore cuts in US interest rates in early/mid 2024 is highly likely. In stark contrast, New Zealand’s 6.00% inflation is sticky/wage-push inflation that is difficult to reduce. The RBNZ do not see any decrease in NZ interest rates in 2024, so it is hard to understand where HSBC are coming from. US interest rates heading back to 4.00% in 2024 against NZ interest rates staying at 5.50% points to NZD gains on the interest rate differentials, not the opposite.

Off course, if the NZ economy falls into a deep/dark recession over the next six months, the RBNZ holding of interest rates at 5.50% may change. However, we do not see that occurring, as the current doom and gloom will not last long on a change of Government, China past the worst with their economic slowdown and export commodity prices improving.

Will we see a resurgence of capital inflows into New Zealand?

At rates below 0.6000 the NZD/USD exchange rates is certainly trading at a cyclically low point compared to historical averages and ranges. The low exchange rate offers an attractive entry point for international investors to buy into “under-valued” assets and businesses in New Zealand (in USD terms). Foreign direct investment into New Zealand has fallen away in the Covid and post-Covid years due to the rest of the world not really knowing whether New Zealand is open for business or not. Offshore portfolio investment into NZ equities and bonds has not increased either, as there has been no big interest rate margin advantage over US bond yields and the previous attractive high dividend paying listed stocks in NZ have also lost their advantage for offshore fund managers.

A recent survey by local law firm, Simpson Grierson on investors across Asia-Pacific, the US and Europe as to their intentions around coming into New Zealand found that only 42% of respondents considered NZ Government policies as supportive of foreign investment (down from 78% last year). Regulatory stability is a big concern, however 31% of respondents said a change in Government would increase their intention to invest. Foreign investor funding for our our infrastructure deficit is critical, therefore an immediate imperative for Nicola Willis and Christopher Luxon in a new Government will be to make it more appealing for those investors to come here. There was a significant increase in respondents looking to make acquisitions into NZ over the next 12 months, 44% in the 2023 survey compared to 29% in 2020 and only 19% in 2019. Jacinda did a lot of damage to New Zealand’s reputation as a reliable investment destination with her draconian oil and gas exploration ban in 2018.

Resurging foreign capital inflows into New Zealand in 2024 may well prove to be a positive for the Kiwi dollar that many may have not considered.

As an export-led economy, why are we so under-performing?

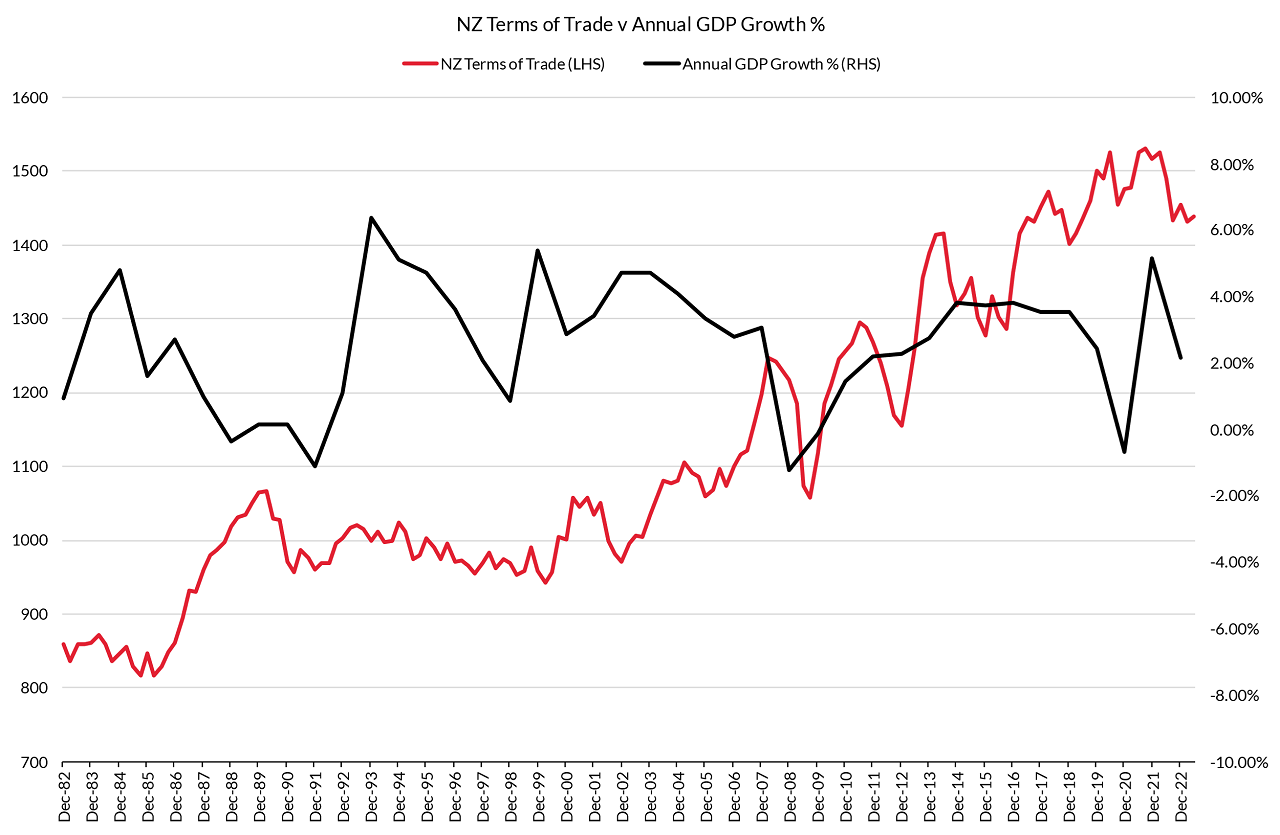

On the assumption that the National and ACT political parties are delivered a spectacular landslide victory by voters on the 14th of October general election, the opportunity will be in front of the new Government to address New Zealand’s lacklustre economic growth performance record. We are labelled an “export-led” economy, however despite the impressive increase in our terms of trade (export prices outstripping import prices) over the last forty years and successfully putting in place many free-trade agreements, the wider economy seems to get no benefit and GDP growth just staggers along at generally low levels (refer chart below).

The question needs to be asked as to why we have not been able to convert record high export prices into greater export production and consequently higher GDP growth? It is also too easy to blame global economic downturns for impacting adversely on our performance. We need to be smarter than that with the land, science and resources we have.

The new Luxon/Willis leadership needs to unlock the potential of the New Zealand economy with fresh and innovative policies to capitalise on rising export prices. Such policies would include streamlining foreign investment and immigration, reducing bureaucratic overheads, tax incentives for export growth (ahla Denmark and Ireland), incentives for low-carbon agriculture production and special economic zones for technology, research, software and medical companies.

If we are unable or are incapable of converting high export prices into higher standards of living (higher GDP growth), then we need to do things differently from the same old/same old.

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

Credit: Source link