Bitcoin’s current journey seems to mirror its past, presenting a striking pattern of growth and resilience. Experts in the field observe a replication of historical bull runs, suggesting a continued upward bullish trajectory for BTC.

As the market anticipates the introduction of a spot Bitcoin ETF, it stands at a pivotal moment, potentially reshaping investment strategies and reinforcing Bitcoin’s prominence in the financial system. This scenario is a confluence of historical trends, regulatory developments, and market dynamics, all pointing towards a sustained bullish period for Bitcoin.

Two Years of Upside Fueled by Spot Bitcoin ETF

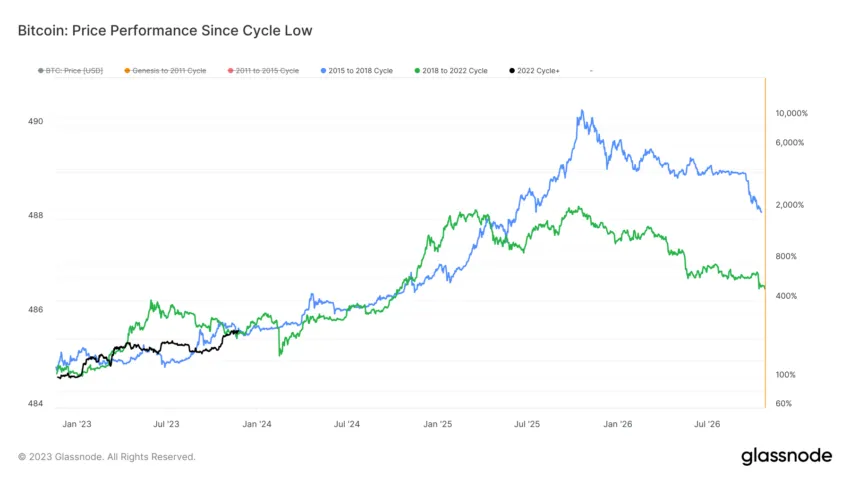

Bitcoin’s price action appears to parallel previous market cycles. According to BeInCrypto’s Global Head of News, Ali Martinez, BTC could be mirroring the bull run seen between 2015 and 2018, as well as the one from 2018 to 2022.

Analyzing the durations and gains of past bullish cycles, Martinez foresees the next peak around October 2025. For instance, the 2015 to 2018 bull run saw Bitcoin rise from under $200 to $20,000. Meanwhile, the 2018 to 2022 cycle pushed the price of BTC from about $3,100 to $69,000.

“Bitcoin history might repeat itself… That means BTC still has 700 days of bullish momentum ahead,” Martinez said.

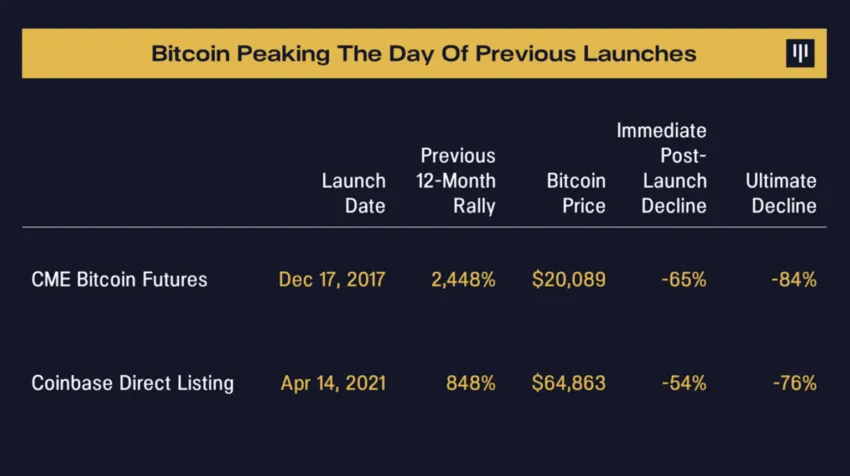

The potential approval of a spot Bitcoin ETF (exchange-traded fund) could be one of the main drivers behind the next bull market. Still, Dan Morehead, Managing Partner at Pantera Capital, believes that Wall Street’s mantra, “Buy the rumor, sell the news,” may hint investor exhaustion when the news breaks.

This pattern was evident in major regulatory announcements like the CME Bitcoin Futures launch and Coinbase public listing, marking the start of significant bear markets immediately after the events.

“The markets did rally – 2,448% – until the very day [CME Bitcoin Futures] listed. That was the top. An -84% bear market started that day. The markets repeated the exact same cycle in the runup to the public listing of Coinbase… The Bitcoin market was up 848% coming into the day of the listing. Bitcoin peaked at $64,863 that day and a -76% bear market started,” Morehead explained.

Nonetheless, ETFs are anticipated to revolutionize Bitcoin access. Acquiring Bitcoin has evolved from the early days of “Bitcoin faucets” to trading on platforms like Kraken and Coinbase. However, many current exchanges are offshore and opaque, deterring institutional participation.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Unlike futures markets, which had a limited impact, Bitcoin ETFs are expected to open significant new investor pools.

“While starting a prediction with ‘This time is different…’ is not usually an auspicious way to begin, I believe it here… The existence of an ETF is a very important step in becoming an asset class. Once an ETF exists, if you don’t have exposure, you’re effectively short,” Morehead added.

BTC Price Prediction For the Next Cycle Top

The BlackRock spot Bitcoin ETF, in particular, is believed to be a game-changer. Analysts link it to the early 2000s launch of gold ETFs.

Just as gold ETFs brought new investors and legitimized gold as an investment, Bitcoin ETFs are predicted to transform BTC’s demand function and further validate it as an asset class.

“Some say a Bitcoin ETF will steal demand from traditional retail venues. I don’t think so. Consider demand for gold bars/coins before and after the gold ETF. [In] 2003 [demand was] 293 tonnes. [In] 2022 [demand surpassed] 1,107 tonnes. The ETF legitimized gold as an investment and demand for physical gold soared,” Matt Hougan, CIO at Bitwise, said.

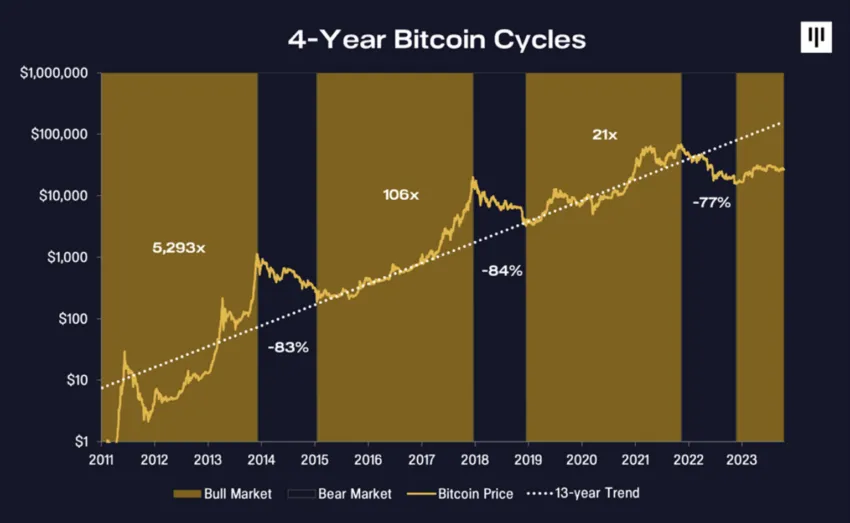

Bitcoin’s inherent cyclicality, driven by its transparent supply and distribution rules, supports this bullish outlook. Satoshi Nakamoto designed Bitcoin to have a predictable four-year cycle, impacting its price movements.

Morehead agrees with Martinez’s prediction, emphasizing that if past trends continue, the current Bitcoin rally might extend until October or November 2025.

Read more: Analyst Reveals How Bitcoin Halving Cycles Could Turn $5 Into $130,000

Meanwhile, the broader economic and regulatory environment also plays a role. Recent legal victories for Ripple and the swift legal process for Sam Bankman-Fried and Binance reflect the growing regulatory clarity and maturity in crypto.

The combination of historical patterns, upcoming Bitcoin ETFs approvals, and the broader regulatory environment indicate that Bitcoin may indeed sustain its bullish momentum for the next 700 days, reinforcing its position in the financial system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Credit: Source link