The artificial intelligence (AI) hype has sent shares of C3.ai (NYSE: AI) soaring in 2023 with outstanding gains of 153% as of this writing. But the wheels have come off in recent months as it is becoming clear that the company is failing to capitalize on the massive opportunity in the AI software market.

C3.ai stock plunged nearly 11% earlier this month after the company released its fiscal 2024 second-quarter results (for the three months ended Oct. 31, 2023). Shares are now down 39% from their 52-week high in mid-June.

Let’s take a closer look at the company’s latest quarterly report and see what’s going wrong for this AI stock that surged big time in the first half of 2023 before falling out of favor on Wall Street.

C3.ai’s mixed results have spooked investors

C3.ai delivered fiscal Q2 revenue of $73.2 million, an increase of 17% over the year-ago quarter. The top line missed the midpoint of the company’s guidance of $72 million to $76.5 million and was below the consensus estimate of $74.3 million. C3.ai also reported a wider non-GAAP loss of $0.13 per share as compared to a loss of $0.11 per share in the same period last year.

The bigger problem, however, was C3.ai’s guidance, which points toward a deceleration in the company’s growth. C3.ai expects $76 million in revenue in the current quarter, which is lower than the $77.7 million Wall Street estimate and points toward a year-over-year increase of 14%. That’s slower than the revenue jump C3.ai recorded last quarter.

Additionally, C3.ai now expects to report a bigger non-GAAP operating loss of $115 million to $135 million in the current fiscal year. That’s a substantial increase over the prior range of $70 million to $100 million. The bigger loss can be attributed to the company’s aggressive investments in the generative AI software market.

However, C3.ai’s aggressive spending stance isn’t translating into growth yet, though the company is confident that the improving customer engagement and the sharp jump in the number of pilot projects and customer trials could help it step on the gas.

Can growth accelerate once again?

A closer look at some of C3.ai’s metrics suggests that the company could indeed have a solid 2024. It witnessed a 100% year-over-year jump in bookings, while the number of new agreements that it struck increased an impressive 148% year over year. The number of pilot projects also increased 177% over the year-ago quarter.

However, a critical look at certain other metrics suggests that the growth in agreements, bookings, and pilots that C3.ai management is boasting of isn’t helping the company’s revenue pipeline. This is evident from the company’s remaining performance obligations (RPO), a metric that measures the future value of all of C3.ai’s contracts.

C3.ai’s RPO fell 27% year over year in the previous quarter to $303.5 million from $417.3 million in the same period last year. The decline in this metric wasn’t matched by the year-over-year increase of $11 million in the company’s revenue, indicating that customers are canceling contracts. Also, C3.ai was sitting on $40 million worth of cancellable contracts last quarter, indicating that its revenue pipeline could shrink further.

One of the reasons behind the drop in C3.ai’s RPO is the company’s switch to a consumption-based model, under which customers pay for its services only when they use it. It was earlier using a subscription-based model, under which it used to lock customers in for larger contract sizes for a longer duration. CEO Tom Siebel pointed this out on the latest earnings conference call: “We anticipated and announced when we made that transition that it would have a short to medium negative effect on revenue growth, a long-term drag on RPO.”

Not surprisingly, the switch seems to have affected the average selling price of C3.ai’s services as customers only use its solutions when needed. The company reported an average selling price of $665,000 last quarter, down almost 20% year over year. Another reason C3.ai’s average selling price has dropped is that it has reduced the entry price of its offerings for pilot customers in a bid to win more business.

Can the stock regain its mojo?

Analysts remain confident of an acceleration in C3.ai’s revenue growth next year. According to consensus estimates, C3.ai’s revenue could increase by 20% in fiscal 2025, up from the 15% growth it is expected to deliver in the current one. Despite that, the stock carries a 12-month median price target of $27 according to 12 analysts covering it. This points toward a drop of 4% from current levels, suggesting that there may not be any more upside for investors over the next year.

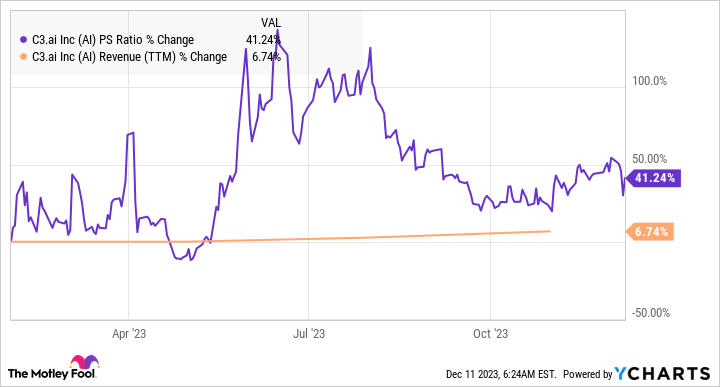

Moreover, C3.ai is trading at an expensive 11 times sales following its 2023 surge. The chart above shows that the inflated valuation hasn’t been matched by an increase in the company’s top line. In simpler words, C3.ai is overvalued right now and it may not turn out to be a good investment over the next year, until and unless its growth accelerates meaningfully.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 7, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

Where Will C3.ai Stock Be in 1 Year? was originally published by The Motley Fool

Credit: Source link