With the end of 2024 quickly approaching, active investors may be looking to position ahead of 2025.

In January, market watchers are often keen to talk about the January effect, which is the idea that stock markets often rally in the first month of the year. However, it has become less consistent as the years go by, and some consider it a myth at this point.

Find out more about the January effect below, and learn what strategies you can use if you do decide to position ahead of a potential January stock rally.

What is the January effect?

The January effect is a theory based on a pattern that analysts have seen year after year: stocks seem to fare better during January than they do during other months of the year. Generally, small-cap companies are affected the most by the January effect, as large stocks are typically less volatile.

The first report of the January effect came in 1942 from Sidney Wachtel, an investment banker from Washington, DC.

Since then, experts have debated possible causes for this phenomenon. Many believe the January effect is triggered by tax-loss selling in the month of December. Tax-loss selling, or tax-loss harvesting as it is sometimes called, is an investment strategy in which individual investors sell stocks at a loss in order to reduce capital gains earned on investments. Because capital losses are tax deductible, they can be used to offset capital gains to reduce an investor’s tax liability on their tax return.

As an example of tax-loss selling for tax savings, imagine if an investor bought 1,000 shares of a company for US$53 each. They could sell the shares and take a loss of US$3,000 in the event that the shares declined in value to US$50 each. The US$3,000 loss from the sale could then be used to offset gains elsewhere in the investor’s portfolio during that tax year.

For more information about the strategy, plus the deadlines, check out our guide to tax-loss selling.

It’s worth noting that tax-loss selling or tax-loss harvesting is a trading strategy that generally involves investments with huge losses, and, because of this, these sales generally focus on a relatively small number of securities within the public markets. However, if a large number of sellers were to execute a sell order in tandem, the price of the security would fall.

Central to the January effect idea is that once selling season has come to a close, shares that have become largely oversold have an opportunity to bounce back. For example, investors who have sold losing stocks before the end of the year may be driven to repurchase those stocks, although they would have to wait for 30 days to pass, as required by the superficial loss rule.

Regardless of whether you’re buying or selling, Steve DiGregorio, portfolio manager at Canoe Financial, recommends that you act swiftly and aggressively during this time of year as “liquidity will dry up.” He has earmarked the second and third week of December as the ideal window to sell or buy at a low point. This is ahead of the “Santa Claus rally,” the trading days around the last week of December when stocks tend to rise ahead of a healthier market in January.

These circumstances have given rise to the alternate notion that stocks get a boost in January because many people receive holiday bonuses in December, providing them with greater investment income. Perhaps it’s one or the other — or perhaps, as with most things, a combination of drivers produces the January effect.

Is the January effect real?

While some say that the January effect was once an efficient market hypothesis that is now fading some mutual fund managers, portfolio managers and institutional investors say it isn’t real at all now. Goldman Sachs (NYSE:GS) first heralded the death of the January effect back in 2017, pointing to two decades worth of analysis that showed returns diminishing in the month of January compared to historical figures going back to 1974.

Those in the “not real” camp claim that while this event may have been tangible back in the 20th century, recent data looks much more random.

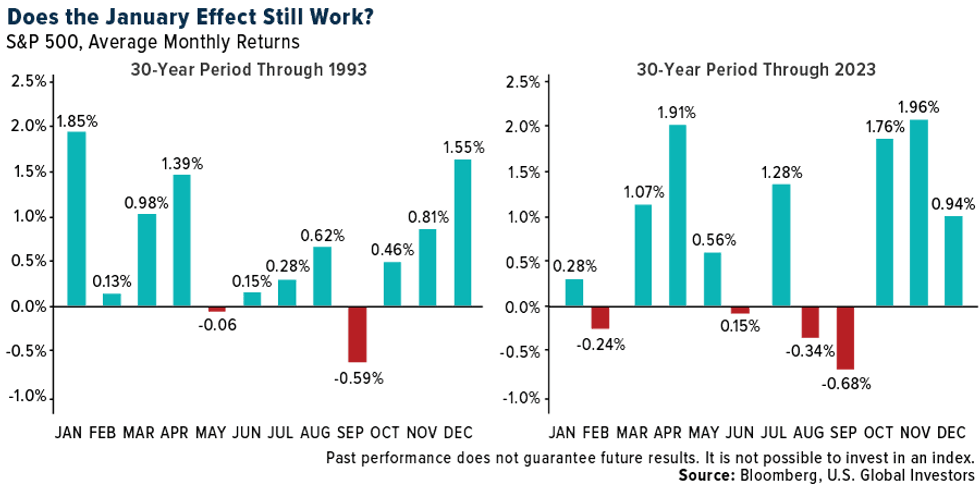

Illustrating this, the graphs below from US Global Investors compare the S&P 500’s (INDEXSP:.INX) average performance by month from the 30 years through 1993 and the 30 years through 2023. While January came in first during the first period with average gains of 1.85 percent, since 1993 it has averaged gains of 0.28 percent, putting it in eighth place.

Chart via US Global Investors.

Investopedia’s more recent analysis continues to support the “January no-effect” position. Looking back three decades since the 1993 inception of the SPDR S&P 500 ETF Trust (ARCA:SPY), investment advisor and global market strategist James Chen points out that in the last 31 years “there have been 18 winning January months (58%) and 13 losing January months (42%), making the odds of a gain only slightly higher than the flip of a coin.”

The past two years, the markets have performed strongly in January. January 2023 saw the S&P 500 jump 5.8 percent over the course of the month after falling at the end of December. However, markets fell back down through February and March, making the rally short lived.

In January 2024, the S&P 500 dipped slightly at the start of the month but ultimately closed January up 2.12 percent higher than its open. Unlike the previous year, the index continued that upward trend through the end of March, at which point it was up 10.73 percent from the beginning of the year.

How can investors capitalize on the January effect?

It can be easy to get swept up in hearsay, and with debate still in play, the January effect is a risky business. Use your judgment, or the judgment of a professional, and don’t get sucked into chasing prices. It’s best not to base your investment strategy on the potential of a seasonal market mantra that reliable evidence shows no longer holds true.

For investors looking to capitalize on a potential rally due to the January effect, here are a few strategies to consider.

- Invest early — One approach is to invest in Q4 of the calendar year in order to essentially place your bets in anticipation of the January effect. If you’re inclined to participate in tax-loss selling, then you could time your buying period for the end of December and hope to harness both phenomena.

- Buy stocks with small market caps and micro caps — This can be a good strategy because these are the stocks that typically see the most movement during this period. As noted, larger companies are typically more stable. Still, that stability comes paired with lower risk, so risk-averse investors should stick with larger stocks.

- Buy dips in stocks you know well and feel confident will return to higher prices — It’s often a good plan to go with what you know, and it’s possible that stocks already in your portfolio will wobble due to tax-loss selling, presenting a lucrative buying opportunity. Just be sure to avoid buying stocks you sold at a capital loss during the prior 30 day period as discussed earlier, as the IRS will view that as a wash.

This is an updated version of an article first published by the Investing News Network in 2018.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web

Credit: Source link