Explore defi’s initial promise in revolutionizing finance and its journey through market fluctuations and challenges.

Emerging as a byproduct of the blockchain revolution, decentralized finance (defi) initially promised a radical shift in the financial sector. However, its journey has been marked by significant fluctuations and challenges.

In 2021, DeFi experienced a surge, aligning with the broader bullish sentiment in the crypto market. Its market cap soared to nearly $180 billion in Nov. 2021, underlining the immense investor interest and confidence in this nascent sector.

This period was characterized by innovative financial models, a surge in decentralized lending, and the emergence of yield farming, which attracted both retail and institutional investors.

However, this rapid growth was not without its drawbacks. The defi sector faced hurdles, including scalability issues, high transaction fees, especially on networks like Ethereum (ETH), and a plethora of scams that exploited the decentralized nature of these platforms.

Consequently, the market witnessed a sharp decline, with the market cap plummeting to about $30 billion by Jan. 2023.

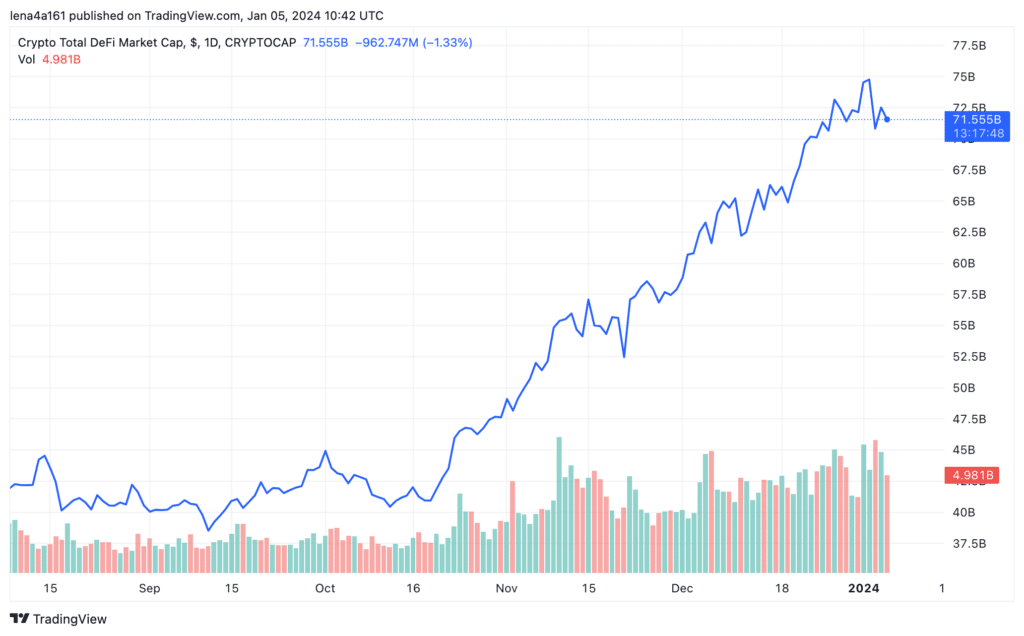

At the end of 2023, defi has shown signs of recovery at a more measured pace. The current market cap is approximately $70 billion, indicating a cautious but steady resurgence.

Let’s dissect the factors behind these shifts and understand what to expect from the defi market in 2024.

2021: the year of unprecedented growth

In 2021, the defi market experienced a period of explosive growth and mainstream adoption, setting the stage for widespread interest and investment in the sector.

Explosive growth

2021 was a landmark year for defi, characterized by a sharp rise in total value locked (TVL), which soared to $175 billion by November, as per DeFi LIama.

This period also saw widespread adoption of defi applications and was marked by substantial innovations in yield farming, liquidity pools, and decentralized exchanges (DEXs).

Key platforms like Uniswap (UNI), Aave (AAVE), and Compound (COMP) grew manifold and gained substantial traction during this period.

Regulatory attention

With this rapid growth, defi also began to attract regulatory attention, particularly from the Securities and Exchange Commission (SEC), with discussions around the need for consumer protection and anti-money laundering measures.

2022: market challenges and correction

In 2022, the defi market experienced a significant correction, partly due to the Terra-Luna crash. This crash had profound effects on the broader defi ecosystem.

Market correction from Terra-Luna crash

The collapse of TerraUSD (UST), an algorithmic stablecoin, and its associated cryptocurrency, Luna, substantially impacted the defi market. UST lost its peg to the dollar, leading to a steep decline in Luna’s value.

This event raised serious concerns about the stability and reliability of algorithmic stablecoins and resulted in a loss of investor confidence in speculative defi projects.

The crash also caused a domino effect across various defi platforms and cryptocurrencies, leading to a decline in their values.

Scalability and efficiency challenges

Following the market correction, major defi platforms turned their focus to scaling solutions to manage increased traffic and lower transaction costs.

Defi 2.0 emerged as a response to these issues, aiming to improve upon the first generation of defi projects.

Defi 2.0 projects focused on enhancing security, scalability, and user-friendliness. This new wave of projects sought to learn from the mistakes of their predecessors and provide more sustainable and efficient solutions for the defi sector.

For instance, some defi 2.0 projects explored providing insurance against impermanent loss in liquidity pools, thereby incentivizing more liquidity providers by reducing risk.

Persistent security concerns

Despite the growth and innovations in the DeFi space, security remained a major challenge. The sector continued to grapple with security issues, with several high-profile hacks, including the major Acala hack in which hackers stole a USD worth $1.3 billion by exploiting the vulnerabilities within Acala’s algorithm.

2023: consolidation and institutional adoption

By 2023, the defi market began to show signs of stabilization and a more cautious approach from investors, focusing on sustainable development and long-term value creation:

Market stabilization

The TVL in defi was reported at nearly $40 billion as of Jan. 2023, which has increased significantly to over $70 billion as of Jan. 2024. However, the TVL levels still remain at almost 40% of their peak 2021 levels.

During 2023, major defi protocols like Uniswap, Curve, Aave, and Synthetix continued to lead the market.

Uniswap, for example, remained the dominant DEX due to its concentrated liquidity and working capital requirements.

Curve retained a stable 10-15% share of the DEX volume, and Aave developed several innovative projects, including the GHO decentralized stablecoin and Lens Protocol.

Institutional interest

2023 witnessed increased institutional adoption of defi, with traditional financial institutions exploring defi applications.

Major companies like Disney, Starbucks, and Adidas showed interest in embracing crypto technology, indicating defi’s growing acceptance in mainstream financial sectors.

Regulatory clarity

Regulatory clarity around defi began to take shape in 2023, with global and national regulators working on developing guidelines for digital assets.

Key areas of regulatory focus included the classification of cryptocurrencies, taxation, anti-money laundering (AML), know-your-customer (KYC) requirements, the regulation of security tokens, and guidelines on stablecoins.

What experts think led to defi’s decline?

Slava Demchuk, the CEO of AMLBot, in a conversation with crypto.news offered a detailed analysis of the defi market’s contraction. He pointed out the correlation between the shrinking TVL in defi and the broader crypto market’s depreciation against the U.S. dollar. Demchuk stated:

“TVL shrank mostly due to crypto closing its value against the U.S. Dollar. This was underscored by the changing dynamics in the global market, which rubbed off on the crypto ecosystem.”

Furthermore, Demchuk addressed the common misconception that the decline in defi’s TVL was primarily due to security breaches and frauds. He clarified that these issues, while prevalent during high market activity periods, are not the fundamental causes of the market downturn. He explained:

“Periods of high market activity, such as bull runs, are generally marked by an increase in hacks and frauds, so we cannot see those as potential triggers.”

In discussing the future prospects of the defi market, Demchuk brings an optimistic outlook, hinting at pivotal developments such as the potential approval of a Bitcoin spot ETF.

He believes such advancements could significantly enhance defi’s credibility and attract more investments into the sector.

On the other hand, Oleg Bevz, an advisor at Playnance, shared a critical view of the defi market’s peak and subsequent fall. Bevz observed the dramatic decrease in TVL from its peak in 2021 and diagnosed the cause as the market’s overreliance on speculative behavior rather than sustainable growth. He stated:

“The current outlook of the defi world per its TVL pegged at $53 billion, down from over $180 billion at its peak in 2021, is proof that the market is bleeding. The boom of the defi market in 2021 was connected to the fact that people started throwing money into the market expecting unrealistic profits, not because they could get real benefits tailored as products or services for that money. Capitalizing on this greed, most projects printed yields out of thin air. The cycle collapsed because it was built more on expectations and FOMO rather than real utility.”

What to expect from the defi market in 2024?

In 2024, the DeFi market is expected to undergo significant developments influenced by several key trends:

Regulation and transparency

The focus on regulatory frameworks will become more prominent in 2024. True defi projects, which are decentralized in nature, are likely to remain outside the current regulatory perimeters.

However, hybrid finance (HyFi) projects, which contain elements of centralized control, may face increased regulatory scrutiny.

The industry is anticipated to pivot towards a balance between privacy and transparency, adopting proactive compliance measures to address institutional concerns and regulatory frameworks.

Tokenization of assets

A major trend for 2024 may be the tokenization of various assets, including yield-bearing stablecoins and real-world assets (RWAs).

This move is expected to enhance liquidity, reduce transaction costs, and open up new opportunities for defi protocol designs.

The trend towards tokenization is predicted to power significant growth in the defi sector, potentially driving market maturation and expanding the scope of collateral use.

Growth in yield-bearing stablecoins

Yield-bearing stablecoins are forecasted to be one of the fastest-growing sectors in defi, expanding from around $1 billion to over $10 billion.

These stablecoins might offer yields stemming from both staked Ether-based and RWA-based stablecoins, thus enhancing their presence in the market.

These trends indicate that 2024 could be a pivotal year for defi, marked by advancements in technology, regulatory clarity, and market maturity, positioning it for renewed growth.

Credit: Source link