Historical context

Satoshi Nakamoto, a mysterious figure, introduced Bitcoin 15 years ago with the help of a small group. In early 2009, Nakamoto released the Bitcoin software and communicated with users via email, never by phone or in person. As the technology gained attention in 2011, Nakamoto disappeared, leaving behind growing speculation and intrigue.

Australian computer scientist Craig Wright has claimed to be Nakamoto since 2016, sparking disputes and lawsuits. Testifying against Wright were Adam Back, Mike Hearn, Martti Malmi and Zooko Wilcox-O’Hearn, all contributors to Bitcoin’s early development.

Adam Back developed Hashcash, which became the base for Bitcoin’s mining process. Martti Malmi managed Bitcoin.org, Mike Hearn contributed code, and Zooko Wilcox-O’Hearn promoted Bitcoin through blogging.

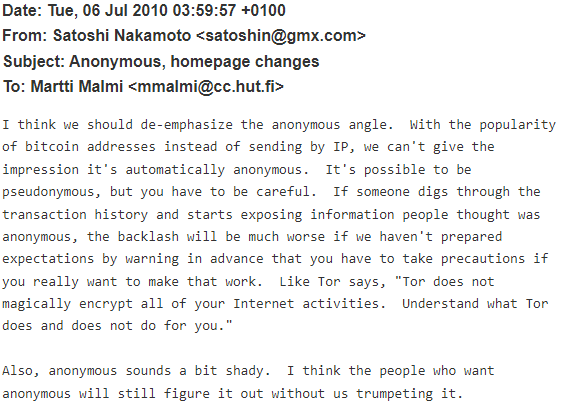

Recently, 120 pages of correspondence between Satoshi Nakamoto and his early collaborator Martti Malmi was released publicly as part of a lawsuit. These emails, available on GitHub, provide new avenues for research and offer insight into Nakamoto’s character as well as Bitcoin’s crucial issues.

Trust is everything

According to Nakamoto, the fundamental issue with traditional currency is the need for trust in centralized institutions like central banks and banks, which often breach that trust through currency devaluation and risky lending practices. Additionally, these institutions require trust with our privacy and financial security, making micropayments difficult due to high overhead costs.

Nakamoto compares this to the trust required in early computer systems before strong encryption, where users relied on system administrators to protect their privacy. However, with the advent of strong encryption, trust became unnecessary as data could be secured from unauthorized access.

Likewise, Nakamoto argues for a similar solution for money with e-currency based on cryptographic proof. This eliminates the need for trust in third-party intermediaries, ensuring security and effortless transactions.

Anonymity issues

Nakamoto recognized early on that Bitcoin was not fully anonymous. While it could be pseudonymous with proper precautions, maintaining privacy was challenging. He advised against emphasizing anonymity to prevent misleading users and suggested users carefully consider privacy implications.

Nakamoto contemplated describing Bitcoin as private but recognized the need to avoid misleading users or fostering distrust. He suggested de-emphasizing the anonymous aspect, believing that those who desire anonymity would understand it without explicit promotion.

Energy consumption

One key insight from Nakamoto’s correspondence is his awareness of Bitcoin’s energy consumption due to its proof-of-work (PoW) consensus mechanism. While PoW is vital for security, it requires significant computing power, raising environmental concerns.

Nakamoto acknowledged these concerns but argued that traditional banking systems’ inefficiencies far outweigh Bitcoin’s energy use. He envisioned Bitcoin replacing resource-intensive infrastructure and billions of dollars in banking fees with a more efficient system.

He emphasized Bitcoin’s potential to be truly peer-to-peer without a trusted third party, unlike centralized electronic money attempts. Nakamoto believed that even if Bitcoin consumed significant energy, it would still be less wasteful than conventional banking activities it aimed to replace.

Bitcoin scaling

Nakamoto expressed confidence in Bitcoin’s scalability, asserting that it could surpass existing payment networks like Visa in transaction capacity. He believed Moore’s Law would ensure the network’s ability to handle growth, contradicting common criticisms today.

Nakamoto highlighted Bitcoin’s potential to scale much larger than Visa’s network with existing hardware and at a fraction of the cost. He emphasized that Bitcoin’s scalability would not hit a ceiling and discussed how it could cope with extreme size. He also anticipated that hardware speed advancements would outpace transaction growth, even under rapid adoption rates.

Security

Nakamoto emphasized the security of the Bitcoin network, stating that its robustness increases with network growth. He acknowledged initial vulnerabilities but argued that the network’s design inherently discourages theft through its economic model.

Nakamoto highlighted that Bitcoin’s security grows alongside its size and the value it protects. While acknowledging initial vulnerability when the network is small, he noted that the effort required to steal outweighs potential gains.

“A key aspect of Bitcoin is that the security of the network grows as the size of the network and the amount of value that needs to be protected grows,” Nakamoto writes. “The down side is that it’s vulnerable at the beginning when it’s small, although the value that could be stolen should always be smaller than the amount of effort required to steal it. If someone has other motives to prove a point, they’ll just be proving a point I already concede.”

For legal reasons, not investment

In Bitcoin’s early days, it was the only cryptocurrency recognized as a commodity by U.S. regulators due to its decentralized nature. Nakamoto, mindful of U.S. regulations, avoided promoting Bitcoin as an investment, preferring users to come to that conclusion independently.

“I would be surprised if 10 years from now we’re not using electronic currency in some way, now that we know a way to do it that won’t inevitably get dumbed down when the trusted third party gets cold feet,” he writes in one of his emails.

Future use cases

Nakamoto gives his early thoughts on ways of the technology’s possible implantation in the current financial system. In one of the emails, he introduces the concept of selling paysafecards for Bitcoins, either through online delivery or physical delivery. These cards, known as Gift Cards in some countries, are often used by individuals without credit history to pay for items that require a credit card.

Later on, Nakamoto gives some ideas for potential use cases:

- Consider positioning it as an intermediate credit for micropayments for virtual goods.

- Explore the concept of one-way payments where only buying Bitcoins and sending money out could be beneficial for pegging the currency.

- Payment for computer time could be another potential use case.

- Avoid discussing the idea of returning money to customers’ credit cards, as credit card companies generally disapprove.

- Any payment processor will likely require you to sell something tangible.

One of the key fragments gives a crucial point in understanding cryptocurrencies’ novelty as opposed to fiat money.

Unlike traditional commodities, Nakamoto claims, digital currencies like Bitcoin offer the possibility of trading over the internet without relying on trusted intermediaries.

Credit: Source link