Any investment firm with greater than $100 million in investments must disclose its trading activity 45 days after the quarter in which it performed those trades. Then, this information is released to the public, which allows investors to track what greats like Warren Buffett and Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) have been doing.

Berkshire Hathaway bought its first Apple (NASDAQ: AAPL) shares in 2016, but it has been selling the stock lately. In the first quarter, Berkshire dumped over 116 million shares of Apple, with an estimated value of over $21 billion using the average price of Apple’s stock in Q1.

This is a huge move considering that Apple used to make up over 50% of Berkshire’s portfolio and is now down to 40%. So why is Berkshire selling?

It’s all about realizing profits — and taking advantage of an unusually low tax rate on corporate profits.

Buffett and Berkshire are using the current tax rate to their advantage

When Berkshire started buying Apple in 2016, it was a completely different stock. Apple was drastically undervalued despite growing at a rapid pace. While neither of these facts is true anymore, Apple’s growth over the past decade has been impressive, and anyone who bought shares when Buffett did and held them along the way has done well.

Of the shares Berkshire sold, the average estimated purchase price was $39.62 per share. With the average price of Apple’s stock being $182 in Q1, Buffett had a paper profit of 359%. That’s a fantastic return for only eight years of investing, and anyone would be thrilled with that gain.

But with profits come taxes, which is why Berkshire has been selling.

The current corporate tax rate is a flat 21%, which means that of its $142.38 per-share estimated profit, Berkshire will have to pay the U.S. government $29.90. In Berkshire’s annual meeting, Buffett called out that this rate is historically low. Buffett also recalled times when it was 35% or even 52% not long ago.

As a result, the company is prudently taking gains now, as higher taxes could be around the corner. The Biden administration has already proposed increasing the corporate tax rate to 28%, which potentially puts Berkshire on the clock to realize gains. Whether this occurs is not a debate Buffett seems willing to engage in. He is just aware that the current rate is the lowest it has been, and he wants to use it while it’s available.

In Berkshire’s annual meeting, Buffett also clarified that Apple would remain its largest investment unless something unforeseen happened.

However, I think there are other reasons Buffett and other shareholders should continue selling off their Apple stake.

Apple is not the company it once was

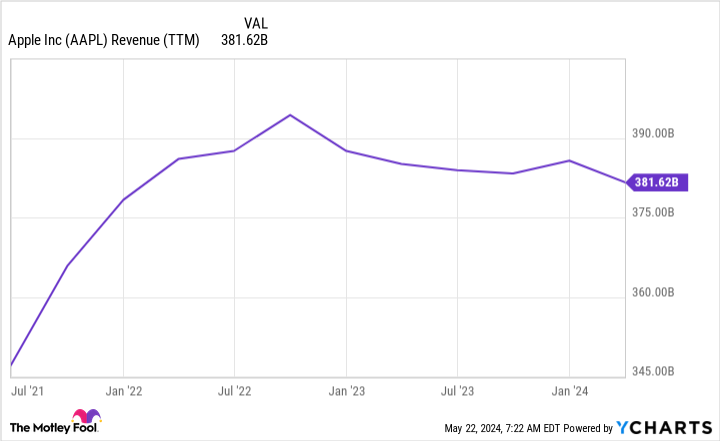

As alluded to above, Apple is no longer growing or cheap. In mid-2022, Apple’s revenue peaked and began to fall.

This isn’t a trend investors want to see, yet Apple has maintained an ultra-premium valuation despite this concerning shift. At nearly 30 times forward earnings, Apple is valued higher than companies like Meta Platforms (23 times forward earnings) and Alphabet (24 times forward earnings), big tech companies with meaningful growth and strong offerings in growing industries like artificial intelligence (AI).

Apple has yet to reveal an AI strategy and hasn’t launched an impactful product recently.

While Apple remains a well-managed company that will not lose investors’ money, it doesn’t appear to be innovating like it used to. As a result, I think there are far better tech stocks than Apple to invest in right now.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, Berkshire Hathaway, and Meta Platforms. The Motley Fool has a disclosure policy.

Warren Buffett Just Sold $21 Billion in Apple Stock. Here’s Why. was originally published by The Motley Fool

Credit: Source link