“The complex US landscape holds a pivotal role in operational success, influencing project timelines and feasibility,” wrote Daniel Yergin, vice chairman of S&P Global.

“Prolonged permitting processes and the spectre of potential post-permit litigation risks present formidable challenges across mining and refining countries. As the industry grapples with this multifaceted challenge, operational concerns stand out as a defining factor shaping domestic production prospects,” says Yergin.

The report underscores the recognition, spanning the US political spectrum, that permitting stands as a significant hurdle in energy project development. Permitting challenges extend beyond the minerals sector, impacting diverse areas, from offshore wind ventures to natural gas pipelines.

According to S&P, the interplay of federal jurisdiction with private or state-owned lands adds complexity, with private or state lands offering a more foreseeable permitting path. However, the narrative is fraught with delays, unpredictability, and escalating costs on federal lands. This issue assumes added gravity since nearly half of the extensive mineral-rich terrain in western states falls under federal government jurisdiction.

Financial impact

The IRA’s financial impact is significant, with the combined IRA and Bipartisan Infrastructure Law contributing a staggering $502 billion to new climate and energy investment.

Nonetheless, experts raise a cautionary flag, citing that the IRA’s dedicated $387 billion could potentially escalate to a $1.2 trillion financial commitment, given the complexity of the US legal environment, which hinders mine development.

The situation is so acute that according to S&P Global data on 127 mines worldwide that began production between 2002 and 2023, a major discovery today likely would not be a productive mine until 2040 or after. Further, large and complex projects in politically sensitive areas can take longer.

The IRA’s repercussions reach into the renewable energy and electric vehicle (EV) sectors, with an expected boost of 30 gigawatts in wind and solar energy by 2030. This growth stems from extended tax credits, catalyzing a swift energy transition.

Anticipated growth in EV sales is projected to catalyze parallel expansion in battery raw material demand. The rise in EVs, coupled with IRA tax incentives, is forecasted to drive a 24% year-over-year increase in EV battery demand between 2021 and 2035. The intricate ties between EV battery demand and specific metals underscore the diverse battery compositions at play, according to S&P Global.

As a result of the IRA’s impact, the report predicts a 23% surge in demand for EV battery capacity in the US by 2035. This escalation translates to an additional 12-15% demand for cobalt, nickel, lithium and lithium over this period.

Domestic suppliers

Amid this projected growth, the report underlines that navigating the intricate maze of permitting poses the most significant threat to the IRA’s execution.

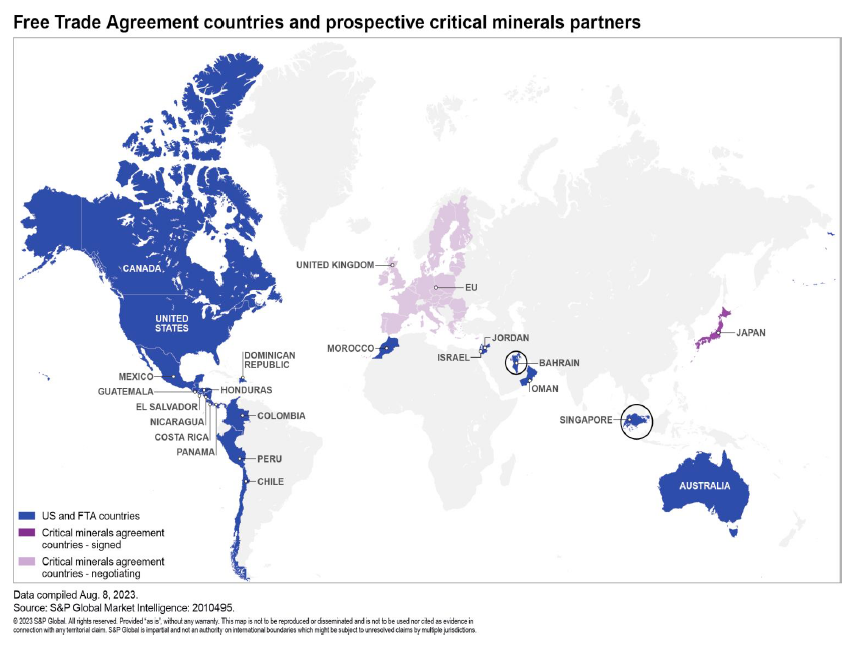

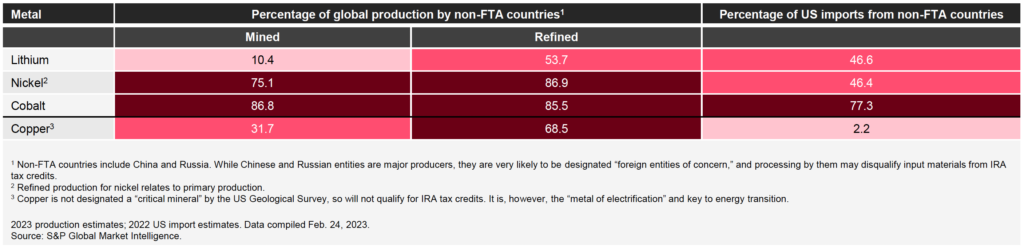

The Act mandates sourcing minerals from domestic suppliers or Free Trade Agreement (FTA) partners. Yet, Yergin says that this quest exposes challenges embedded in prevailing trade patterns and the pivotal role non-FTA countries occupy in the critical metals market.

On a more positive front, the report notes a critical reality: upfront costs in hard rock mining dwarf those in other energy sectors.

While the IRA kindles the renewable energy and EV sectors’ momentum, it simultaneously exposes the intricacies of establishing a robust supply chain. Balancing domestic production, sourcing obligations, navigating operational hurdles, and addressing the permitting labyrinth are formidable challenges stakeholders must surmount to harness the North American energy transition’s full potential.

Credit: Source link