Markets are down today, and a series of related factors is exerting pressure. First, investors are concerned about a possible resurgence in the rate of inflation, which is directly linked to the second fear. This fear arises from rising oil prices, driven by the Russian-Saudi agreement to extend their oil production cuts until December of this year. Finally, with oil prices approaching $90 per barrel, the cost of gasoline is rising in the US markets, even though the summer driving season has come to an end.

Higher gas prices directly contribute to inflation. According to the latest data from AAA, the national average price for a gallon of regular unleaded reached $3.80 on September 6, surpassing last year’s high price and earning the title of the second-highest nationwide average gasoline price. As gas prices keep climbing, it’s likely that the Federal Reserve will face heightened pressure to consider further rate hikes, thereby increasing the risk of a recession.

Every shift in market conditions presents opportunities for investors, whether the markets rise or fall. With crude oil prices on the rise and gas prices increasing, oil stocks are positioned for potential gains.

Wall Street analysts have taken notice and are tagging some of the market’s largest oil companies as ‘Buys.’ Let’s dive in and explore these companies, along with insights from the analysts.

ConocoPhillips (COP)

We’ll start with ConocoPhillips, one of the industry’s giants. The company boasts a market cap of over $147 billion and consistently ranks among the largest independent exploration and production companies in the oil sector, based on a combination of proven reserves and known production. ConocoPhillips operates in 13 countries and employs a workforce of over 9,700.

This solid foundation positions ConocoPhillips as an oil giant capable of weathering a volatile economic landscape. In its last quarter, ConocoPhillips generated over 1,800 thousand barrels of oil equivalent per day (Mboe/d), compared to just under 1,700 barrels per day in the 2Q22 period. Year to date, as of the end of 1H23, ConocoPhillips’ production stands at 1,798 Mboe/d, up from the 2022 full-year average of 1,738.

Among the company’s prominent operations are its liquefied natural gas (LNG) projects. LNG is gaining significance as a cleaner-burning fossil fuel compared to coal or oil. ConocoPhillips operates LNG projects worldwide, with notable locations in the Gulf of Mexico, the Caribbean Sea, West Africa’s coast, and Australia.

ConocoPhillips finished the second quarter with $7.1 billion in cash and short-term investments – after distributing $2.7 billion to shareholders through a combination of $1.4 billion in dividends and $1.3 billion in share repurchases.

ConocoPhillips offers both a fixed dividend and a variable dividend that changes depending on the company’s performance. The latest payout included a regular dividend of $0.51 per share (offering a 1.66% yield) and a variable dividend of $0.60 per share (1.95% yield).

This stock has caught the attention of Neal Dingmann, 5-star analyst from Truist, who sees the firm’s strong presence in LNG as one of its major upsides. Dingmann writes of this company and its stock, “We believe ConocoPhillips has premiere US upstream inventory coupled with a material amount of attractive LNG assets. While the company’s upstream and LNG assets are more than ample to continue the business for well over a decade, we would not be surprised to see COP add additional positions in either area. While we believe US ops and LNG will dominate future upside, the company also has numerous other attractive assets such as Surmont and Willow that we believe will produce strong cash flow along with a stellar balance sheet.”

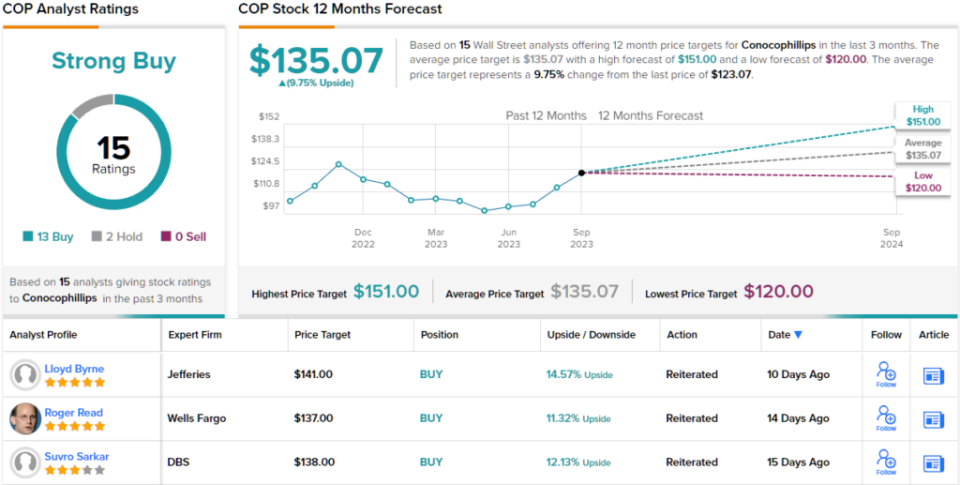

Dingmann’s bullish stance fully complement’s the Buy rating he places on COP shares, while his $151 price target shows his confidence in a 23% upside potential for the coming year. (To watch Dingmann’s track record, click here)

All in all, no fewer than 15 analysts have weighed in on COP shares recently, with 13 Buys and 2 Holds giving them a Strong Buy consensus rating. (See ConocoPhillips stock forecast)

Chevron Corporation (CVX)

The second major oil company on our list, Chevron, is one of the world’s largest hydrocarbon producers and a giant by any measure. The company generated nearly $240 billion in revenue last year and boasts a market cap of ~$318 billion.

Chevron is known for its activities in oil and natural gas exploration and production, its hydrocarbon transportation assets (including a shipping company for maritime transport), its extensive refinery network that produces a range of fuels, lubricants, petrochemicals, and additives, and its retail segment, which includes a chain of gas stations that market the refined products. Additionally, Chevron is a 50/50 partner with its peer company Phillips 66 in the production of industrial fuels and chemicals.

A look at the last reported quarter, 2Q23, will show us where the company stands. Specifically, revenues were down almost 29% from 2Q22, but the $48.9 billion result was over $900 million better than had been anticipated. Chevron’s bottom line, reported in non-GAAP measures as an EPS of $3.08, was 10 cents ahead of the forecast.

Along with better-than-expected revenues and earnings, Chevron also impressed on cash flows. The company’s cash flow from operations was reported as $6.3 billion, a figure that included the $2.5 billion in free cash flow. The company was able to use its strong cash position to deliver $7.2 billion in capital returns to shareholders, through a combination of dividends and buybacks.

Chevron last declared its dividend on July 28, for $1.51 per share. This annualizes to $6.04 per common share, and yields 3.62%. Chevron has a dividend history going back to 1990, and has been gradually raising the payment since 2005.

So it’s clear that Chevron has sound footing, based on strong fundamentals – and that was the starting point for Raymond James analyst Justin Jenkins, who wrote of the company: “With a strong financial base, high relative shareholder payout, and an attractive relative asset portfolio, we think Chevron still offers the most straightforwardly positive risk/reward in a market that’s become tougher to differentiate among the oil & gas majors. 2Q earnings were again solid with CVX’s Upstream portfolio with Sunday’s pre-release with strong Permian production data being the big upside – underscoring CVX’s Permian growth trajectory.”

The 5-star analyst didn’t stop there, but summed up his comments with an upbeat take: “Overall, based on a secure balance sheet, top-tier leverage to the oil macro, and capital allocation that continues to move in a preferred direction, we maintain our Outperform rating…”

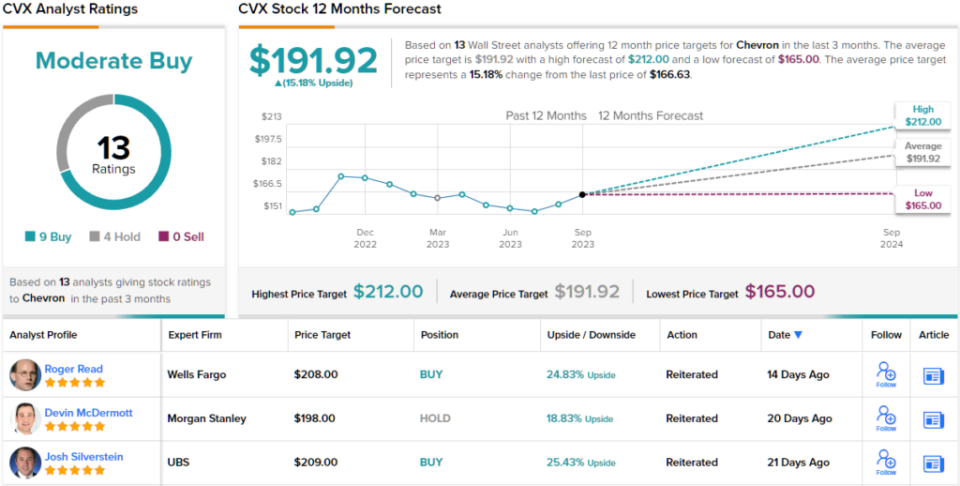

Jenkins’ Outperform (i.e. Buy) rating was paired with a $200 price target that implies a 20% upside on the one-year time horizon. (To watch Jenkins’ track record, click here)

Turning now to the rest of the Street, 9 Buys and 4 Holds have been published in the last three months. Therefore, CVX has a Moderate Buy consensus rating. (See Chevron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link