If passed, the proposed upgrade to Ethereum’s leading DEX will enable UNI stakers to collect a portion of protocol fees.

One of DeFi’s oldest discussions is back in the spotlight.

Uniswap, Ethereum’s leading decentralized exchange, is seeing its native token surge after the Uniswap Foundation floated a proposal to distribute a portion of protocol fees to UNI stakers.

UNI spiked more than 60% on the news, boosting its market cap above $8 billion.

The proposal was welcomed by UNI holders, who have repeatedly called for the so-called ‘fee switch’ to be enabled, thereby increasing the utility of the token beyond governance.

The Uniswap Foundation’s governance lead, Erin Koen, proposed the upgrade, saying that it would reward UNI token holders who had staked and delegated their tokens.

“If approved by the community, Uniswap Governance’s resilience and decentralization will increase,” he said.

A Snapshot vote is set for March 1, with an on-chain vote scheduled for March 8.

Timely Trade

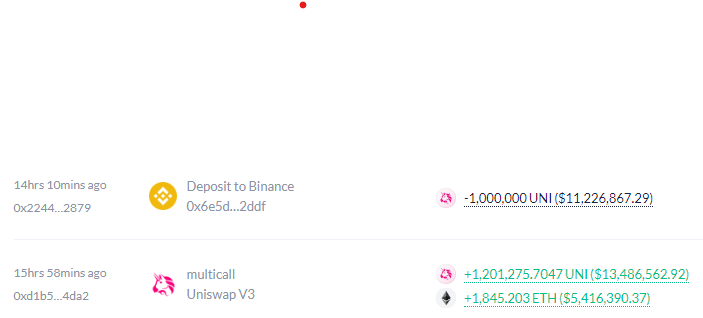

Onchain data shows that a wallet providing substantial UNI liquidity withdrew its tokens and sent 1M UNI – worth around $7 million at the time – to Binance. The transactions were flagged yesterday by blockchain observer Lookonchain.

Assuming that the UNI hasn’t been sold yet, the prescient whale is up more than $4 million while avoiding impermanent loss.

Encouraging Governance Participation

With $4.9 billion in total value locked (TVL), Uniswap is Ethereum’s leading decentralized exchange, routinely processing over $1 billion of spot trades per day.

It is governed by UNI holders, but like most decentralized organizations, it has seen governance participation drop off amid the bear market.

Koen’s proposal aims to improve Uniswap governance – which he calls minimized – by making delegation a prerequisite to staking UNI and earning a portion of protocol revenue.

He added that “existing delegators must choose new delegates to stake tokens and earn rewards, likely creating mass re-delegation events short- to medium-term.” Koen also said he thinks there will be a higher churn rate as votes shuffle between delegates more often.

In November 2023, Uniswap DAO voted to delegate a portion of UNI tokens held by the Uniswap Foundation to underrepresented delegates that maintain an 80% participation rate.

Credit: Source link