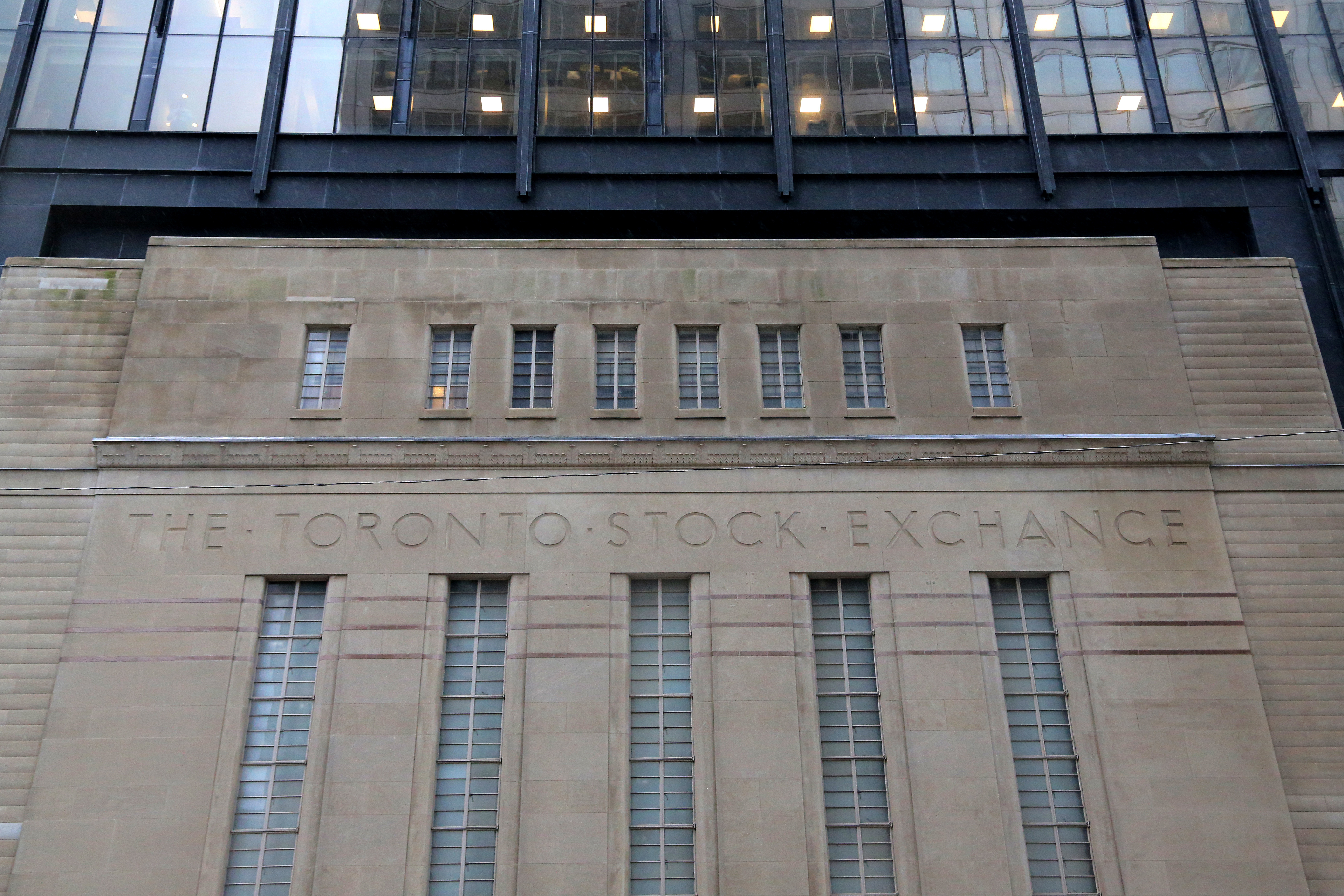

The Art Deco facade of the original Toronto Stock Exchange building is seen on Bay Street in Toronto, Ontario, Canada January 23, 2019. REUTERS/Chris Helgren Acquire Licensing Rights

Oct 25 (Reuters) – Futures for Canada’s main stock index were muted on Monday as investors braced for U.S. inflation figures later in the week for clues on how long the Federal Reserve could keep interest rates at elevated levels.

December futures on the S&P/TSX index were flat at 7:03 a.m. ET (1203 GMT).

Materials stocks are expected to see an uptick on the back of higher copper prices, even as subdued gold prices could limit gains on the index.

Investors are looking forward to U.S. inflation data, due on Tuesday for clues on interest rate trajectory of the world’s biggest economy.

Last week, Federal Reserve Chair Jerome Powell did not rule out further interest rate increases pushing back against market expectations that the U.S. central bank’s rate hikes had reached an end.

The Toronto Stock Exchange’s S&P/TSX composite index (.GSPTSE) closed up 67.06 points, or 0.34%, at 19,654.47 on Friday.

U.S. stock index futures edged lower on Monday as investors awaited economic data.

In corporate news, Australian pension fund AustralianSuper rejected an offer to drop its opposition to a $10.5 billion bid for Origin Energy by joining a consortium led by Canada’s Brookfield (BAM.TO) Asset Management and its partner EIG.

COMMODITIES AT 7:03 a.m. ET

Gold futures : $1,942.3; +0.2%

US crude : $77.38; +0.3%

Brent crude : $81.61; +0.2%

($1= C$1.3809)

Reporting by Khushi Singh in Bengaluru; Editing by Tasim Zahid

Our Standards: The Thomson Reuters Trust Principles.

Credit: Source link