Ethereum mainnet fees dropped 44% in 2023, signaling increased migration to cheaper Layer 2 scaling solutions.

Ethereum’s Layer 2s are enjoying widespread usage from users after last year’s Merge, according to a report by P2P lending protocol PWN.

Led by Arbitrum and Optimism, which witnessed a 190% and 103% surge in network fees, respectively, the overall Layer 2 ecosystem saw fees increase 400% from 2022 to 2023.

Along with soaring fees on Layer 2s come reduced costs for users on Ethereum’s mainnet, PWN reports. The network witnessed a 44% decline in generated fees, more than double the average for all Layer 1s.

It seems users are migrating in droves to Layer 2 solutions, with the move to Proof-of-Stake accelerating the transition.

Bitcoin, turbocharged by the Ordinals ecosystem, registered the highest growth among Layer 1s with a 461% surge in fees generated.

DeFi and NFTs Take A Dive

Decentralized exchanges suffered a 51% drop in total fees generated last year. Led by Uniswap, which commands 64% of the entire fee market, the DEX sector generated $871M in 2023.

Despite suffering a threatening hack in late November, KyberSwap was the only DEX that saw growth in its fee market, jumping 73%.

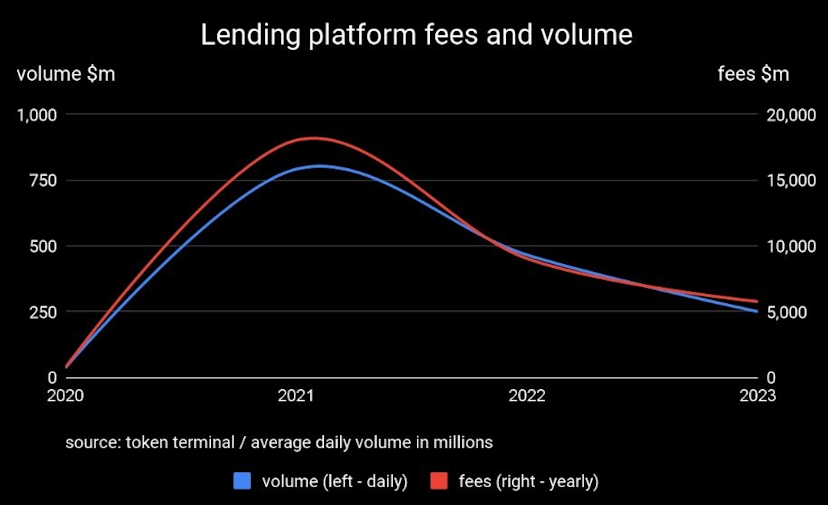

Lending platforms highlight a mixed bag in terms of the concentration of value and fees generated. The entire sector saw fees decline 36%, with market leader Aave mirroring that number. However, half the category dropped – with some, such as Maple Finance, dropping 99% – whereas the other 50% increased. Radiant was the top performer, generating 479% more fees over 2022.

The NFT marketplace sector was hit hard by last year’s grueling crypto winter. Fees plummeted by 87% despite Blur’s meteoric 2,718% rise.

Stablecoins are widely poised for growth this year, with USDC set for a comeback after a dismal 2023. It registered its first net supply increase since the collapse of Silicon Valley Bank last year – totalling a $1.23B rise on the year.

Credit: Source link