The global crypto market cap ended last week with a 7% drop, losing $160 billion as it closed at $2.15 trillion.

While Bitcoin (BTC) influenced the broader market, several altcoins charted their own paths, benefiting from unique developments within their ecosystems.

Here are some of these cryptocurrencies to keep an eye on this week, following their diverse price movements last week:

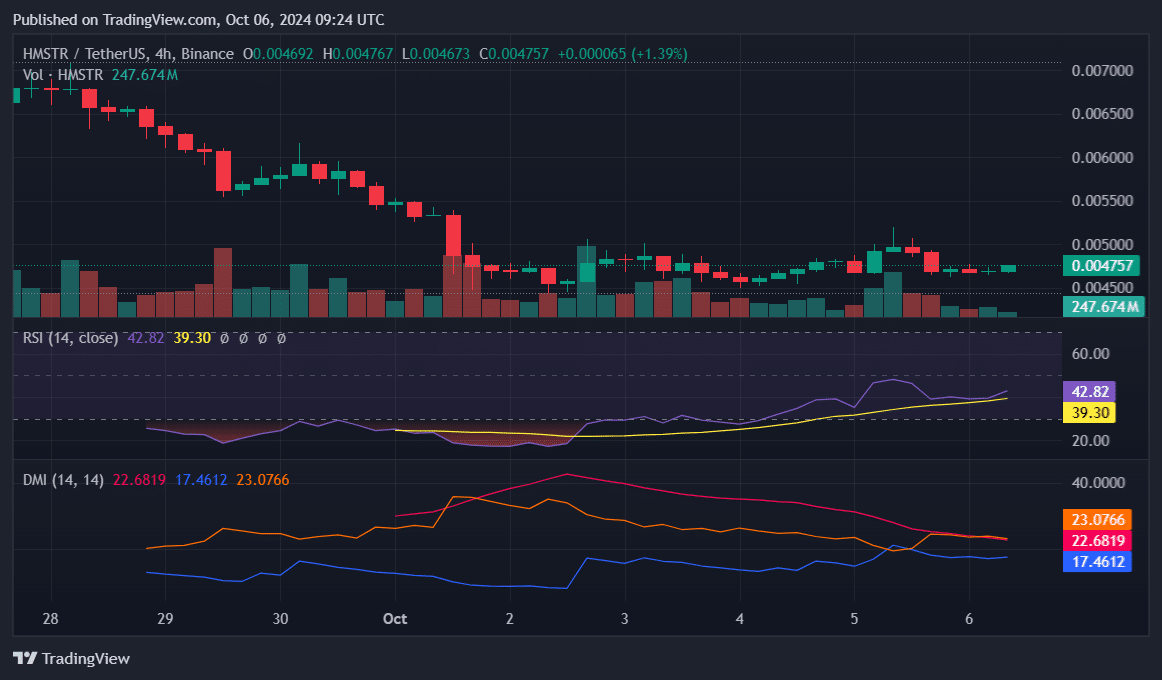

HMSTR collapses 18%

Hamster Kombat (HMSTR) saw a bearish week, dropping 18% to $0.004714. Its worst day came on Oct. 1 when it fell 13.94% amid a broader market decline on the back of geopolitical tensions.

Last week’s bearishness built on a downtrend HMSTR has faced since its airdrop on Sept. 26. However, the four-hour chart shows some signs of recovery, with the RSI sloping upward, now at 42.82.

For the DMI, the +DI is steady at 17.46, signaling slight buyer momentum. However, the -DI at 23.07 slopes downward, indicating weakening selling pressure. The ADX is at 22.68 and trending downward, as the current trend loses strength.

These figures suggest a possible recovery if buying momentum continues, with bulls possibly targeting $0.0051. However, the downtrend may persist if buyers do not pick up pace this week.

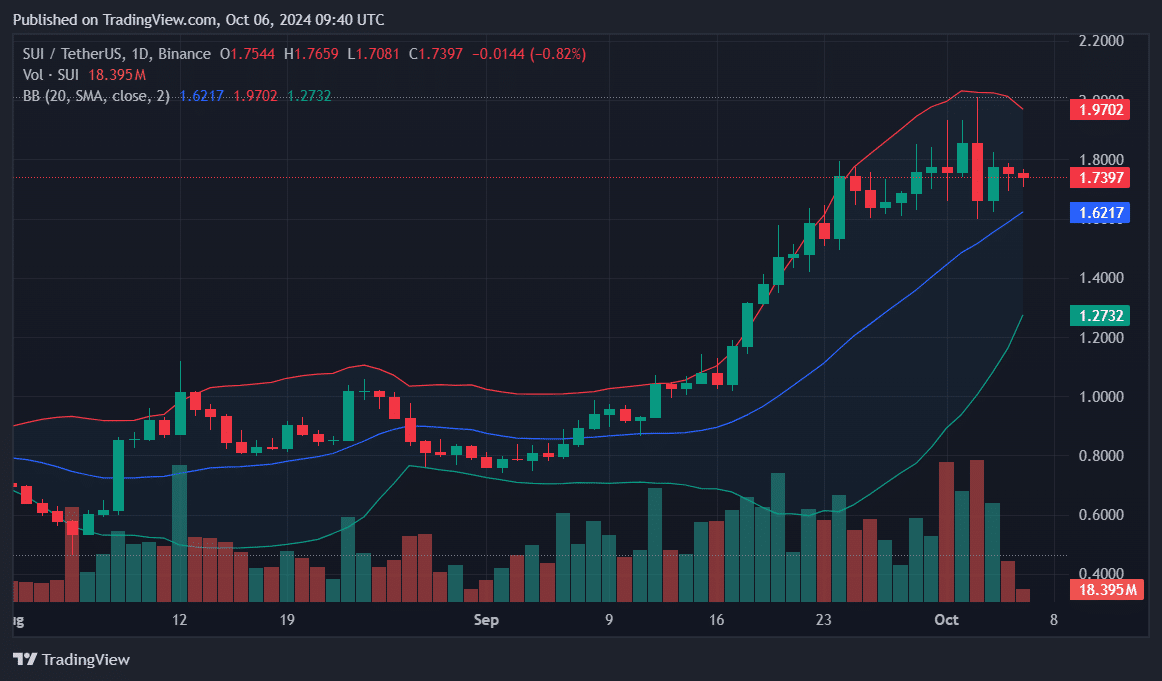

SUI demonstrates resilience

Sui (SUI) showed resilience despite broader market volatility, dropping only 0.3%. On Oct. 1, amid market turmoil, SUI dipped just 0.97%.

However, it saw a sharper 10.38% decline on Oct. 3, its largest intraday crash in three months.

SUI appears to be forming a bull pennant following its uptrend in September. Currently, the Bollinger Bands indicate the upper band at $1.97, which acts as resistance, and the 20-day MA at $1.62 provides immediate support.

With SUI trading below the upper band, the price could stabilize above the $1.62 support.

Investors should monitor for a bounce between $1.62 and $1.97, with a breakout above the resistance likely signaling bullish momentum for the week.

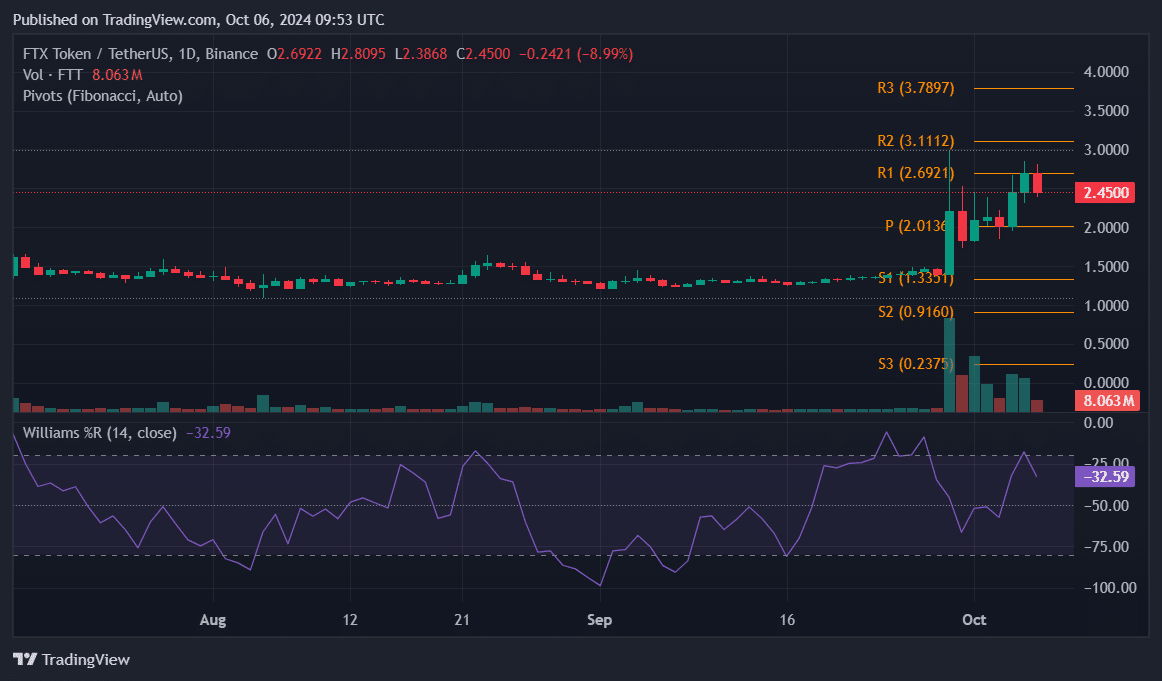

FTT bucks the trend

FTX Token (FTT) defied market trends last week, gaining 22% while most assets declined.

On Oct. 1, FTT rose by 13.89%, followed by a 21.53% surge on Oct. 4 and another 9.86% the next day.

Amid this uptrend, the Williams Percent Range stands at -32.59, signaling that FTT is near overbought territory but still has room for further gains.

As it witnesses a 9% retracement this new week, bulls need to defend the Pivot support at $2.01 to prevent a slip into bearish territories. Below this, the next support rests at $1.33, marking lows last seen in two weeks.

Should FTT recover from the latest correction, market participants should watch for a break above the resistance level at $2.68, which continues the bullish momentum.

Credit: Source link