In the wake of Ethereum exchange-traded funds (ETFs) approval, top analyst Michaël van de Poppe is bullish on five specific altcoins and predicts substantial returns.

This landmark event has spurred interest across the Ethereum ecosystem, setting the stage for an altcoin season. Here is a look at the altcoins van de Poppe is eyeing to buy, each chosen for their potential to yield significant gains.

1. Optimism (OP)

Optimism, a Layer-2 scaling solution for Ethereum, is the first altcoin on the list. With Ethereum’s price surge, platforms enhancing its efficiency are expected to thrive.

This Layer-2 network utilizes roll-up technology to batch transactions, reducing costs and increasing speed. Michaël van de Poppe highlighted its impressive total value locked (TVL) ratio, indicating robust ecosystem growth. Optimism’s low circulating supply further enhances its bullish outlook.

“I think that a coin like Optimism can do between, I would say, 300% to 800% in BTC value in the coming six months. I think that’s very likely and that’s probably the first run,” van de Poppe said.

2. Arbitrum (ARB)

Next is Arbitrum, another Layer-2 solution competing closely with Optimism. It leverages zero-knowledge rollups, a technology providing faster and more secure transaction processing.

Despite its price struggles, Arbitrum’s ecosystem shows strong development momentum. Van de Poppe believes its substantial TVL and ongoing advancements make it a solid investment, poised for a significant rebound.

“If you look at the TVL of this Arbitrum, it’s almost the exact same amount as the market capitalization. So that is super bullish as the ecosystem is also growing. But once we look at the price action, it is garbage,” van de Poppe added.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

3. Woo Network (WOO)

Woo Network, a decentralized exchange (DEX) known for its high liquidity and low fees, is another altcoin van de Poppe plans to buy.

In the decentralized finance (DeFi) sector, DEXs are gaining traction due to increasing regulatory pressures on centralized exchanges. Woo Network’s technological advantages and growing user base position it well for growth, particularly as trading volumes on Ethereum continue to rise.

“Once Ethereum starts to do well and the volumes are already waking up, this is where WOO comes in. There’s also a revenue being made so that is why I think it’s a great one to have. I think when the whole cycle starts for WOO, it can actually yield between 500% to 1,500%,” van de Poppe explained.

4. Wormhole (W)

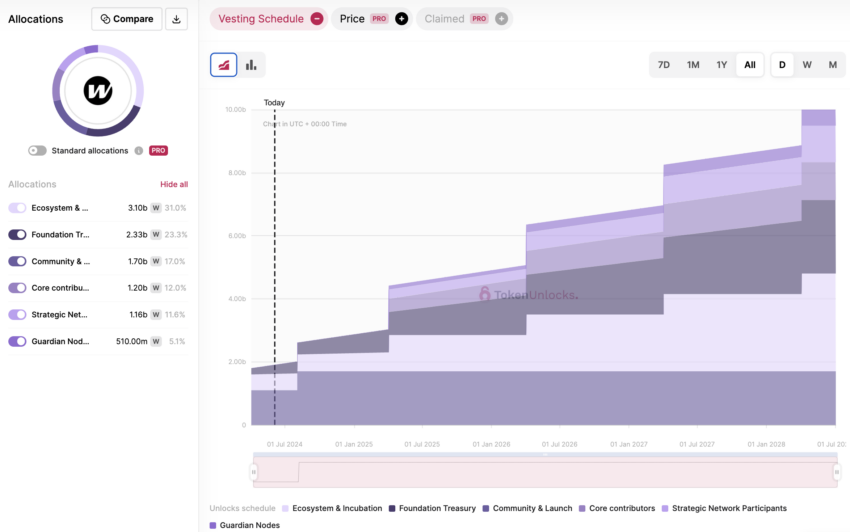

Wormhole, a bridge protocol for interoperability between blockchains, ranks fourth. As the DeFi landscape expands, seamless asset transfers across different blockchains are critical.

Its innovative solutions facilitate this cross-chain communication, making it an attractive investment. Although relatively new, its potential for widespread adoption and integration into various blockchain ecosystems is high.

“I want to bet on safe Solana (SOL) solutions. The only tricky part with Wormhole is the fact that there are still unlocks, but these unlocks are going to take some time so that’s why I think that this one is going to do really well,” van de Poppe added.

5. Dogecoin (DOGE)

Finally, Dogecoin, a well-known meme coin, remains a favorite. Despite its volatility, Dogecoin’s community support and recent price performance make it a viable short-term play.

Michaël van de Poppe sees it as a high-risk, high-reward asset, especially amid a broader crypto market upswing.

“Whether you like it or not, you see all the meme coins doing well. Floki, Book of Meme, Bonk. All of those meme coins are doing well. This is the time when you want to get yourself into a position of Dogecoin. It’s the easiest one. It will do a 4x to 5x or maybe even more,” van de Poppe concluded.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

These altcoins are selected based on their technological strengths, market positioning, and potential for high returns. However, it is essential to approach these investments with caution, given the inherent volatility of the cryptocurrency market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link