Nvidia has been a bellwether in the artificial intelligence (AI) space thanks to its graphics processing units (GPUs) that have played a crucial role in the training and deployment of AI models. But the stock has fallen out of favor of late as investors are worried about its slowing growth.

This is evident from the fact that the stock is down 5% since releasing its fiscal 2025 second-quarter results on Aug. 28. The chipmaker’s quarterly revenue jumped an impressive 122% year over year to $30 billion last quarter as it continued to dominate the market for AI chips, while its terrific pricing power resulted in a 152% year-over-year increase in adjusted earnings to $0.68 per share.

However, management’s forecast that its revenue would increase at a relatively slower pace of 80% year over year in the current quarter seems to have made investors jittery. There is no doubt that Nvidia is still on track to grow at a very healthy pace and continues as the undisputed leader in the AI chip market, but it seems that the company’s expensive valuation is counting against it.

Meanwhile, another AI company that recently released its results has seen its stock price zoom higher despite growing much slower than Nvidia. Here’s a closer look at this name and why it seems like a solid AI stock right now.

AI is helping Oracle build a terrific revenue pipeline

Oracle (NYSE: ORCL) has jumped into the limelight this year as AI is driving a marked acceleration in the company’s cloud business. This is why shares of the company, which was traditionally known for its database software, shot up more than 11% following the release of its fiscal 2025 first-quarter results (for the period ended Aug. 31) on Sept. 9.

Total revenue increased 8% year over year to $13.3 billion in constant currency terms, clearing the $13.2 billion consensus estimate. Adjusted earnings increased at a faster pace of 17% from the same period last year to $1.39 per share, which was again higher than the $1.33 Wall Street estimate.

However, all eyes were on Oracle’s remaining performance obligations (RPO), a measure of the total value of a company’s contracts that will be fulfilled at a future date. The company’s RPO jumped 53% from the same quarter last year to a record $99 billion, suggesting that it is building an impressive revenue pipeline that should supercharge its growth in the long run.

More specifically, Oracle’s overall cloud revenue jumped 22% year over year during the quarter to $5.6 billion, while there was a 46% spike in cloud infrastructure revenue to $2.2 billion. Management said that 42 additional cloud GPU contracts were signed for a total of $3 billion in the previous quarter.

Moreover, the demand for Oracle’s cloud infrastructure is outpacing supply, which is why the company intends to continue investing in capacity to satisfy the burgeoning end-market. As a result, it said its capital expenditure in fiscal 2025 would be double last year’s levels. That might seem like an ambitious move, but the demand for cloud infrastructure for training and deploying AI models is increasing rapidly.

Customers are renting Oracle’s infrastructure to scale up AI development, and this trend is likely for a long time to come as Goldman Sachs estimates that the demand for cloud services could increase at an annual rate of 22% through 2030, generating $1 trillion in annual revenue. The investment bank points out that generative AI could account for $200 billion to $300 billion of this spending on the back of investments by companies looking to create AI applications.

Specifically, the infrastructure-as-a-service (IaaS) market — which was Oracle’s fastest-growing segment last quarter — could generate $580 billion in revenue in 2030. Therefore, the company could be at the beginning of a stupendous growth opportunity as its IaaS revenue stood at $2.2 billion in the fiscal first quarter, translating to an annual revenue run rate of $8.8 billion this fiscal year.

Stronger growth could send the stock higher

Management says that its strong contract backlog will increase revenue growth throughout fiscal 2025. So the company expects its fiscal second-quarter sales to increase between 8% and 10% in constant currency terms, which would be a slight improvement over the previous quarter.

More importantly, the company is confident that its fiscal 2025 top line is on track to increase by double digits, with full-year total cloud-infrastructure revenue growing faster than last year.

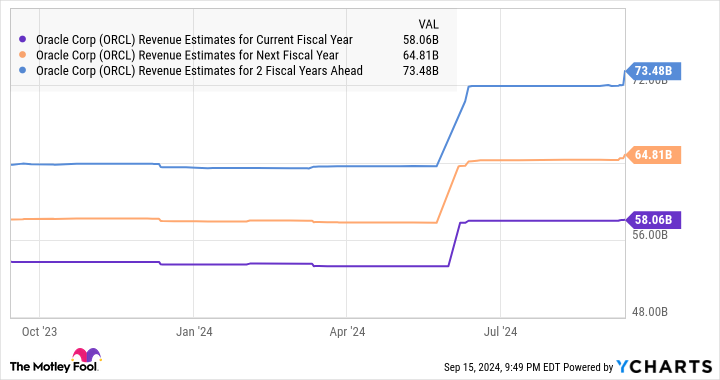

And analysts expect this double-digit growth to continue over the next couple of fiscal years as well.

But investors have already seen how big the cloud computing market is expected to become thanks to the adoption of AI. So don’t be surprised to see Oracle’s growth improve in the coming years, and the market could reward that with more upside.

That’s why it could be a good idea for investors to buy Oracle while it is trading at an attractive 25 times forward earnings, a discount to the Nasdaq-100 index’s earnings multiple of 31 (using the index as a proxy for tech stocks). This AI stock could fly higher following the 54% gain it has clocked so far this year.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $715,640!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Forget Nvidia: This Top Artificial Intelligence (AI) Stock Is Skyrocketing and Can Soar Higher was originally published by The Motley Fool

Credit: Source link