Ripple’s (XRP) price had a rather exceptional 24 hours on Saturday as the altcoin witnessed a massive surge.

This rally was not the result of a recent development but sentimentality arising from nostalgia for a landmark decision in the crypto space.

Ripple’s New Anniversary

XRP price soared on July 13 as it marked the first anniversary of Ripple’s win against the Securities and Exchange Commission (SEC). On this day in 2023, the courts ruled in favor of Ripple stating XRP is in and of itself not a security.

This ruling brought an end to the lawsuit, which began in December 2020 when the SEC went after the company. This win by Ripple also resulted in many top cryptocurrency exchanges, including Coinbase and Kraken, relisting the XRP.

XRP holders celebrated the first anniversary of this decision by increasing the buying pressure on the asset resulting in a rally. However, this does not draw attention away from the fact that despite the landmark ruling, XRP is not noting much demand among investors. Among them are institutional investors, one of the most influential cohort who have been staying away from the Ripple token.

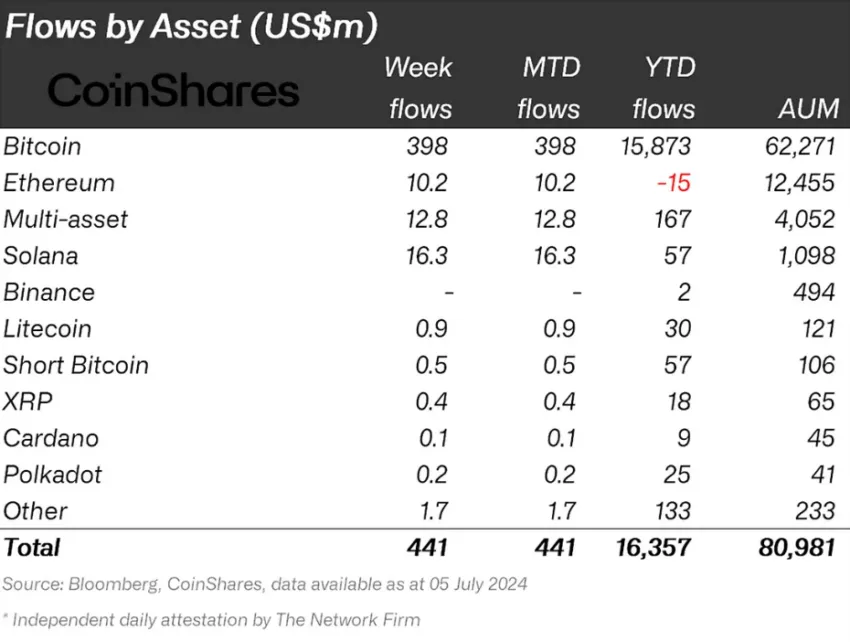

According to a CoinShares report, institutions have been opting for other tokens over XRP. Solana, Litecoin, and Polkadot have noted significantly higher inflows year to date than XRP’s $18 million. This shows that institutional investors’ interest in XRP is fading.

Read More: How To Buy XRP and Everything You Need To Know

XRP Price Prediction: Bullish or Bearish?

XRP price noted a near 20% rise as it hit the intra-day high of $0.566. This was followed by a cool down to register a 12% rise. The altcoin can be seen changing hands at $0.534, which is a good thing for more than one reason.

The Ripple native token is above the 23.6% Fibonacci Retracement level. This level is also known as the bear market support floor and could provide support to XRP in continuing its recovery.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the sudden increase leads to sudden profit-taking, a drawdown cannot be ruled out. Losing the 23.6% Fib line would send the altcoin back into consolidation under $0.51, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link