Shares of ailing fintech firm PayPal (NASDAQ:PYPL) failed to impress (or “shock the world”) when it revealed its artificial intelligence (AI) plans as part of its recent announcement. Undoubtedly, PayPal is very much in the AI race after the not-so-surprising announcements that were quick to be shot down by analysts and investors alike. The firm is still a legit underdog in the so-called AI race, even if its recent AI-driven features failed to generate hype right off the bat.

Though PayPal may not be standing nearly as tall as its peers in the mega-cap tech scene, some of whom have far more ambitious AI plans, I still believe it’s a mistake to count PayPal out of the game as it looks to get its share price back on the right track.

Indeed, nothing seems to be working for PayPal these days. The stock likely lost a ton of confidence when it shed more than 80% of its value since its mid-2021 peak at just north of $300 per share. After such a catastrophic implosion, investors don’t seem to be buying into the firm’s turnaround potential.

PayPal Is Shocking Nobody Right Now, but It May at Some Point

Whether we’re talking PayPal’s PYUSD stablecoin offering in the crypto universe, the recent layoff of 9% of its staff, or the latest AI plans, it seems like the firm is really trying to put its hand in many pies to win back some of the investors it had lost over the last two and a half years. For now, it doesn’t seem like they’re coming back. However, if PayPal can continue innovating on the front of AI, perhaps it can shock the world at a later date.

In any case, the recent AI announcements seem to have set a pretty low bar. And whenever you’ve got a low bar, it makes it easier to overdeliver. In many ways, PayPal stock seems like dead money, but at these depressed multiples (shares go for 18.6 times trailing price-to-earnings right now), I believe the stakes haven’t been this low in quite a while. As such, I’m inclined to be bullish on the stock.

PayPal’s AI Announcement: Nothing to See Here, Folks?

There’s no shortage of analysts who weren’t shocked in the slightest following the company’s presentation centered on AI tech. Mizuho analyst Dan Dolev is one of the analysts who was unenthused by the event, going as far as to say the firm’s intent of “doubling down on Branded Checkout may prove a long-term regret.”

With the negative initial reaction in the stock to PayPal’s six AI-powered initiatives, it certainly seems like the tough crowd has gotten a heck of a lot tougher, even with the much lower price of admission on shares.

Of the six new AI features, which include an enhanced checkout, Smart Receipts, Fastlane (one-click), CashPass, Advanced Offers, and Upgraded Venmo Business, none really stood out to me as a massive game-changer. Indeed, any one of PayPal’s rivals could leverage AI in a way to do many of the same things in the future. At this juncture, it seems like the crowd is inclined to believe that anything PayPal can do, mega-cap tech (think the Magnificent Seven members) can do better, especially when it comes to AI.

Which of the Big Six AI Innovations Is Most Intriguing?

While Branded Checkout may prove to be somewhat regretful, as Mr. Dolev pointed out, I think the upgraded Venmo Business profiles feature holds the most potential of all six recently announced AI initiatives. Indeed, Venmo is a robust platform with many loyal users to whom PayPal can showcase new tech.

Any new innovation that can make the lives of users (especially business users) easier will increase brand loyalty. I firmly believe that adding value (through AI or not) will allow the company to more easily increase its pricing over time.

Over the long run, such convenience updates could add up and help bolster the Venmo (and PayPal) ecosystem in a way that makes it harder to jump ship over to a competing payment service provider.

Understandably, it will take some time before investors warm up to the recent AI initiatives, perhaps when the AI bets start resulting in actual cash flows — something that may happen a lot sooner than the skeptics and bears expect.

Is PYPL Stock a Buy, According to Analysts?

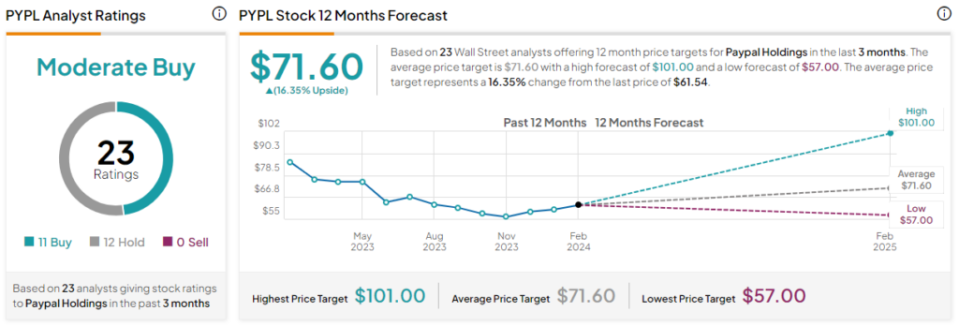

On TipRanks, PYPL stock comes in as a Moderate Buy. Out of 30 analyst ratings, there are 14 Buys and 16 Hold recommendations. The average PYPL stock price target is $71.60, implying upside potential of 16.35%. Analyst price targets range from a low of $57.00 per share to a high of $101.00 per share.

The Takeaway

I don’t think it’s fair for investors to punish PayPal for its recent AI-heavy event. While it may not have showcased the most ground-breaking features on the planet, I do believe PayPal is on the right track. And over time, the firm certainly has the ability to enrich its offering further as it welcomes AI with open arms.

Disclosure

Credit: Source link