A market prophet says the S&P 500 could crash 30%, and a recession is probably underway.

Gary Shilling doubts the Fed will cut interest rates before summer, but sees a return to 1% or 2%.

Shilling prefers Treasuries to gold, predicts earnings will weaken, and expects many more layoffs.

The S&P 500 could plummet 30%, a US recession may already be underway, and the Federal Reserve is unlikely to cut interest rates before the summer, a legendary market prophet has warned.

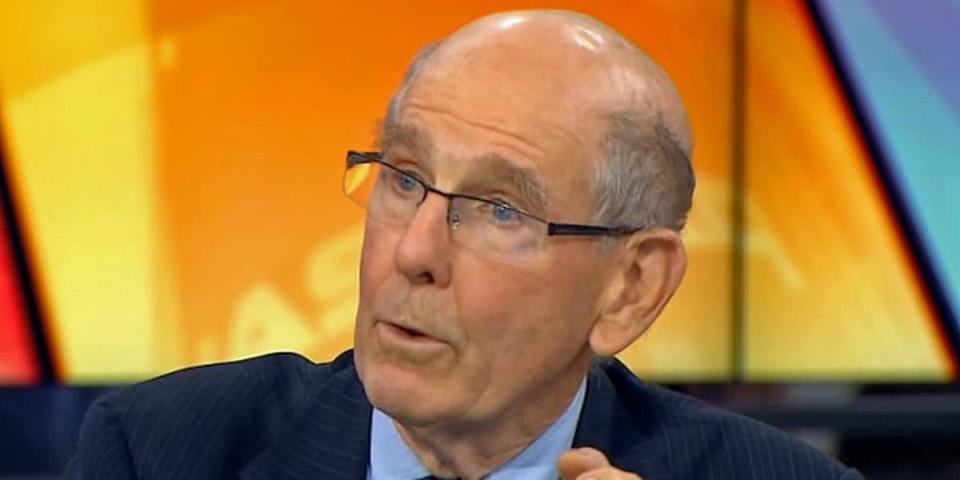

Gary Shilling, who served as Merrill Lynch’s first chief economist before launching his own consulting firm over 45 years ago, delivered the dour outlook on a Rosenberg Research webcast in late December. He rang the alarm on company earnings, touted government debt over gold, and predicted layoffs would accelerate in the months ahead.

Shilling is known for making several correct calls in decades past, but financial markets and the economy have defied his dour forecasts in recent years. Here are his 10 best quotes from the webcast, lightly edited for length and clarity:

1. “I think we still can have a 25% or 30% decline in the S&P.”

(The delayed impacts of the Federal Reserve’s hikes to interest rates, and pressure on corporate profits this year, threaten to drive the benchmark US stock index as low as 3,300 points or its lowest level since the fall of 2020, Shilling said.)

2. “I like Treasurys. They’re about the best credit in the world. If you worry about the federal government going broke, you better get your gold bars and AK-47 and a cave to go in.”

3. “I just have never had any interest in gold. It has so many forces that push the price around: political risk, inflation, deflation, mining, what the central banks are doing, and so on. A lot of the time, those forces must basically cancel each other out.”

4. “I think we’re probably in a recession now. NBER wait until they get all the data in, the revisions, and everything else. By the time they make the call, it’s about as handy as a pocket in your underwear.”

(Shilling was referring to the National Bureau of Economic Research, a private organization that officially calls recessions, usually several months after they start.)

5. “Soft landings are pretty rare. There’s only been one in the entire post-war period and that was in the mid-90s. I define a soft landing as the Fed raising its target rate and then lowering it with no recession. A soft-landing forecast is bucking history.”

6. “Small businesses don’t tend to have deep pockets. They’ve got to be very sensitive to economic conditions, financial conditions. When you see them cutting way back on their hiring plans, that tells you that there is trouble out there.” (Shilling was highlighting recent surveys showing small-business owners are worried about the economy and scaling back their expansion goals.)

7. “We’re seeing weakening in profits. We’re seeing weakness in employment. Of course, it’s a much more drawn-out situation than normal because employers had such a devil of a time hiring people, that it’s taking them an awful lot of blows of the two-by-four to the head to shift gears into firing.”

(He was suggesting that labor shortages during the pandemic have made companies loath to conduct layoffs.)

8. “I don’t think that they are permanent reprieves. I think they are simply delays.”

(Shilling argued the economy has been shored up by government programs and employers’ reluctance to fire workers, but dwindling pandemic savings, mounting credit-card bills, and rising debt delinquencies signal a downturn ahead.)

9. “There’s been an awful lot of overenthusiasm. There’s been front-running of the Fed, which is probably not going to do anything on the downside in rates until probably the middle of the year. Meanwhile, the economy is probably going to continue to weaken, and there’s more and more evidence of a recession. The feeling that it’s going to be a sudden cut and that there is a soft landing … I think both those are going to be disappointed.”

10. “I don’t see any reason why the Fed isn’t going to knock the funds rate down to close to where it was when we started.”

(Rates have jumped from nearly zero to over 5%, but they’re likely to return to 1% or 2%, Shilling said.)

Read the original article on Business Insider

Credit: Source link