A UPS seasonal worker delivers packages on Cyber Monday in New York, US, on Monday, Nov. 27, 2023.

Stephanie Keith | Bloomberg | Getty Images

November’s solid jobs report did not assure that the economy will come in for a soft landing, but it did help to clear the runway a little more.

After all, there’s nothing about a 3.7% unemployment rate and another 199,000 jobs that even whispers “recession” let alone screams it.

At least for now, then, the U.S. economy can take another win with a small “w” as it looks to navigate through what had been the highest inflation level in more than 40 years — and a still-uncertain path ahead.

“Overall, the jobs market is doing its part to get us to a soft landing,” said Daniel Zhao, lead economist at jobs rating site Glassdoor. “It’s boring in all the right ways. That’s a welcome change after a few years of less-boring reports.”

Indeed, despite a high level of anxiety heading into the Labor Department’s nonfarm payrolls report, the details were fairly benign.

The level of job creation was just above the Wall Street estimate of 190,000. Average hourly earnings rose 4% from a year ago, exactly in line with expectations. The unemployment rate unexpectedly declined to 3.7%, easing worries that it could trigger a historically dead-on signal known as the Sahm Rule, which coordinates increases of the unemployment rate by half a percentage point to recessions.

Still, the solid report couldn’t dispense the lingering feeling that the economy isn’t out of the woods yet. The fear primarily comes from worries that the Federal Reserve’s aggressive interest rate increases haven’t exacted their full toll and still could trigger a painful downturn.

“The key uncertainty for the labor market in 2024 is whether job growth slows to a more sustainable pace, or whether the economy moves from monthly job gains to monthly job losses. The former would be consistent with the Fed’s soft-landing scenario, while the latter would mean recession,” said Gus Faucher, chief economist at PNC Financial Services. “PNC still thinks recession is the more likely outcome in 2024, but it is a close call.”

All about consumers and inflation

Key to whether the so-called landing is soft or hard will be the consumer, who collectively accounts for nearly 70% of all U.S. economic activity.

On that front, there was another round of good news Friday: The University of Michigan’s closely watched consumer sentiment survey showed that inflation expectations, a key economic variable for prices, plummeted in December. Respondents put one-year inflation expectations at 3.1%, a stunning 1.4 percentage point drop.

However, such gauges can be “fluky” and are not in line with some other signals coming from consumers, said Liz Ann Sonders, chief investment strategist at Charles Schwab. Debates over soft landings and inflation expectations and interest rate outlooks tend to miss bigger points, Sonders added.

Prior to 2023, Sanders and Schwab had been stressing the notion of “rolling recessions,” meaning that contractions could hit certain sectors individually while not dragging down the economy as a whole. The distinction may still apply heading into 2024.

“The recession versus soft landing debate sort of misses the necessary nuances of this unique cycle,” Sonders said. “A best-case scenario is not so much a soft landing, because that ship has already sailed for [some] segments. It’s that we continue to roll through such that if and when services gets hit more than the brief ding so far and it takes the labor market with it, you’re already in stabilization or recovery mode in areas that that already took their big hits.”

Getting to the soft landing, then, likely will require navigating some of those peaks and valleys, none more so than establishing confidence that inflation really has been vanquished and the Fed can take its foot off the brake. Inflation, according to the Fed’s preferred gauge, is running at 3.5% annually, well above the central bank’s 2% goal though consistently falling.

Still nervous about rates

There was one other good piece of good inflation news Friday: Rental costs nationally declined 0.57% in November and were down 2.1% year over year, the latter being the biggest slide in more than 3½ years, according to Rent.com.

However, one interesting development from the latest economic data was a bit less market confidence that the Fed will be cutting interest rates quite as aggressively as traders previously believed.

While the traders in the fed funds futures space still roundly expect that the Fed is done hiking, it now expects only about a 45% chance of a previously expected cut in March, according to CME Group data. Traders previously had been expecting 1.25 percentage points worth of cuts in 2024, but lowered that outlook as well to a tossup with just a full point of decreases following the data releases.

That may in itself seem like only a nuanced change, but the move in pricing reflects uncertainty over whether the Fed keeps talking tough on inflation, or concedes that policy no longer needs to be as tight. The fed funds rate is targeted in a range between 5.25%-5.5%, its highest level in more than 22 years.

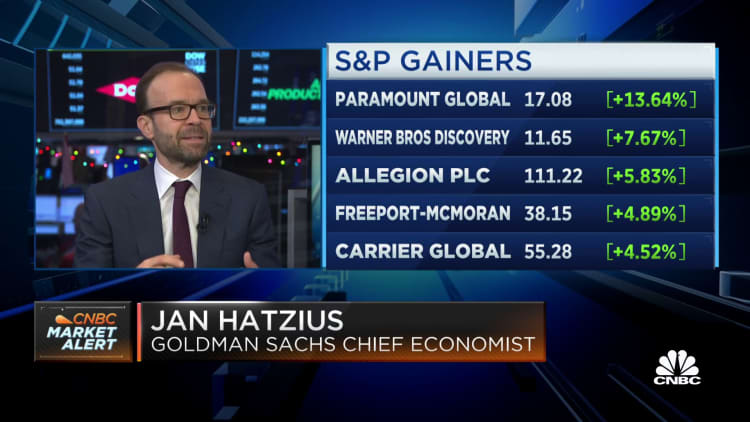

“The key thing though, from a broader perspective, is that they can cut if the economy were to see more of a slowdown than we expect. Then the Fed could cut could provide some support,” Jan Hatzius, chief economist at Goldman Sachs, said Friday on CNBC’s “Squawk on the Street. “That means the risk of recession is in my view quite low.”

Goldman thinks there’s about a 15% chance of a recession next year.

If that forecast, which is about the standard probability given normal economic conditions, holds up, it will require continued strength in the labor market and for consumers.

Periods of labor unrest this year indicate, though, that not all may not be well on Main Street.

“If things were going great. then people would not be marching in the cold and rain because they want more pay because the cost of living is going up,” said Giacomo Santangelo, economist at job search site Monster.

Workers won’t need economists to tell them when the economy has landed, he added.

“The alleged definition of a soft landing is to bring on to bring inflation down to 2% to 2½% and have unemployment go up to that full employment level. That’s really what we’re what we’re looking for, and we’re not there yet,” Santangelo said. “When you’re on an airplane, you know what it feels like when a plane lands. You don’t need the the person in the cockpit to come on and go, ‘Alright, we’re going to be landing now.”

Credit: Source link