Investing on Wall Street has been akin to riding a roller coaster since this decade began. Over the past four years, the major stock indexes have oscillated between bear and bull markets on a couple of occasions.

When volatility rules the roost on Wall Street, investors have a tendency to pile into time-tested outperformers. While the FAANG stocks have certainly fit the bill for the past decade, it’s companies enacting stock splits that have been investors’ preference over the past couple of years.

A stock split is an event that allows a publicly traded company to cosmetically alter its share price and outstanding share count by the same magnitude, without having any impact on its market cap or operating performance. Stock splits can be used to make shares of a company more nominally affordable for everyday investors (a forward-stock split), or can increase a company’s share price to ensure continued listing on a major stock exchange (a reverse-stock split).

Investors have flocked to high-profile stock-split stocks for more than two years

Since the midpoint of 2021, nine high-flying companies have conducted forward-stock splits, including semiconductor stock Nvidia (NASDAQ: NVDA), internet search behemoth Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), and e-commerce kingpin Amazon (NASDAQ: AMZN), which effected respective splits of 4-for-1, 20-for-1, and 20-for-1.

Although the act of splitting their respective shares is a very short-term catalyst driven by investor emotions, forward-stock splits more importantly act as a beacon for businesses that are out-executing and out-innovating their competition.

For example, Nvidia has gone on to become the infrastructure backbone of the artificial intelligence (AI) revolution since conducting its split in July 2021. The company’s A100 and H100 AI-inspired graphics processing units (GPUs) may account for a greater than 90% share of GPUs in use by high-compute data centers this year. While Nvidia’s stock would probably be soaring with or without its stock split in July 2021, its previous split has made shares more affordable for investors without access to fractional-share purchases.

Stock splits have also served as a reminder of just how impressive Alphabet’s and Amazon’s respective moats are. Alphabet’s Google tallied a nearly 92% share of global internet search in December, which is 88 percentage points higher than its next-closest competitor. Google Cloud has also gobbled up a 10% share of worldwide cloud infrastructure services spending.

Meanwhile, Amazon brought in approximately 40% of U.S. online retail sales in 2022, per Insider Intelligence, and it’s the leading provider of global cloud infrastructure services via Amazon Web Services (AWS). AWS sports an annual sales run rate of $92 billion and is currently responsible for the lion’s share of Amazon’s operating income.

Long story short, it’s very easy to see why investors have flocked to high-profile stock-split stocks in recent years. Just keep in mind that not all stock-split stocks are worth investing in.

This ultra-popular stock-split stock is worth avoiding in 2024

Whereas forward-stock splits are almost always conducted by top-notch companies, reverse-stock splits are, more often than not, a sign of trouble. Though there have been a few instances throughout history of reverse-stock splits working out nicely for long-term investors, such as tech-based travel company Booking Holdings, reverse splits are usually situations to avoid.

For once-high-flying marijuana stock Canopy Growth (NASDAQ: CGC), its recent split is all the more reason to keep your distance in 2024. Effective Dec. 20, 2023, the company completed a 1-for-10 reverse split. Had this split not taken place, Canopy’s common stock would be trading for about $0.45 per share, which is more than 99% below its all-time high.

At one time, the Canadian pot industry appeared primed for success. When our neighbors to the north gave recreational weed the green light to be legally sold in October 2018, it was widely expected that vertically integrated licensed producers would thrive. In particular, Canopy Growth was expected to benefit from international exports and a domestic surge in demand for higher-margin cannabis derivatives (e.g., edibles, beverages, and vapes).

Unfortunately, reality never came close to matching these expectations. Part of the blame does lie with Canadian regulators. Federal regulators were incredibly slow to approve cultivation licenses prior to October 2018, while provincial regulators in Ontario (Canada’s largest province by population) initially relied on a lottery system to award dispensary licenses. This lottery system resulted in far too few retail locations opening in a key province.

Consumer behavior didn’t quite align with projections for Canadian cannabis companies, either. Cannabis users have gravitated toward value-based products and dried cannabis flower. In other words, margins for Canadian licensed producers are far below what was expected.

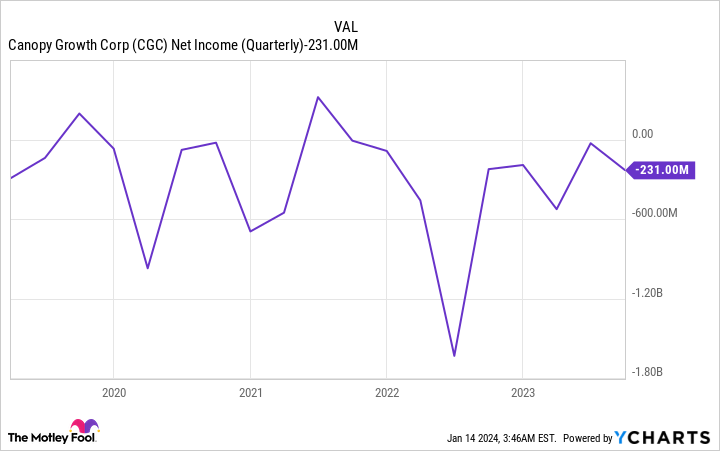

But let’s not beat around the cannabis bush — Canopy Growth deserves more than its fair share of the blame, too. Management grossly overestimated domestic and global production needs, which is one reason the company took a goodwill impairment charge of more than $1.4 billion in fiscal 2023 (the company’s fiscal year ended March 31, 2023).

Furthermore, during the early stages of the marijuana craze, Canopy Growth’s stock-based compensation was exorbitantly high. Even after hiring David Klein in 2020 from Constellation Brands to tighten Canopy Growth’s proverbial belt, the company still hasn’t been able to back its way into the profit column.

A history of poor acquisitions, coupled with grossly overexpanding production capacity without understanding consumer demand trends, has decimated the company’s once-robust cash pile. Since closing a roughly $4 billion equity investment from Constellation Brands in November 2018, Canopy Growth’s cash, cash equivalents, and short-term investments have shrunk to around $201 million, as of Sept. 30, 2023.

Although Canopy Growth has raised some cash by issuing stock and conducting private placements, the company’s auditors have included a going concern warning in its operating results. This means Canopy may not have the capital to cover its expected operating liabilities over the next 12 months.

The final nail in the coffin for Canopy Growth is that there’s no guarantee the U.S. federal government will change marijuana’s scheduling anytime soon. President Joe Biden has signaled no willingness to legalize cannabis for recreational purposes, and multiple attempts to enact banking reform measures have been stymied in the U.S. Senate. Without the ability to enter the most lucrative cannabis market in the world, Canopy Growth stock likely has further to fall.

Should you invest $1,000 in Canopy Growth right now?

Before you buy stock in Canopy Growth, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Canopy Growth wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Booking Holdings, Constellation Brands, and Nvidia. The Motley Fool has a disclosure policy.

The Once High-Flying Stock-Split Stock to Avoid Like the Plague in 2024 was originally published by The Motley Fool

Credit: Source link