USDT breached $90 billion in market cap for the first time.

Tether has overcome drawbacks from the Luna, FTX and U.S. banking crises with its USDT stablecoin making new highs this week, while the overall stablecoin market shows signs of growth.

USDT’s market capitalization climbed to $90.4 billion on Friday, the highest ever. Meanwhile, the weekly change in aggregate stablecoin supply is making a shift to positive growth after dipping all year, while trading volume is also picking up, data by CoinMetrics show.

Stablecoins are usually an indicator of crypto market health, and their recent performance lays the foundation for the bull narrative currently unraveling in the industry.

“This upward trend can be interpreted as a leading indicator of improving liquidity on-chain, suggesting an environment where more capital is available for deployment,” according to a Dec. 5, CoinMetrics report.

Stablecoins See Green Shoots

Utilization rates, the proportion of deposited funds being borrowed, for USDT, USDC and Dai in Aave have climbed to levels last seen in 2021.

That shows a “rising appetite for leveraging these assets for yield generation strategies,” according to CoinMetrics.

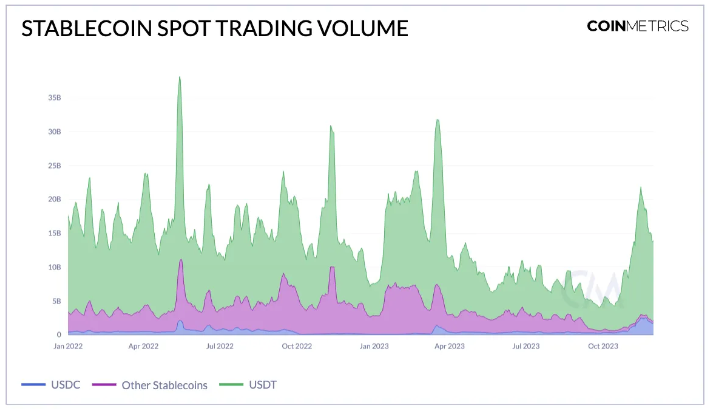

Stablecoin spot trading volume has also climbed and is now at the highest since March.

USDT dominates, reaching $18.8 billion on Nov. 15, while USDC volumes have also risen, reaching a record $2.5 billion in November. Still, volumes for most other stablecoins have seen a downfall.

It’s a Tether Story

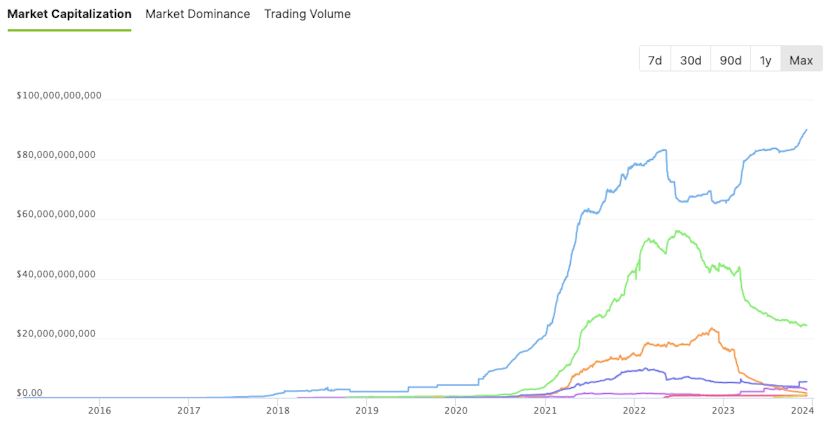

But the recovery of the stablecoin market is mostly a Tether story. The overall market cap of stablecoins is down 6% this year, to $125 billion from $134 billion, according to Coingecko data.

Since January, market cap for USDT increased by 36%, Dai’s rose just under 7%, while USDC’s and BUSD’s declined, by 45% and 90%, respectively. TUSD market cap more than doubled as Binance used it to replace BUSD. Tron’s USDD was flat.

Still, DAI, the crypto-backed stablecoin issued by MakerDAO, has enjoyed a 44% increase in market cap in the past thirty days, reaching $5.3 billion as of writing.

USDC Downfall

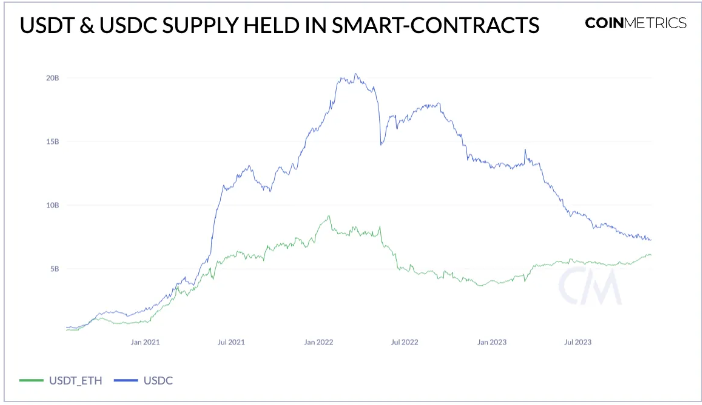

USDC, formerly the king of DeFi, is about to be replaced by USDT.

USDC’s supply in smart contracts peaked at over $20 billion in March 2022, more than halving to $7 billion now. In contrast, Ethereum-based USDT’s presence in smart contracts has increased from $4 billion at the start of this year to over $6 billion.

The declining market cap for USDC was prompted by the U.S. banking crisis, which left USDC’s issuer Circle with its deposits exposed as regional banks went under.

Also, as yields have risen for U.S. Treasury bonds, investors have returned to traditional markets. This trend was further magnified by the regulatory clampdown from authorities in North America, stymying growth and leading traders to find options outside the jurisdiction of the United States.

Still, USD-backed stablecoins had an average of $600 billion in monthly trading volume, a whopping 7,400% difference from its European counterparts.

Lack of Transparency

Even as regulators and experts have cautioned against the lack of transparency regarding its reserves, USDT enjoys the lion’s share of stablecoin market cap.

The top digital dollar has been rated D for safety by Bluechip, a non-profit stablecoin rating company.

Co-founder and CEO, Benjamin Levit, told The Defiant that non-disclosure of names and locations of banks, and custodians who hold USDT’s reserves is a big red flag, he said. “This prevents users from being able to assess the credibility/strength of those institutions and the regulations which govern them, if any,” he added.

For now though, crypto participants aren’t concerned as Tether’s lead versus competitors is at the widest ever.

Credit: Source link