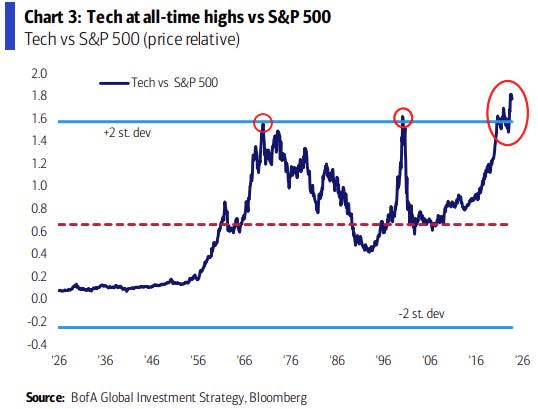

Technology stocks just hit all-time highs relative to the S&P 500, according to Bank of America.

The surge has eclipsed the dot-com bubble highs from 2000 and the highs seen during the 1960s bull market.

Bank of America’s Michael Hartnett credits the “AI productivity miracle bull” for tech’s recent dominance.

Our Chart of the Day is from Bank of America, which highlighted the recent outperformance of technology stocks versus the S&P 500.

In fact, tech stocks just hit a record high relative to the S&P 500, eclipsing the dot-com bubble’s peak in 2000 as well as the highs seen during the 1960s bull market.

The chart measures the relative price performance between technology stocks and the S&P 500. As the chart moves higher, it signals that tech stocks are outperforming the broader market, and vice versa when the chart is moving lower.

Bank of America investment strategist Michael Hartnett credited the ongoing outperformance in tech stocks to the “AI productivity miracle bull.”

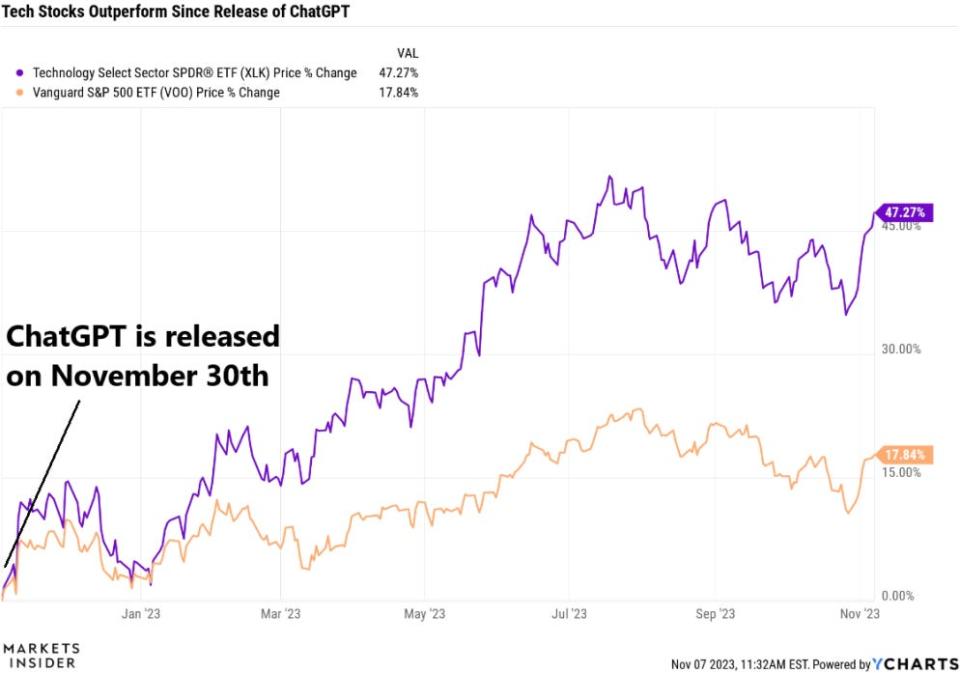

The tech rally was supercharged after OpenAI released its ChatGPT chatbot in November 2022. That helped fuel a reversal of last year’s bear market, with the Nasdaq 100 up 43% year-to-date.

Since ChatGPT was released, the Technology Select Sector SPDR ETF has jumped 47%, far outpacing the S&P 500’s 18% gain over the same time period.

A lot of the bullishness has been driven by the idea that as the adoption of artificial intelligence grows, it will help fuel efficiencies and productivity gains that should boost profits over the long term.

And tech companies at the center of the AI boom — like Nvidia, Alphabet, and Microsoft, among others — are set to see a surge in business as they supply AI-related hardware and software to companies adopting the new technology.

“I think the promise of AI is real. This year, our growth is being driven by productivity… Higher real growth, more borrowing, more capital investment, I want to be in stocks and not bonds,” Wharton professor Jeremy Siegel said last month.

Read the original article on Business Insider

Credit: Source link