The stock market did not take kindly to machine vision company Cognex Corp.‘s (NASDAQ: CGNX) recent second-quarter earnings report. Unfortunately, its end markets are weakening in 2024, and the hoped-for pick-up in orders in the all-important second and third quarters (as customers prepare for the fourth quarter) is highly unlikely to come in 2024. Still, much of the bad news is already in the price now, and Cognex is a company with outstanding long-term growth prospects. Here’s why it’s an attractive stock to buy right now.

Cognex’s disappointing earnings

The company’s revenue declined by 17% in 2023, and the bounce back in 2024 isn’t going to be as much as investors were hoping. Cognex’s revenue declined 1% in the second quarter, and excluding the benefits of acquisitions and foreign currency movements, it was down by 7%.

Moreover, management’s revenue guidance for the third quarter of $225 million to $240 million was below market expectations and disappointing, considering second-quarter revenue was $239 million.

Simply put, it will be another disappointing year for Cognex, and management wasn’t slow in highlighting why.

Cognex’s end markets

Management estimates its served market at $6.5 billion, with its overall market share at about 15%. The table below shows the relative importance of each market and Cognex’s strength within it.

Cognex End Market | Served Market | Cognex Market Share |

|---|---|---|

Automotive | $1.5 billion | 15% |

Electronics | $1.35 billion | 20% |

Logistics | $2 billion | 15% |

Medical related | $650 million | >10% |

Others | $1 billion | <20% |

Data source: Cognex.

Management discussed these end markets in the earnings presentations, and, unfortunately, the only two elements that currently have positive drivers are logistics and the semiconductor market within “others.” The rest are negative.

End market weakness in 2024

In Cognex’s historical core end market of automotives, CEO Rob Willett cited “a further step down in our broader automotive business, particularly in Europe” with “more tentativeness” of its automotive customers due to weak auto sales and “political uncertainty.”

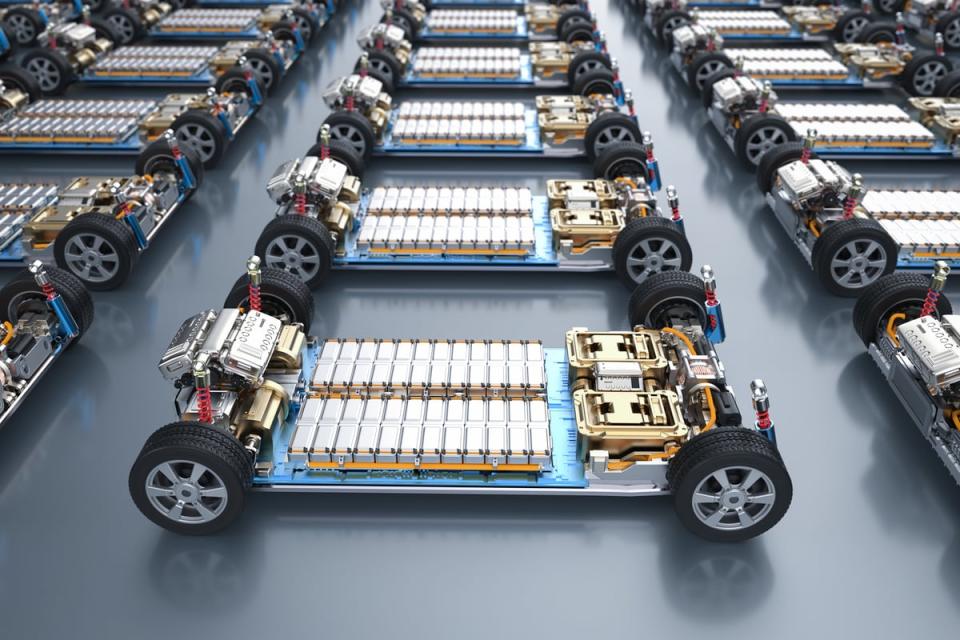

As if that wasn’t bad enough, Willett also said electric vehicle (EV) battery customers were cutting back on projects, and their revenue declined in the second quarter. That’s not good, as it’s supposed to be a growth area for Cognex.

Management also tempered growth expectations in consumer electronics (Apple has been a significant customer in the past), with Willett citing weak consumer demand and “particular weakness” in China. It also noted “uncertainty” around the timing and size of its customers’ investments.

Logistics (machine vision is used in e-commerce fulfillment centers) is a bright spot, with double-digit revenue growth in the first half. It is recovering from a period of severe retraction following the boom in spending during the pandemic-related lockdown periods.

Why Cognex is an outstanding stock to buy

It’s indisputable that Cognex is operating in some challenging markets right now. Still, investors must appreciate that its revenue growth has always been volatile. Much of the previous volatility comes down to the development of significant order growth, such as with Apple in 2014, or the growth in its logistics end market during the lockdowns, interspersed with slowdowns as these growth bursts don’t prove sustainable.

Still, that’s how growth companies work, and the current cyclical weakness in their end markets primarily results from their exposure to relatively high interest rates. Higher interest rates make automobile purchases more expensive and pressure consumer spending on discretionary items such as consumer electronics.

As such, Cognex’s end markets will likely improve in a more benign interest rate environment.

In addition, the long-term drivers of machine vision adoption remain strong. It’s a vital part of the automated processes in factories and warehouses and helps inspect and guide increasingly complex processes. Moreover, advances in artificial intelligence (AI) (Cognex is infusing more AI applications into its products) will help image recognition and enable more complex operations.

A stock to buy

Management estimates its end markets will grow 13% annually over the long term and sees Cognex’s annual growth at 15%. History suggests that will be the case, and the current weakness won’t last forever. As such, the stock’s whopping 62% decline from its all-time high makes it a highly attractive stock to pick up on weakness.

Should you invest $1,000 in Cognex right now?

Before you buy stock in Cognex, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cognex wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Cognex. The Motley Fool has a disclosure policy.

Take Advantage of the Dip to Buy This Unstoppable Long-Term Growth Stock was originally published by The Motley Fool

Credit: Source link