Social Security in the United States is facing several challenges that necessitate changes to ensure its sustainability and adequacy. Chief among these are long-term solvency issues due to an aging population and a declining worker-to-retiree ratio. Funds are projected to become insolvent in 2033 or 2034, according to the latest estimate.

See: 4 Social Security Shakeups from Biden That Could Hit Your Wallet by 2024

Find: 3 Ways To Recession-Proof Your Retirement

Although the majority of retirees’ benefits will still be covered by taxpayers, the government and the Social Security Administration (SSA) are going to have to make some tough choices regarding the program in the very near future. Taxpayers are going to have to brace for cuts to the program at some point.

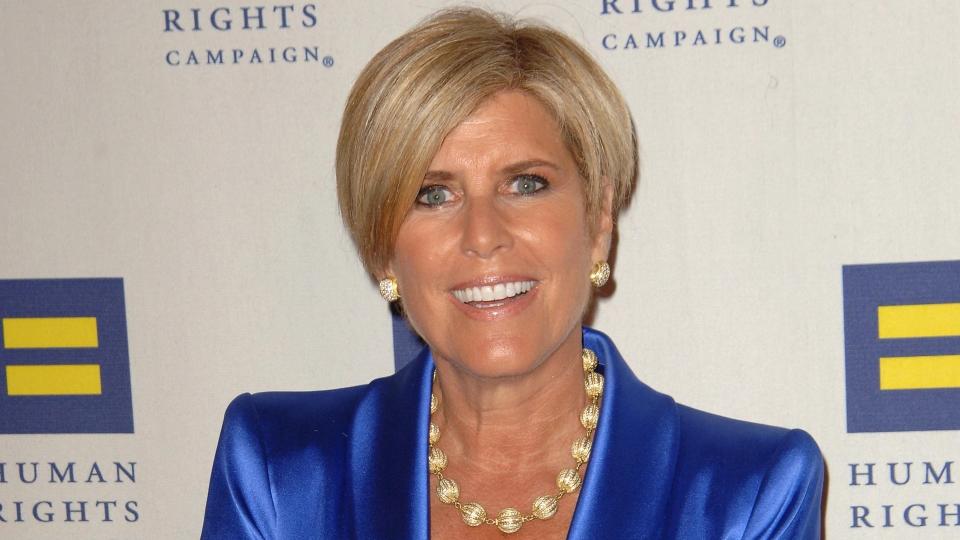

Adjustments to a few related issues, like benefit formulas, cost-of-living adjustments (COLA), means testing for high-income earners and changes to wage caps have been hotly debated by lawmakers and experts for years now, including personal financial advisor and bestselling author and podcaster Suze Orman.

“Social Security’s in trouble; we are in trouble. And the only people that are going to save us, is us,” Orman told Moneywise last year. Here are three pressing issues that Orman and others are predicting will have to be addressed at the earliest possible time.

Raising the Full Retirement Age to 70

Orman has frequently gone on record as being a “big believer” in the higher earner in a household waiting until they are 70 to claim Social Security benefits. Doing so allows one to collect 24% to 32% more than their benefit would be at full retirement age. She predicts that Congress will eventually raise the full retirement age (FRA) for the first time since 1983, when it scheduled gradual FRA increases (which started in 2000).

“I expect that when Congress does get around to addressing Social Security reforms, another increase in the FRA will be front and center. Possibly to age 70,” Orman wrote back in March.

Adjusting the Cost-of-Living Adjustment

At 8.7%, the cost-of-living adjustment regarding Social Security benefits for 2023 is the highest ever. However, analysis by The Senior Citizens League indicates that “during the period from the start of the COVID-19 pandemic in 2020 through to December 2022, Social Security benefits have fallen short of COLAs by $1,054 on average,” according to the advocacy group’s Social Security and Medicare policy analyst, Mary Johnson.

The Social Security Administration (SSA) will soon calculate the COLA for 2024. With the exception of the past two months, inflation has gradually decreased from the historic rates witnessed last summer.

But consumer prices have remained high and unpredictable, so Orman doesn’t predict changes to COLA formulas. Rather, she recommended a couple of things to deal with its decreased value: building an emergency fund and, again, delaying retirement, because you’re getting the COLA for any year delayed after the age of 62. “That adds to the value of your eventual benefit,” wrote Orman.

“What’s so important to understand is that it’s not just people who are already getting a Social Security benefit who are credited with the COLA. Once you turn 62, the COLA is added to your benefit, even if you are delaying starting to collect,” Orman added.

Social Security: No Matter Your Age, Do Not Claim Benefits Until You Reach This Milestone

Collecting Tax on Higher Earners

Increasing or eliminating Social Security’s cap on taxable wages, now set at $160,200 a year, would help soften the disintegration of Social Security’s payroll tax base caused by rising wage inequality. Most workers’ taxes would not change, while the degree of increase in high earners’ taxes would depend on whether the cap was raised or eliminated.

“Right now the program only collects tax on incomes up to $160,200. Collecting more from higher earners would help address the program’s shortfall,” Orman suggested.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman Makes 3 Social Security Predictions as COLAs Fall Short by Average of $1,054

Credit: Source link