- US inflation comes in hotter than expected, but markets brush it off

- Dollar unable to gain much, equities close at new all-time highs

- Gold hit by profit taking, yen soft even as BoJ speculation heats up

Inflation surprise doesn’t scare markets

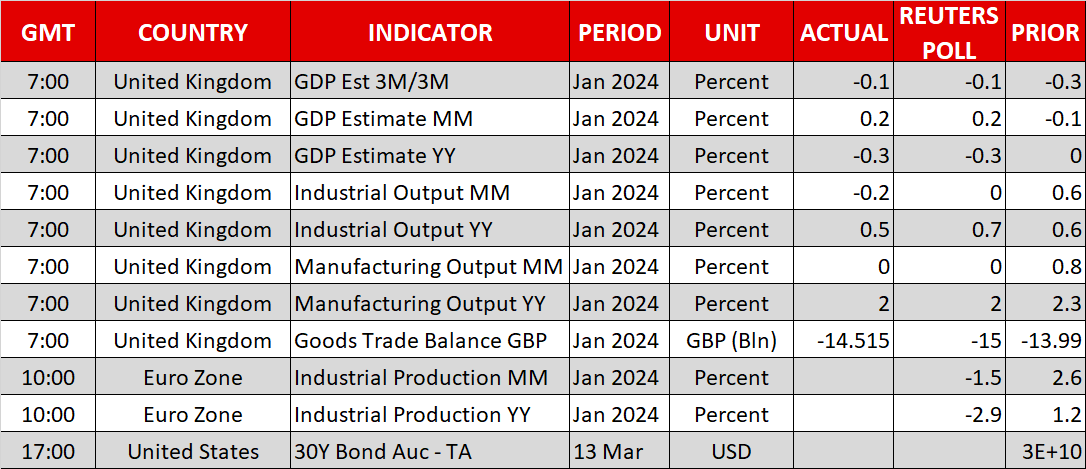

A surprisingly hot US inflation report was not enough to frighten investors yesterday. Inflation as measured by the consumer price index clocked in at 3.2% in February, missing expectations that it would remain steady at 3.1%. It was a similar story for core inflation, which slowed less than anticipated.

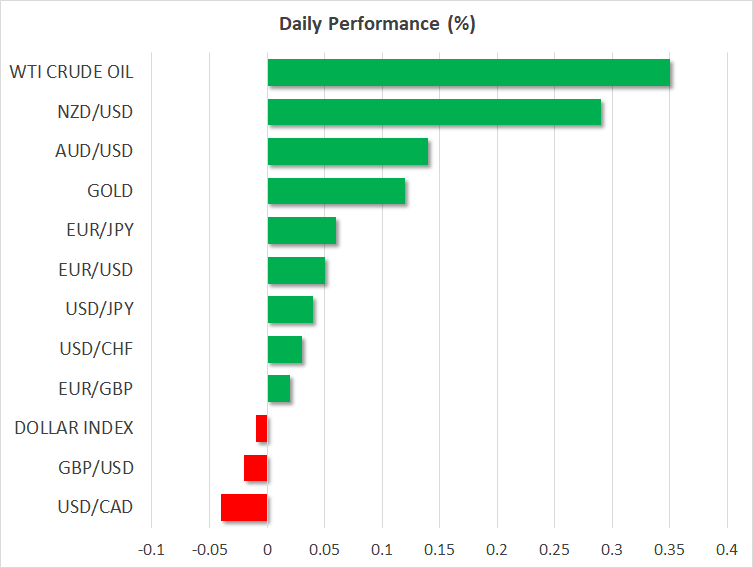

Despite the overshoot in inflation, global markets did not react much. The dollar climbed as investors dialed back bets of a Fed rate cut in June, but its gains were limited. Investors appear confident that this inflation setback won’t materially change the timeline of Fed cuts, as other US data releases have been on the softer side lately, especially on the labor market.

Overall, there’s a clear asymmetry in how the dollar has reacted to economic data in recent months. Stronger data releases seem unable to boost the greenback much, whereas weaker indicators tend to inflict serious damage on the reserve currency.

One element behind the dollar’s inability to storm higher has been the sanguine tone in equity markets, which has suppressed demand for safe haven plays like the dollar. In other words, any sustained dollar rally might require a correction in high-flying stock markets, which does not seem imminent (see below).

Stocks close at new records

Shares on Wall Street completely brushed aside the hot CPI readings, and instead cruised higher to close at new record highs. Chipmakers and heavyweight tech stocks led the charge, with Nvidia (NASDAQ:) shares gaining a stunning 7% as the hype around artificial intelligence reached fever pitch.

It was a deafening show of force as equities seem immune even to their arch-nemesis, which is interest rates staying higher for longer because inflation is persistently hot. Stocks can absorb bad news on economic growth without much damage, as that would bring rate cuts closer, but they are usually more vulnerable to negative inflation news.

Hence, it’s difficult to envision what can derail this equity rally. Valuations are stretched with the S&P 500 trading at 21 times what analysts expect earnings to be over the coming year, but investors seem convinced that corporate earnings growth is about to reaccelerate with some help from artificial intelligence income streams, justifying the premium prices.

In a nutshell, this does not seem like a stock market ‘bubble’ yet, even if valuations are historically expensive. That said, the more stretched valuations become, the more vulnerable equities are to a selloff in case the economy does not meet the market’s rosy expectations.

Gold retreats, yen softens despite BoJ rumors

Gold prices suffered their first retreat of this month in the aftermath of the hot CPI prints, as a spike higher in bond yields and the dollar diminished some of the precious metal’s appeal, sparking a wave of profit taking after an incredible rally.

Meanwhile, the Japanese yen has struggled this week even despite mounting signs that the spring wage negotiations were a huge success, opening the door for the Bank of Japan to tighten policy as early as next week.

Investors seem hesitant to bet on a lasting recovery in the yen. Ultimately, the question is whether any rate increase would be a one-off move, which seems likely as the BoJ would be swimming against a global tide of rate cuts. Hence, the carry trade that has devastated the yen could remain alive even if the BoJ rolls out a symbolic rate increase next week.

Credit: Source link