Solana (SOL) has recently faced a challenging period, moving within a bearish pattern that hinted at a potential drawdown. The price has begun to reflect these concerns, with the broader market failing to provide enough support for a recovery.

As Solana struggles to maintain upward momentum, its price has experienced a significant decline, leading to further uncertainty in the market.

Solana Is Losing Investor Interest

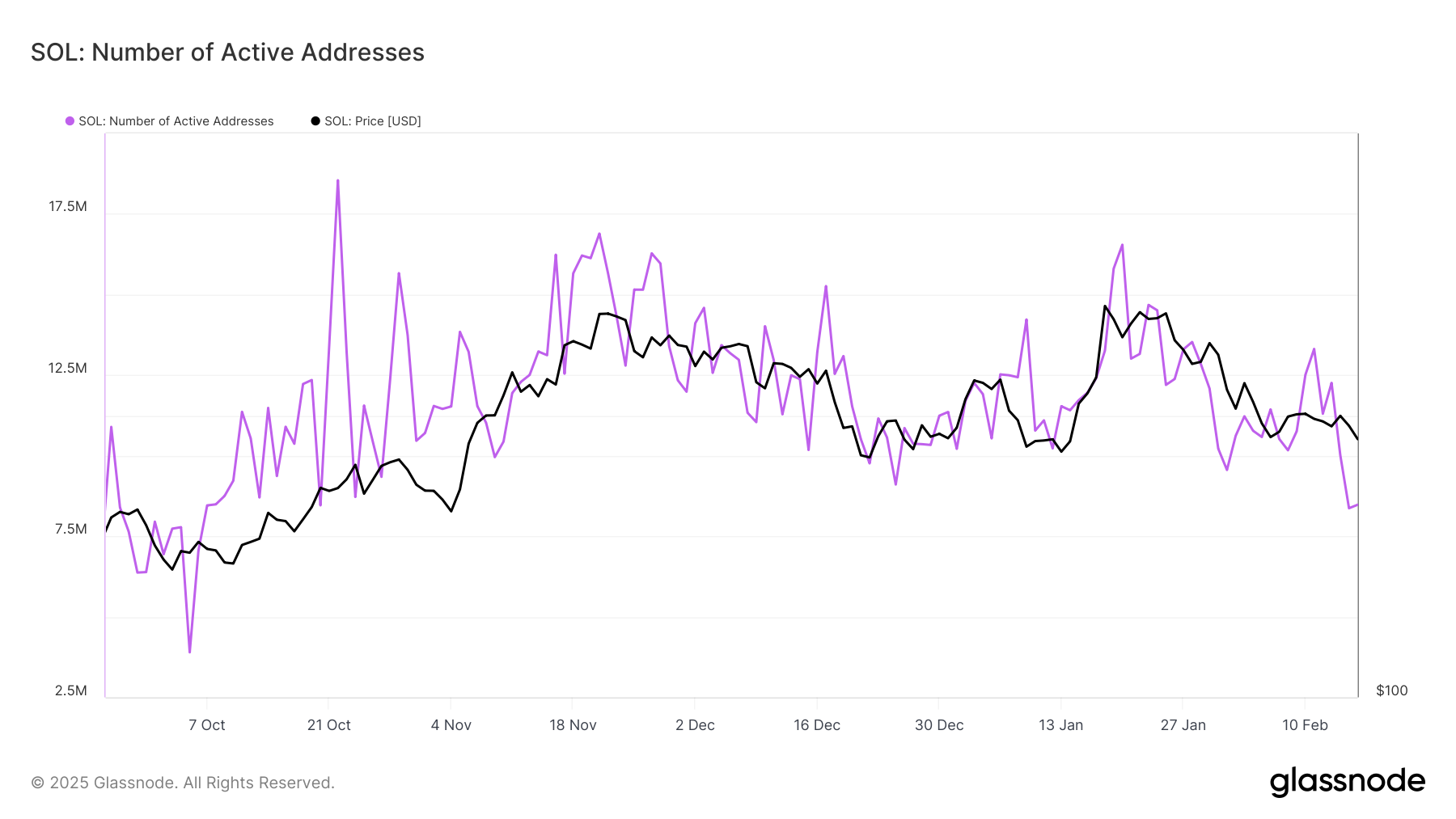

Solana’s network activity has slowed considerably, with active addresses falling to a five-month low. This decline in transaction activity reflects waning investor confidence, as holders seem to pull back from engaging with the network.

The lack of significant growth or recovery in price action over the past two weeks has likely caused many investors to adopt a more cautious stance.

As the active addresses continue to drop, Solana holders are becoming increasingly skeptical about the token’s near-term prospects. Without meaningful growth or a clear bullish signal, these investors may continue to hold back, potentially exacerbating the downward pressure on SOL’s price and making a recovery more difficult.

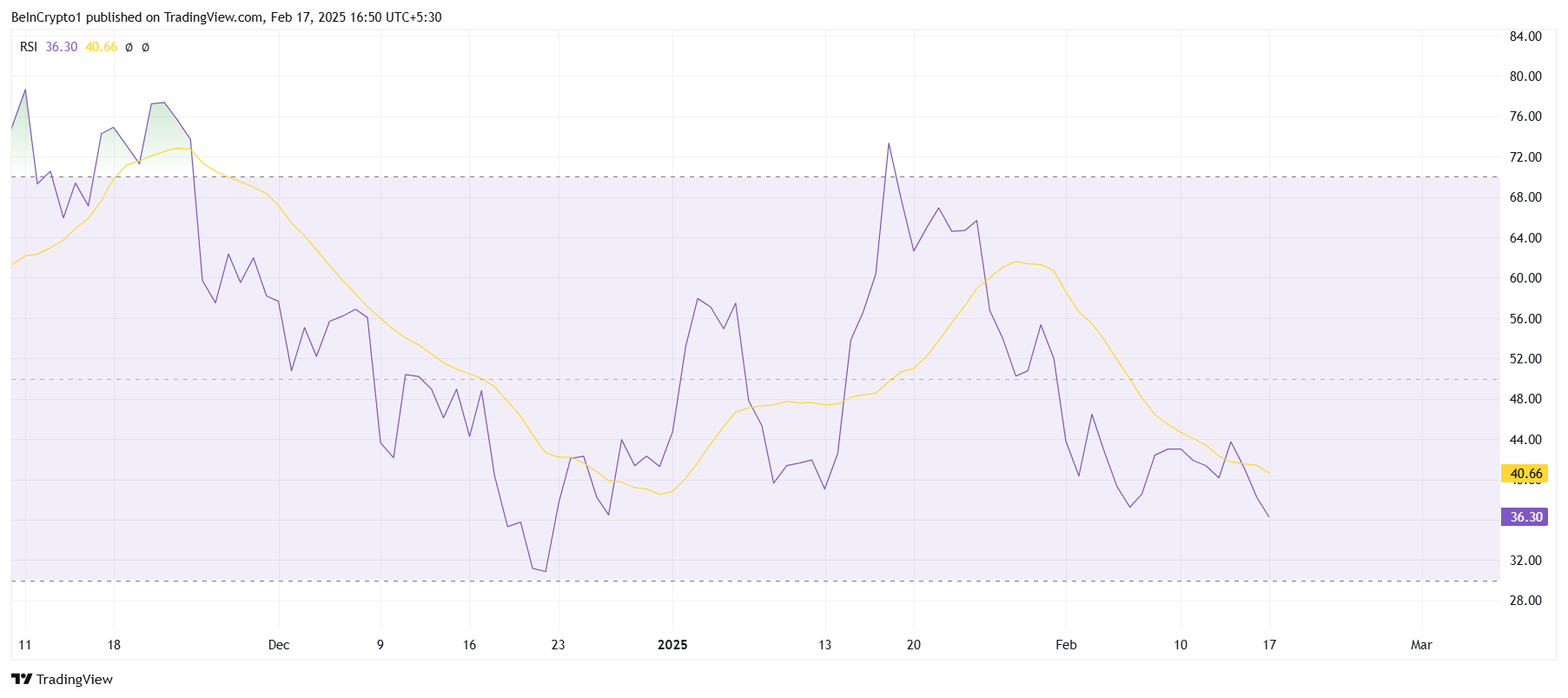

Key technical indicators, such as the Relative Strength Index (RSI), indicate that Solana’s broader macro momentum also remains under pressure.

Currently, at a monthly low of 40.66, the RSI suggests that bearish momentum is dominating Solana’s price action. When the RSI is below 50, it typically indicates that sellers are in control, which could prolong the downward trend.

With the broader market cues remaining uncertain, the RSI points to continued weakness for Solana. Unless there is a significant shift in sentiment or a favorable market catalyst, it seems that SOL may continue to face downward pressure in the near term, potentially pushing the price lower.

SOL Price Prediction: Recovering Losses

Solana’s price has dropped by 7% over the last 24 hours, trading at $177 and holding above the support level of $175. However, the altcoin recently broke below the ascending wedge pattern, suggesting that the price could continue its decline. If the current downtrend persists, Solana may struggle to hold above critical support levels.

This bearish pattern projects a potential further drawdown, but the price may not dip below $161 in the immediate term. However, if Solana loses the support of $161, it could face a deeper decline, potentially testing levels around $156 or lower. Such a scenario would further validate the bearish outlook and delay any recovery attempts.

On the other hand, if Solana manages to bounce off the $183 support, the price could rise back toward $201, provided broader market conditions improve. Breaching the $201 level is key for invalidating the current bearish thesis and would signal that Solana has regained upward momentum, potentially paving the way for a stronger recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link