No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

Economists are scratching their heads and housing industry leaders are venting their frustrations as mortgage rates continue a relentless climb to new heights not seen in more than two decades, chasing yields on government debt that are being pushed higher by factors beyond Federal Reserve tightening.

The Optimal Blue Mortgage Market Indices, which track daily rate lock data, show rates on 30-year fixed-rate conforming loans hitting a new 2023 high of 7.59 percent Tuesday — an all-time high in Optimal Blue records dating to 2017.

At 7.95 percent, rates on jumbo mortgages that exceed Fannie Mae and Freddie Mac’s loan limits looked poised to push through the 8 percent benchmark, as paper losses mount at banks that fund most jumbo lending and Treasury yields rise.

National Association of Realtors Chief Economist Lawrence Yun vented his frustration with Fed policymakers, who have telegraphed their intention to implement at least one more rate hike this year.

“The Fed is overdoing the rate hike,” Yun said in a LinkedIn post Wednesday. “The economy is measurably slowing. Even the lagging indicator job gains are coming in light.”

Yun said he’s worried that rising interest rates could actually fuel inflation as would-be homebuyers throw in the towel, fueling more demand for rentals, and making housing more scarce as builders balk at paying higher rates on construction loans.

A weekly survey of lenders by the Mortgage Bankers Association (MBA) showed that applications for purchase loans were down a seasonally adjusted 6 percent last week when compared to the week before, and 22 percent from a year ago.

Joel Kan

“The purchase market slowed to the lowest level of activity since 1995, as the rapid rise in rates pushed an increasing number of potential homebuyers out of the market,” MBA Deputy Chief Economist Joel Kan said in a statement.

With rates on 30-year fixed-rate conventional loans rising for the fourth consecutive week to the highest rate since 2000, Kan said some borrowers searching for ways to lower their monthly payments are turning to adjustable-rate mortgage (ARM) loans.

Although ARM loans accounted for 8 percent of mortgage applications last week, they had an even bigger share when mortgage rates made a similar surge last fall. During the second week of October 2022, ARM loans accounted for 13 percent of applications, the highest share since March 2008.

Appearing on CNBC’s “Squawk Box,” Yun noted that rates on ARM loans aren’t much lower than those for more traditional 30-year fixed-rate conventional loans (according to the MBA survey, rates on ARM loans averaged 6.49 percent last week).

“My advice right now is go into the 30-year fixed, because even with that, one can always refinance once the interest rate goes down,” Yun said. “The mortgage rates are topping out now — hopefully there is some downward drift in the upcoming months.”

MBA CEO Bob Broeksmit expressed similar sentiments on CNBC Wednesday, urging the Fed to “be clear that they’re done with rate increases and to also “make clear that they’re not going to sell mortgage-backed securities off their balance sheets.”

Jumbo mortgage rates spike

Homebuyers seeking jumbo mortgages exceeding Fannie and Freddie’s conforming loan limits — $726,200 for one-unit properties in most areas of the country — have been hit particularly hard by recent rate increases.

At this time last year, rates on jumbo mortgages were about half a percentage point less than for conforming loans. Now the situation has reversed, with the “spread” between jumbo mortgages and conforming loans widening to nearly 40 basis points on Wednesday, according to Optimal Blue rate lock data.

Conforming loans are largely financed by investors who buy mortgage-backed securities guaranteed by Fannie and Freddie. But jumbo mortgages are mostly provided by banks that hold the loans on their books. Stresses on regional banks sparked by the failures of Silicon Valley Bank, Signature Bank and First Republic Bank have made jumbo loans more expensive and harder to come by this year.

This week, Rocket Mortgage began offering some relief by pricing mortgages of up to $750,000 as conforming, in anticipation that Fannie and Freddie’s 2024 loan limits will go up by at least 3 percent on Jan. 1 to reflect home price appreciation over the last year.

Mike Fawaz

“The market has changed a lot, and jumbo pricing isn’t as favorable as it used to be,” Mike Fawaz, executive vice president of Rocket’s wholesale channel, Rocket Pro TPO, told Inman.

Banks that have large holdings of Treasurys are seeing the value of those assets decline as interest rates rise, helping push unrealized losses on bank balance sheets up by 8.3 percent during the second quarter, to $558.4 billion, according to the Federal Deposit Insurance Corp.

10-year Treasury yields at highest since 2007

Yields on 10-year Treasury notes, a barometer for mortgage rates, surged to a new 2023 high of 4.80 percent Tuesday, a level not seen since August 2007 on the eve of the subprime mortgage crisis.

While the Fed has tight control over short-term interest rates, rates on long-term assets like Treasurys and mortgage-backed securities (MBS) that fund most home loans are dependent on investor demand. When investors are eager to put their money in bonds and MBS, that pushes rates down. But when investors lose their appetite for those assets, that drives rates up.

The recent surge in long-term Treasury yields has defied many forecasters’ expectations, and economists are searching for reasons.

Last year’s rise in long-term rates was driven “by market expectations of higher short-term rates as the Fed tightened policy and by investors’ demands for extra compensation to hold longer-dated assets because of fears of higher inflation,” The Wall Street Journal’s Nick Timiraos reported Wednesday.

With inflation seemingly cooling and the Fed signaling that it’s done, or will soon be done, raising short-term rates, economists suspect flagging demand for Treasurys by foreign investors, U.S. banks and investment managers could be factors in the sustained rise in long-term rates, Timiraos reported.

Even if long-term rates have peaked, there’s increasing uncertainty over whether they’ll come down next year, as many economists and investors had been anticipating.

“What we’re seeing is a reappraisal of how the bond market prices uncertainty itself,” PGIM Fixed Income economist Daleep Singh told Timiraos. “The compensation required to underwrite potentially the new structural regime with more volatile growth and inflation and fewer predictable sources of demand to absorb record amounts of government debt issuance has clearly risen.”

Another factor crimping demand is that the Fed, which bought trillions of Treasurys bonds and MBS during the pandemic to bring borrowing costs to historic lows, is now letting those investments roll off its books.

Fed has trimmed $1 trillion from balance sheet

Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis

The Fed’s Treasury and MBS holdings peaked at $8.5 trillion last year, but a shift to “quantitative tightening” has allowed the central bank to trim its assets by more than $1 trillion by allowing $60 billion in maturing Treasurys and $35 billion in MBS to roll off its books each month.

Broeksmit said that the spread between 10-year Treasury yields and 30-year fixed-rate mortgages is about 125 basis points higher than its historic norm and that the Fed is partly responsible.

“I still think some of the increase in the spread between the Treasury and the mortgages is a fear that the Fed would actually sell [MBS] in the open market,” Broeksmit said on CNBC. “So if they were to make clear that that’s not on the horizon, I think that that would help and the bank demand will, I think, come back. We’ve seen some increase in supply with some of the failed banks MBS being on the market, but I think that’s mostly been resolved.”

Where rates are headed next

Futures markets tracked by the CME FedWatch Tool put the probability of one or more additional Fed rate hikes this year at 37 percent, but see a one-in-five chance (19.6 percent) that the Fed will bring rates back down below current levels by March before the spring homebuying season kicks off.

The upcoming Nonfarm Payrolls report to be released Friday by the U.S. Bureau of Labor Statistics is likely to play a factor in determining where rates are headed next, as Fed policymakers see tightness in the labor market as a key driver of inflation.

Tuesday’s release of the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) report seemed to panic bond market investors, sending yields on 10-year Treasurys up 12 basis points.

The JOLTS data, which showed job openings increased by 690,000 at the end of August, to 9.6 million, “was startling, but the data are very noisy and are subject to large revisions,” Pantheon Macroeconomics analysts said in their U.S. Economic Monitor report Wednesday.

“We don’t take JOLTS seriously, but the surge in yields and plunge in stock prices after the release of the data yesterday says a great deal about the pervasive nervousness of investors,” Pantheon economists Ian Shepherdson and Kieran Clancy wrote.

Bond market investors “appear to be taking seriously the Fed’s collective assertion that rates will stay higher for longer, despite the abundant evidence that the Fed’s interest rate forecasts are rarely correct,” they said.

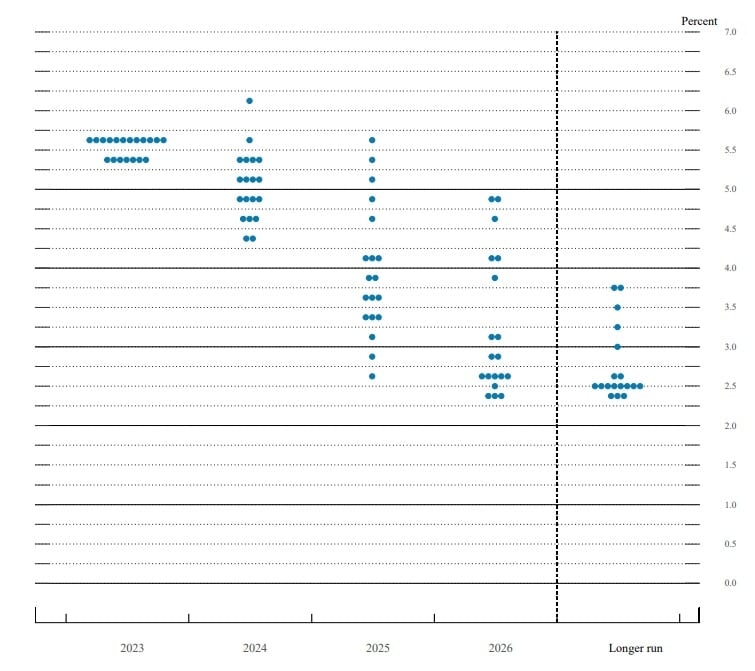

‘Dot plot’ reflects Fed’s ‘higher for longer’ rate strategy

Fed policymakers voted unanimously on Sept. 20 to keep the central bank’s target for the short-term federal funds rate at 5.25 to 5.5 percent.

But looking at the Federal Open Market Committee’s latest “dot plot” — projections of where policymakers think the short-term federal funds rate will be in the future — most see the need for one more rate hike this year. By the end of next year, however, some think it will be as low as 4.375 percent or as high as 6.125 percent (hawkish Federal Reserve Governor Michelle Bowman could be the outlier on the high end).

That is an “enormous” spread of 1.75 percentage points, Shepherdson and Clancy wrote, “but markets for now are interested only in the upside risks.”

Betting that Treasury yields have peaked “seems extraordinarily risky,” the Pantheon economists concluded. “But unless you think the U.S. economy can grow at a real 2 1⁄2 percent pace forever, untroubled by the Fed, 10-year yields can’t be sustained at the current level. The market won’t flip, though, until the data shift, and Fed officials acknowledge the change.”

In the meantime, Pantheon economists say, “yields could overshoot further.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Credit: Source link