Shiba Inu’s burn rate surges as more investors tuning to track asset’s movement

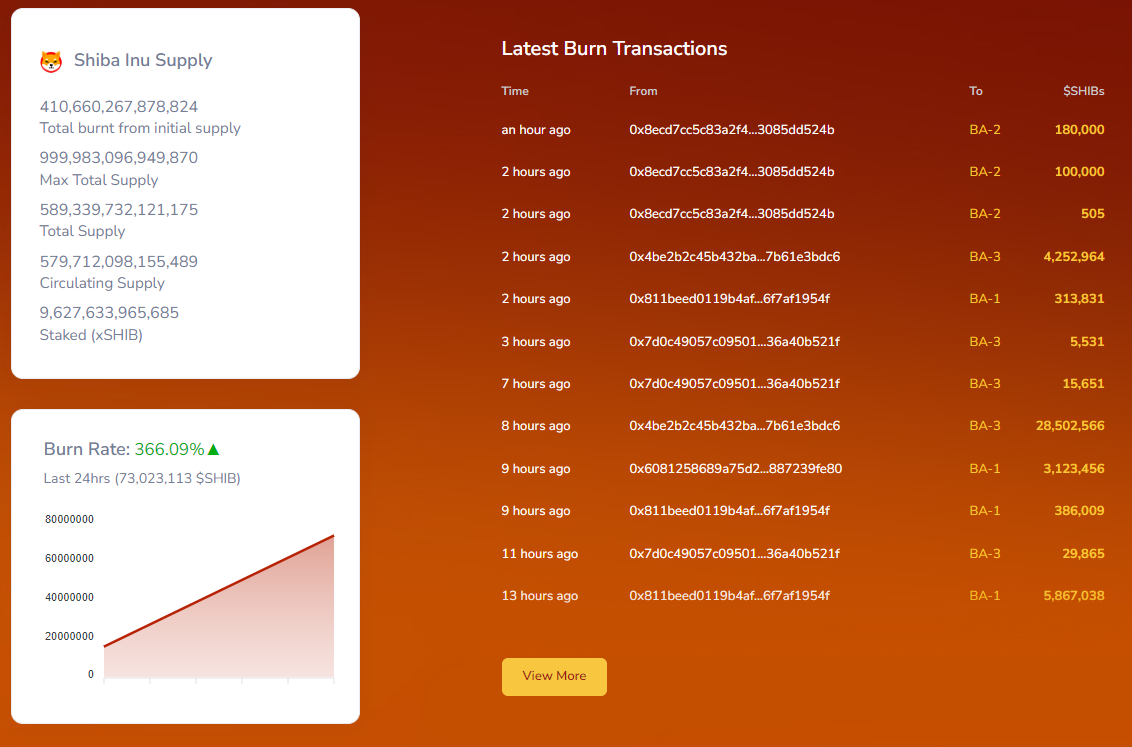

Shiba Inu’s (SHIB) burn rate has skyrocketed, showing an almost 400% increase. Millions of SHIB tokens are being destroyed, a phenomenon that has caught the attention of both investors and analysts. As of the latest data, the price of Shiba Inu is approximately $0.00000731, but what’s more intriguing is the underlying activity.

What’s driving burn rate?

The most plausible explanation for this surge in the burn rate is the recent uptrend in Shiba Inu’s market performance. An uptrend generally attracts more users to a network, increasing overall activity. This, in turn, leads to more tokens being burned as part of transactions or specific burn mechanisms within the ecosystem.

Does it affect price?

Interestingly, despite this massive increase in the burn rate, Shiba Inu’s price has remained relatively stable. There has not been much volatility, which might come as a surprise to those who equate token burns directly with price increases. Token burns reduce the overall supply, but they do not automatically mean that the remaining tokens gain value. Market dynamics are influenced by a multitude of factors, and supply is just one of them.

For investors, a higher burn rate coupled with stable prices could be seen as a positive sign of network health and user engagement. However, it is essential to note that the burn rate alone should not be the sole metric for making investment decisions.

While the burn rate is an exciting metric, it is crucial to look at the bigger picture, including other indicators like trading volume, liquidity and market sentiment. In the case of Shiba Inu, the stable price despite the high burn rate could be an indicator of a mature market response, where the effects of token burns are already priced in.

Credit: Source link