BTC jumped before dropping seconds after the SEC tweeted the sport Bitcoin ETF had been approved.

Bitcoin traders today got a brief glimpse at how the market would react if the U.S. Securities and Exchange Commission approves the spot Bitcoin ETF thanks to the SEC’s failed tweet, and it appears it was a “sell the news” event.

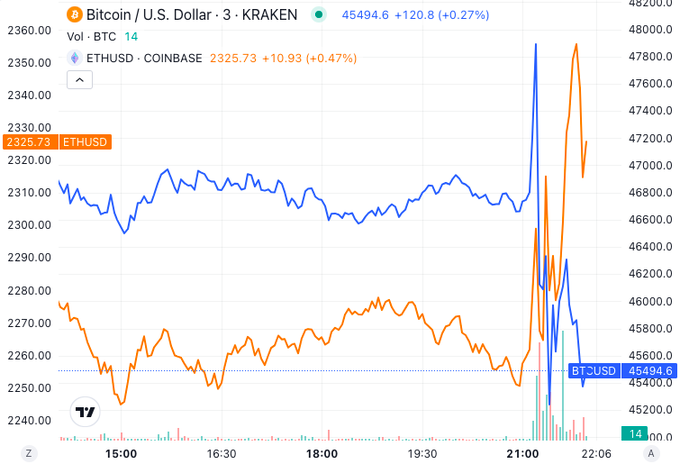

BTC briefly jumped above $47,800 before dropping to around $45,600 when the SEC posted on X that the spot Bitcoin ETF has been approved. The digital asset was trading at $46,700 before the SEC’s tweet.

BTC dropped to as low as $44,900 when SEC Chair Gary Gensler tweeted that the SEC’s X account had been compromised and that the agency “has not approved the listing and trading of spot bitcoin exchange-traded products.”

BTC has since recovered and is trading at around $46,000.

In the lead up to the expected Bitcoin ETF approval, traders have questioned whether optimism that institutional investors will now be able to easily access Bitcoin thanks to a spot ETF has been already incorporated in the Bitcoin price. If that were the case, then traders would likely sell BTC upon confirmation of the approval, or “sell the news.”

ETH Jumps

ETH ripped upwards in the wake of the confusion — the digital asset gained over 3% in the hour after the SEC’s deleted tweet. Solana’s SOL performed similarly to ETH, rocketing up on the news and then quickly retracing. BTC is down nearly 2% on the day.

While ETH has since retraced its gains and the asset’s price action is flat in the past 24 hours, the economist Alex Kruger suggested on X that the upside for Bitcoin post-approval is limited and that the market focus will shift to a potential ETH ETF approval.

There are pending applications for an ETH ETF which many have speculated will be approved if a Bitcoin product opens the floodgates.

Start for free

Kruger noted a potential airdrop from the staking protocol Eigenlayer, as another catalyst for ETH moving forward.

The ETHBTC ratio is down more than 40% from its all-time high and today dropped to oversold according to its relative-strength index.

Fake ETF News

The possible approval of a Bitcoin ETF has already been the source of two pieces of news which eventually turned out to be false.

Last week, some claimed that a report from Matrixport, a research firm, which argued that the SEC would deny all BTC ETF applications, was responsible for a flash crash across digital asset markets. The media outlet CoinTelegraph also falsely reported the approval of the Bitcoin ETF in November.

The rapid market action in response to the three pieces of false news surrounding the Bitcoin ETF shows just how closely market participants are watching the development. Today’s SEC twitter blunder gave them a brief glimpse into the volatility that can be expected when the real announcement comes.

Credit: Source link