Eleven states filed a lawsuit this week against President Joe Biden’s recent $156 billion student debt forgiveness plan, stemming from last year’s rejection of the president’s reprieve pitch.

Alabama, Alaska, Idaho, Iowa, Kansas, Louisiana, Montana, Nebraska, South Carolina, Texas and Utah are also asking to be repaid for Biden’s Saving on a Valuable Education Plan (SAVE) loan forgiveness. All 11 states either fully or partially backed former Republican President Donald Trump in the 2020 presidential election—one of Nebraska’s three congressional districts supported Biden, a Democrat.

The president’s $156 billion plan was outlined last month as a smaller attempt than his prior $430 billion student debt erasure initiative from last year. Initially, Biden was seeking $10,000 in federal student loan debt forgiveness for the majority of borrowers and $20,000 for Pell Grant recipients.

After a similar group of states sued against that debt forgiveness plan, the Department of Education had to suspend its plans and has since been pursuing a new version of the forgiveness plan.

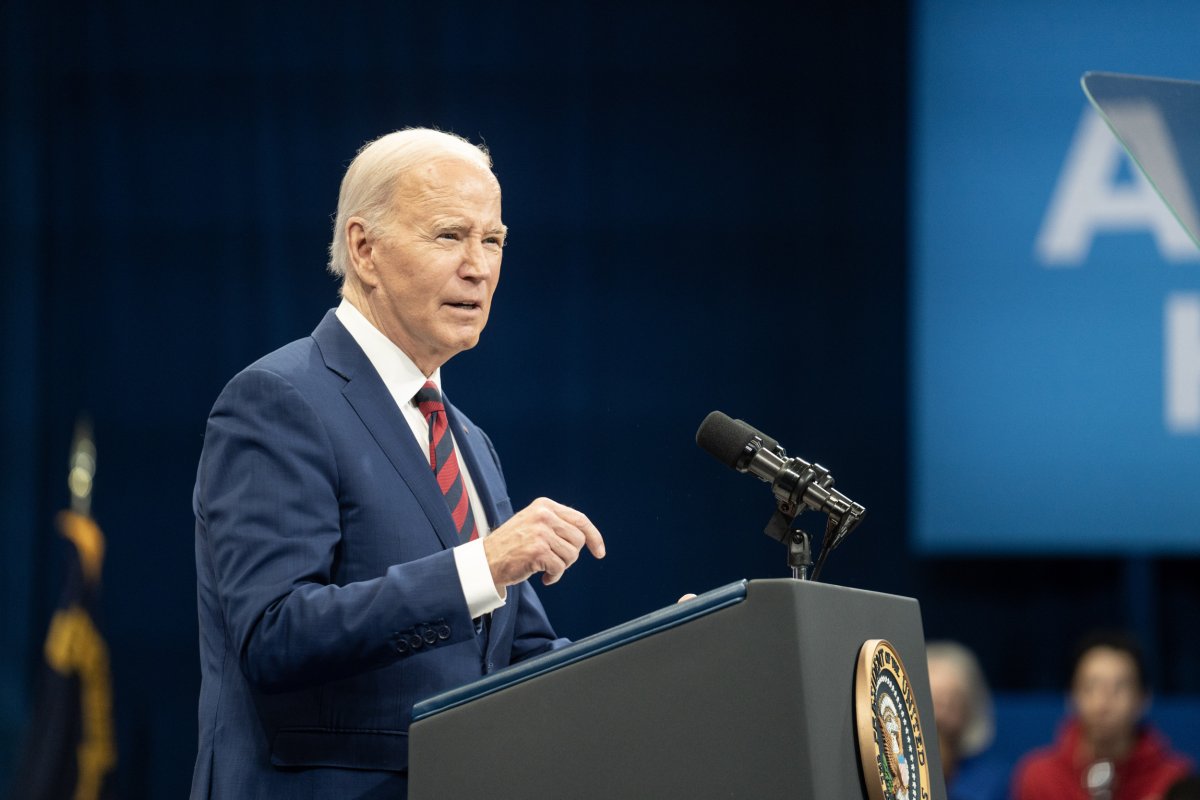

Eros Hoagland/Getty Images

“President Biden is defying the ruling of the United States Supreme Court while also seizing power from Congress,” Kansas Attorney General Kris Kobach said in a news conference. “Fortunately, in America, we live in a constitutional republic and the courts can strike down an illegal or unconstitutional executive act. That is what we are asking the court to do in this case, and we look forward to seeing the president’s attorneys in court.”

In the lawsuit, the states ask for an award to the plaintiffs of their “reasonable fees, costs, expenses, and disbursements.” This would include all attorney’s fees associated with the litigation and additional relief “as the Court may deem just and proper.”

The states collectively allege the Biden administration violated America’s separation of powers and went beyond its statutory authority. In the lawsuit, the 11 states are asking the court to officially declare the SAVE plan illegal and block it from moving forward.

Under the SAVE plan, 8 million people are eligible for lower payments or potentially full debt forgiveness. The repayment plan calculates monthly loan payments based on income and family size as well as discretionary income, lowering the amount owed for millions.

Around half of the eligible borrowers saw their monthly payments drop to zero if they make under $16 an hour.

Despite the pushback, Biden has not backed down on his promises to forgive student debt, which nationally sits at more than $1.7 trillion.

“From day one, I promised to fix broken student loan programs and make sure higher education is a ticket to the middle class, not a barrier to opportunity,” Biden wrote on X this week.

While the Supreme Court might have struck down Biden’s initial student debt forgiveness plan, experts are not so certain this new lawsuit will bring similar results.

“The odds of success for the states in this lawsuit are much lower than the one-time forgiveness case,” attorney and Student Loan Sherpa founder Michael Lux told Newsweek.

Lux said states will likely struggle to establish legal standing, especially as it concerns to Biden’s new SAVE repayment plan.

“The legal authority for the Department of Education to create the SAVE plan is much stronger than the argument for one-time forgiveness,” Lux said. “In the one-time forgiveness case, the government argued they were authorized to do so though disaster legislation passed in the wake of 9/11. In this case, the government can argue that Congress explicitly authorized creation of income-driven repayment plans and left it up to the Department of Education to determine exactly how the program worked.”

Robert Farrington, founder of The College Investor, echoed this sentiment.

“The SAVE plan is simply a rebrand of the old RePAYE plan,” Farrington told Newsweek. “And the changes were simply rule changes that appear to be allowed by the existing regulations.”

“As such, this challenge is a much more unlikely attempt to block things. Furthermore, given that millions of Americans are already enrolled in the SAVE plan, and some have even received loan forgiveness from it, changing it could prove difficult.”

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Credit: Source link