Prices and demand for rare earths have taken a hit in recent years. However, the long-term outlook for these important materials remains positive.

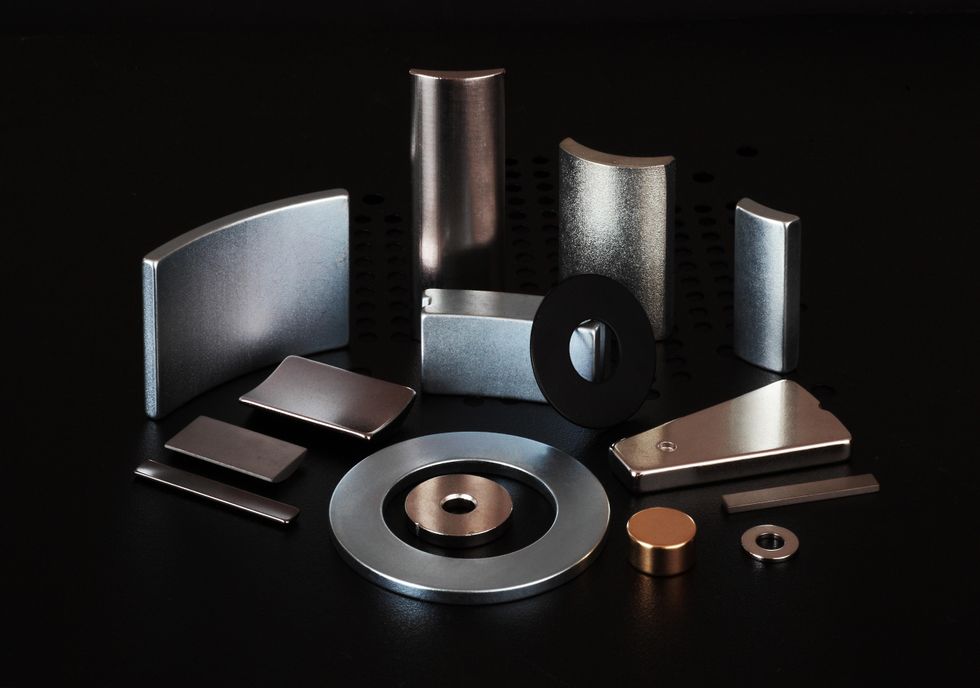

Rare earth elements (REEs) are key metals for high-tech applications, including permanent magnets, which have widespread potential, especially in the technology and electric vehicle sectors.

With future demand looking strong, countries around the world are keen to secure rare earths from sources outside of China — which is good news for rare earths companies in Australia. Indeed, looking at the next couple of decades, the International Energy Agency notes that rare earths demand could double by 2040.

For investors interested in getting a foot in the market, below is a list of the largest ASX rare earths stocks by market cap. Data for this stocks list was collected using TradingView’s stock screener on December 17, 2024.

1. Lynas Rare Earths (ASX:LYC)

Market cap: AU$6.29 billion

Share price: AU$6.64

Lynas Rare Earths is Australia’s largest rare earths miner, as well as the only significant rare earth materials producer in the world outside of China. Focused on integrated delivery, Lynas is a miner and supplier of high-grade rare earths. According to the company, its Mount Weld asset in Western Australia is one of the highest-grade rare earths mines in the world.

In June, the company announced that its Lynas Malaysia facility is on track to commence first production of two separated heavy rare earths products, dysprosium and terbium, in 2025.

Lynas Rare Earth’s AU$800 million Kalgoorlie rare earths processing facility officially opened in Western Australia in November.

During the fourth quarter of 2024, Lynas reported neodymium and praseodymium (NdPr) production of 1,504 tonnes. Its total rare earth oxide production reached 2,188 tonnes during the same period.

2. Iluka Resources (ASX:ILU)

Market cap: AU$2.16 billion

Share price: AU$5.09

Iluka Resources has decades of experience in the mining industry, mostly in the production of zircon and high-grade titanium dioxide-derived rutile and synthetic rutile. However, in recent years, it has developed a rare earths portfolio.

At its Eneabba operation in Western Australia, Iluka has a strategic monazite-rich mineral stockpile that it plans to process. The company is currently working on a feasibility study for a fully integrated rare earths refinery at Eneabba, which would produce separated rare earth oxides from its own feedstock and potentially from third-party feedstock as well. Construction will start once earthworks have been completed, with first production at the refinery expected in 2025.

Iluka’s Wimmera project in Victoria, Australia, also has the potential to be a long-term supplier of zircon and rare earths. Iluka is currently working towards a definitive feasibility study for the project.

3. Brazilian Rare Earths (ASX:BRE)

Market cap: AU$520.2 million

Share price: AU$2.20

Brazilian Rare Earths is advancing its district-scale Rocha da Rocha rare earth province in the state of Bahia, Brazil.

The company’s 1,410 square kilometres of mining claims are highly prospective for both heavy and light rare earths, with grades of over 40 percent total rare earth oxides (TREO) found. The company’s exploration campaigns have identified three styles of rare earths mineralisation across the project area, including source rock for high-grade niobium and scandium, shallow high-grade monazite sand and ionic clay rare earths mineralisation.

Brazilian Rare Earths’ current resource estimate for Rocha da Rocha stands at 510 million tonnes at 1,513 parts per million TREO. This includes the high-grade Monte Alto project with a monazite sand rare earths resource of 25.2 million tonnes at 1 percent TREO; it has a higher-grade shallow, free-dig resource core of 4.1 million tonnes at 3.2 percent TREO. The company is working toward completing an updated resource estimate for the district.

In December, Brazilian Rare Earths announced it had received approval for the final exploration report for the Monte Alto exploration licence, a significant milestone in securing a mining permit for the project. The company is preparing an economic development plan that will be underpinned by the project’s scoping study, which management expects to complete in Q2 2025.

4. Arafura Rare Earths (ASX:ARU)

Market cap: AU$271.09 million

Share price: AU$0.11

Arafura Rare Earths is advancing its Nolans NdPr project in Australia’s Northern Territory, and is currently in the midst of construction. Arafura has plans for Nolans to be a vertically integrated NdPr operation with processing facilities on site. According to the company, the Nolans project will supply around 4 percent of global NdPr oxide demand once complete, with an annual production capacity of 4,400 tonnes of NdPr concentrate.

The company has signed several offtake agreements, including one with Siemens Gamesa Renewable Energy that commences in 2026. The deal guarantees a five year contract under which Arafura will supply Siemens Gamesa with NdPr from Nolans. The supply deal will kick off at 200 tonnes for the first year, before increasing over time as the project reaches nameplate production.

According to Arafura’s quarterly report for the period ended September 2024, the Nolans project is shovel ready, with construction set to commence once funding is secured. A final investment decision is expected to be made in the first half of 2025.

5. Northern Minerals (ASX:NTU)

Market cap: AU$165.97 million

Share price: AU$0.02

Northern Minerals is focused on developing its Browns Range dysprosium-terbium project in Western Australia and bringing the project’s Wolverine deposit into production.

The company has a long-term rare earths concentrate supply agreement with Iluka Resources for all concentrate produced from Browns Range until 30,500 tonnes of contained rare earth oxides have been delivered.

Northern Minerals is developing Browns Range through a three stage system, and the project has been producing heavy rare earth carbonate since 2018. The company is now working on a definitive feasibility study for a commercial-scale mining operation and beneficiation plant at Browns Range that will respectively extract and process ore from Wolverine.

Northern Minerals is on track to complete a definitive feasibility study in Q3 2025, and is targeting first production in Q4 2027.

FAQs for ASX rare earths stocks

What are rare earths?

Rare earths are a category of elements that share many chemical properties. In fact, all but two — yttrium and scandium — are also called lanthanides. These elements are commonly found in the same deposits and are necessary for diverse technological applications such as rare earth magnets.

In total there are 17 rare earth elements, and they are split into light and heavy rare earths, with each segment being grouped together on the periodic table. On the light side, there are cerium, lanthanum, praseodymium, neodymium, promethium, europium, gadolinium and samarium, and on the heavy side there are dysprosium, yttrium, terbium, holmium, erbium, thulium, ytterbium, yttrium and lutetium.

Which countries have the most rare earths?

In terms of both rare earths reserves and rare earths production, China is the frontrunner by a long shot, with 44 million tonnes of reserves and 240,000 tonnes of production in 2023. However, Vietnam, Brazil and Russia all have reserves above 10 million tonnes. With regards to production, the US is in second place at 43,000 tonnes due to the Mountain Pass mine in California, and Myanmar is in third place with 38,000 tonnes.

What makes rare earths rare?

Rare earths are actually relatively abundant in the Earth’s crust, contrary to what their name suggests. However, they’re quite dispersed instead of being found concentrated in specific areas, which means locating economic deposits to mine is difficult.

As China controls much of global rare earths production, many countries have deemed them critical minerals and are prioritizing supply chain security.

This is an updated version of an article originally published by the Investing News Network in 2018.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web

Credit: Source link