Investor Insight

Prospect Ridge Resources’ compelling investment value proposition stems from the company’s robust growth ambitions driven by its highly prospective assets near the renowned Golden Triangle region, and a management team with substantial technical expertise.

Overview

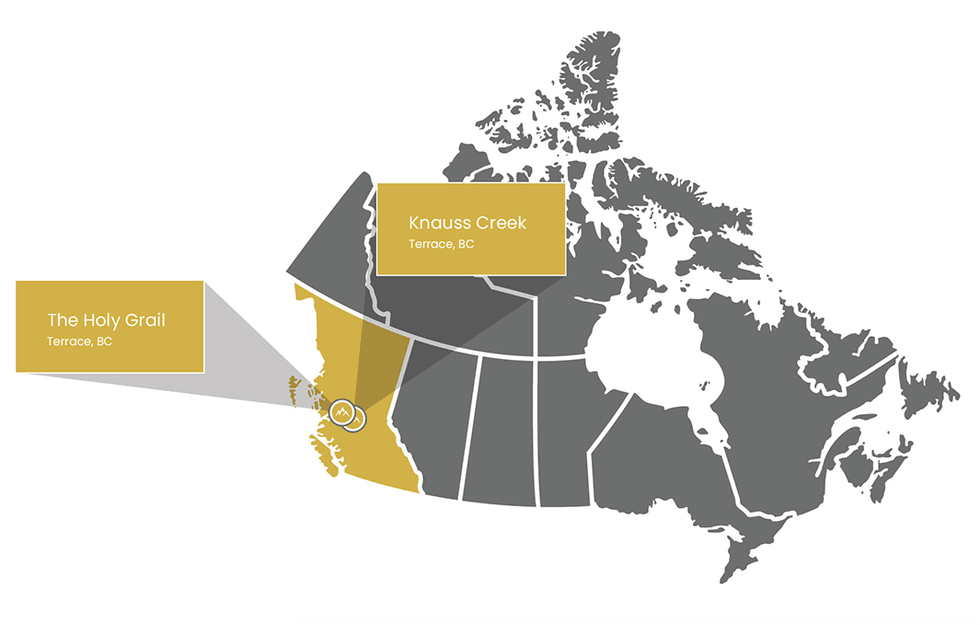

Prospect Ridge (CSE:PRR,OTC:PRRSF,FRA:OED) is a precious metals exploration company focused on key projects in Northern British Columbia near the prolific Golden Triangle. The Golden Triangle in northwest British Columbia has been a hub for mineral exploration and mining endeavors for over 150 years. The company owns 100 percent of both the Knauss Creek property and the Holy Grail property.

The Knauss Creek property resembles the high-grade mineralization found in the historical Dorreen mine. Exploration at Knaus Creek has revealed high-grade mineralization comprising gold, silver, copper, lead and zinc. The Copper Ridge zone, which is in the southern part of the Knauss Creek property, is particularly interesting. In 2023, a total of 241 samples were collected from this area which extended the Copper Ridge mineralized zones over an east-west strike length of 1,550 meters, a north-south strike of 850 meters, and a height difference of 470 meters.

Prospect Ridge Resources has also completed an inaugural drilling program at the Copper Ridge zone to test high-priority targets in the western and central portion of this large system.

The other property, Holy Grail, has also historically produced high-grade gold and silver from placer mining. Prospecting results at the Holy Grail property showed exceptional promise, uncovering significant discoveries of gold, silver, copper, lead and zinc.

Prospect Ridge benefits from a team of professionals boasting extensive expertise in geology and mining. The company is led by Micheal Iverson, CEO, who has more than three decades of experience in mining exploration. The management team has a proven track record of executing several successful exploration and development projects, including Fortuna Silver Mines and NioGold Mining’s Marban project.

Company Highlights

- Prospect Ridge is a Canada-based exploration and development company with two highly prospective land packages in British Columbia.

- The company’s two key assets are the Knauss Creek property and the Holy Grail property, located near the renowned Golden Triangle region in northwestern British Columbia. The Golden Triangle has historically been known for abundant precious and base metal discoveries, with numerous active mining projects and ongoing resource exploration.

- The flagship Knauss Creek property has revealed high-grade surface samples up to 78.9 g/t gold, 4,740 g/t silver, 29.4 percent copper, 33.33 percent lead and 4.10 percent zinc. The Copper Ridge zone is particularly interesting, where a 1.5-km strike zone containing high-grade gold-silver-copper trends were discovered.

- The company has completed an inaugural drilling program to test the drill-ready target Copper Ridge zone.

- Prospecting results from the Holy Grail property are exceptionally promising. They reveal noteworthy discoveries of gold, silver, copper, lead and zinc.

- Prospect Ridge is led by a proven team of executives with more than 100 years of combined experience leading several successful exploration and development projects, including Fortuna Silver Mines and NioGold Mining’s Marban project (sold to Oban Mining, now Osisko Mining).

Key Projects

Knauss Creek Property

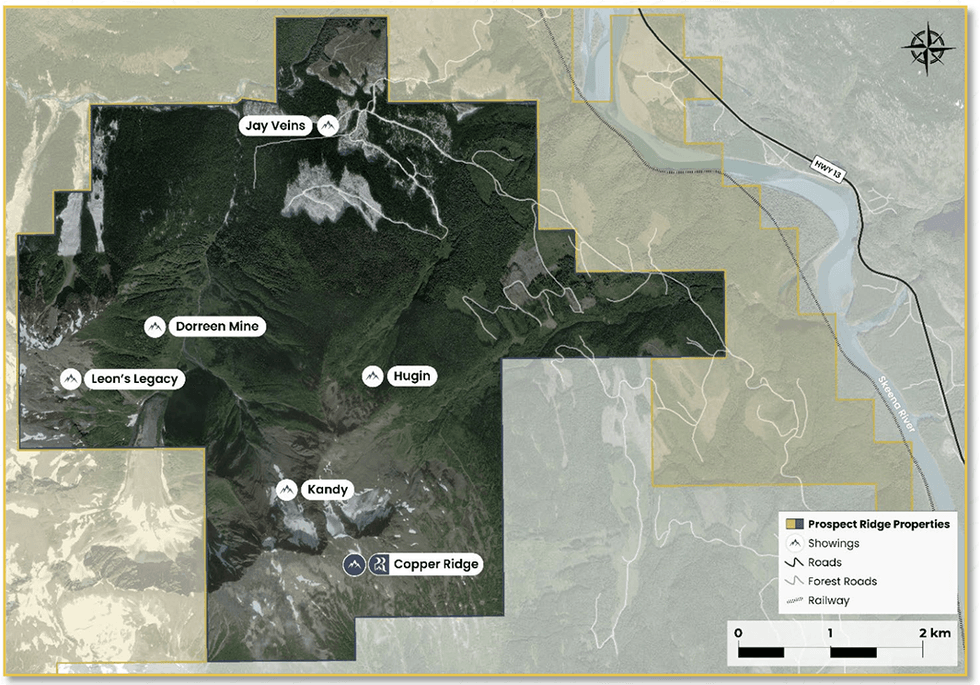

The Knauss Creek property, situated 35 kms north of Terrace, BC, spans 2,944. It has excellent infrastructure access, proximity to Highway 16, numerous logging roads traversing it, and the Canadian National Railway passing through.

The property is home to the historical Dorreen mine. Various showings on the property, including the Jay Veins, Hugin, Kandy and Copper Ridge, contain gold, silver, copper, lead and zinc mineralization. The current focus is on the Copper Ridge zone, a high-grade polymetallic mineralization zone spanning 1,500 meters.

Assays from outcrop samples gathered during the 2023 prospecting season have revealed numerous high-grade gold, silver and copper findings. Highlights from rock outcrop sampling, include:

- Sample W489444 contains 6.70 grams per ton (g/t) gold, 4,610 g/t silver, 2.23 percent copper

- Sample W489424 contains 15.9 g/t gold, 987 g/t silver, 0.29 percent copper, 17.55 percent lead, 6.99 percent zinc

- Sample W501837 contains 0.49 g/t gold, 134 g/t silver and 29.4 percent copper

- Sample W501812 contains 2.14 g/t gold, 264 g/t silver and 10.35 percent copper

Consequently, the Copper Ridge zone has been extended, now measuring an east-west length of 1,550 meters, a north-south strike length of 850 meters, and a vertical difference of 470 meters. Field data suggests the veins follow a north-south orientation and dip towards the east.

The interpretation suggests the zone comprises a network of mineralized veins arranged like a ladder hosted within a granodioritic intrusion.

The company has completed an inaugural drilling program to evaluate drill-ready targets like the Copper Ridge zone, which confirmed the orientation of the veins and extended them more at depth.

Holy Grail Property

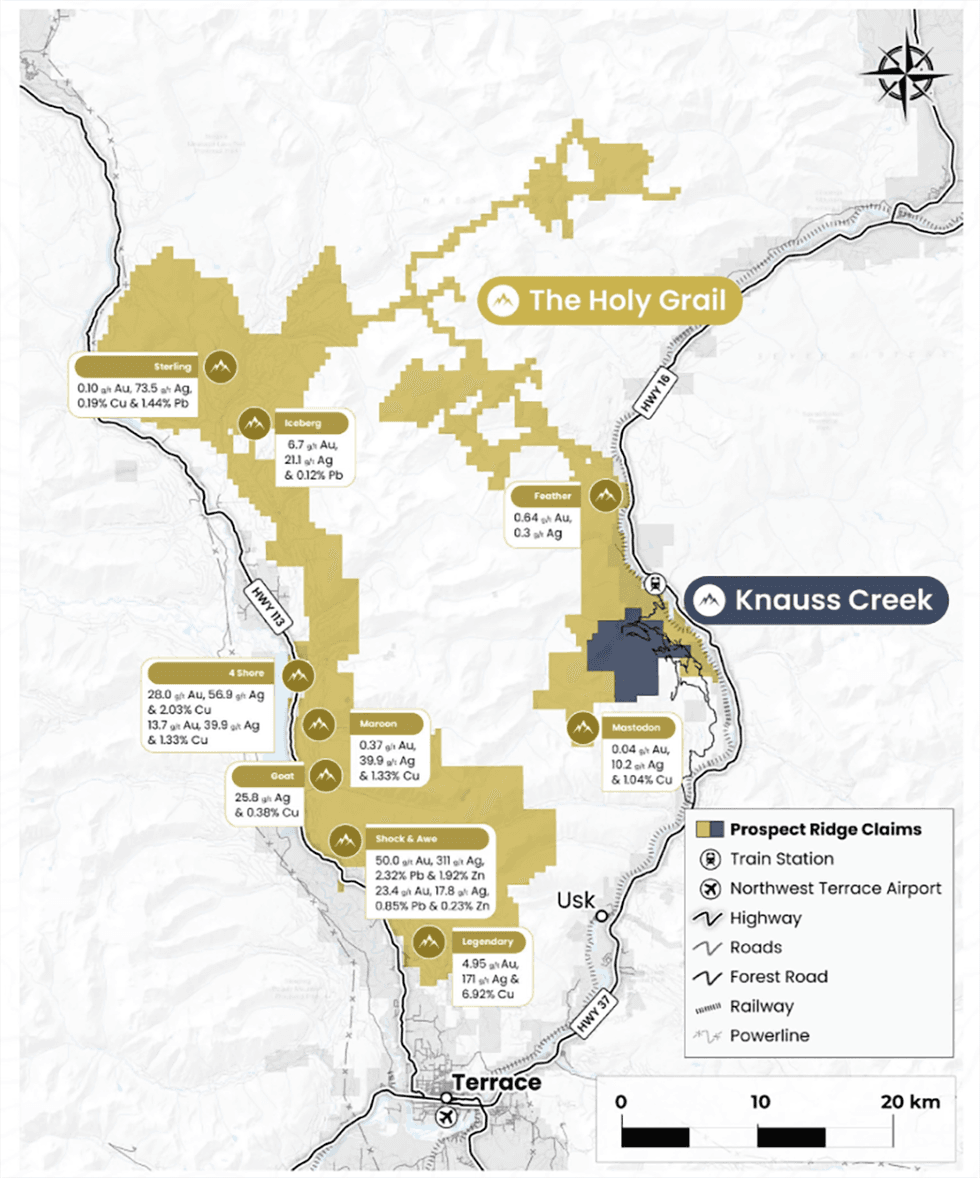

The Holy Grail property is located 10 km north of Terrace, BC, and forms a horseshoe that encloses the fully owned Knauss Creek property in its southeastern part. It currently spans 70,109 hectares. The property is easily accessible via a highway, multiple serviced roads, logging roads, and ATV trails that cross cut it.

Prospecting results from the Holy Grail property displayed remarkable potential through substantial findings of gold, silver, copper, lead and zinc. Key highlights of the results include:

- Grab sample C362354 returned 28.0 g/t gold, 56.9 g/t silver and 2.03 percent copper on the 4 Shore showing

- Grab sample C362357 returned 13.7 g/t gold, 39.9 g/t silver and 1.33 percent copper on the 4 Shore showing

- Grab sample C363353 returned 0.37 g/t gold, 58.7 g/t silver and 3.43 percent copper on the Maroon Creek showing

- Grab sample C363092 returned 6.7 g/t gold, 21.1 g/t silver, and 0.12 percent lead on the Iceberg showing.

Management Team

Michael Iverson – CEO and Director

Michael Iverson has over three decades of experience in public and private capital markets. He also has significant experience in the mining industry, having founded Niogold Mining and Fortuna Silver Mines. At Niogold, he spearheaded the acquisition and exploration of an expansive land parcel in Val D’Or, leading to the company’s acquisition by Oban Mining, presently known as Osisko Mining , at a substantial premium to its market capitalization. At Fortuna, he played a vital role in the company’s prosperous evolution into a silver producer with operational mines in Peru and Mexico. Iverson, over his entire career spanning three decades, has achieved, in aggregate, market capitalizations over $1 billion.

Yan Ducharme – President and Director

Yan Ducharme is a professional geologist with over 25 years of experience in greenfield and brownfield exploration projects in Quebec, Ontario, Africa and South America. He was on the exploration team at SEMAFO and Cambior/Iamgold and was an exploration manager at NioGold (then vice-president exploration), Canadian Malartic, SOQUEM, and Wesdome Gold Mine. He worked in underground mines and open pits. Ducharme obtained a masters in earth sciences from the University of Quebec in Montreal.

Jasmine Lau – CFO

Jasmine Lau is a seasoned finance and accounting expert with a wealth of experience as a CFO in the mineral exploration and resource sector, having worked on projects across the globe. She was employed in internal audit at Teck Resources and Deloitte, where she focused on audits of public mining and resource companies. Lau is a CPA, CA, and holds a Bachelor of Commerce degree from the University of British Columbia.

Simon Ridgway – Chairman and Director

Simon Ridgway is the CEO of Rackla Metals, a Vancouver-based junior gold exploration company listed on the TSX Venture Exchange since September 2011. He is also the CEO, president and director of Volcanic Gold Mines, a Vancouver-based company engaged in gold and silver property acquisition and exploration.

Michael Michaud – Director

Michael Michaud is a professional geologist with over 30 years of experience. He is an expert in developing and executing regional and mine-site exploration strategies across diverse deposit types in North and South America, Africa, Asia and Europe. Michaud is the vice-president of exploration at Wesdome Gold Mines. He also held roles at several firms, including Iamgold, St Andrew Goldfields, SRK Consulting and North American Palladium. Michaud holds an honors B.Sc. from the University of Waterloo and an M.Sc. from Lakehead University.

Toby Lim – Director

Toby Lim has been a practicing solicitor since 1997, focusing on corporate and securities law. He received a Bachelor of Commerce degree with honours from the University of British Columbia in 1992, followed by a Bachelor of Laws degree from Osgoode Hall Law School in Ontario in 1996.

Jacques Brunelle – Director

Jacques Brunelle has over three decades of involvement in the North American mining sector. He has held executive positions as president and director in publicly traded companies, including Niogold Mining, where he served in 2003, culminating in a successful acquisition by Osisko Mining in 2016. Throughout his career, Brunelle has raised substantial funds for exploration and equity financing initiatives in both public and private enterprises.

Bradley Scharfe – Director

Bradley Scharfe has over 25 years of experience in North America’s capital markets. Scharfe has led financing endeavors throughout his career and assembled robust companies across various sectors, including resources and commodities. He specializes in raising, deploying and managing venture capital for companies in their early growth stages. Previously, Scharfe served as a venture capital stockbroker with Canaccord Capital, a leading Canadian investment firm. Scharfe holds a Bachelor of Arts degree from the University of Toronto, where he majored in commerce and economics.

Credit: Source link