Charles Raup, President, U.S. Confection at The Hershey Company, has recently made a significant stock transaction, selling 2,065 shares of The Hershey Co (NYSE:HSY) on November 29, 2023. This move by a key insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Charles Raup of The Hershey Co?

Charles Raup is a prominent figure within The Hershey Company, holding the position of President, U.S. Confection. In his role, Raup is responsible for overseeing the company’s confectionery operations within the United States, a segment that is critical to Hershey’s overall success. His insights into the company’s operations and market position make his trading activities particularly noteworthy to investors seeking to understand insider sentiment.

The Hershey Co’s Business Description

The Hershey Company, known for its iconic Hershey’s chocolate bar, is a global leader in chocolate and sugar confectionery. Founded in 1894 by Milton S. Hershey, the company has grown into a confectionery powerhouse with a wide range of products, including chocolates, sweets, mints, and other snacks. Hershey’s commitment to quality and innovation has helped it to build a strong brand presence and a loyal consumer base. The company’s operations span across various geographies, with a significant footprint in North America and expanding interests in international markets.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

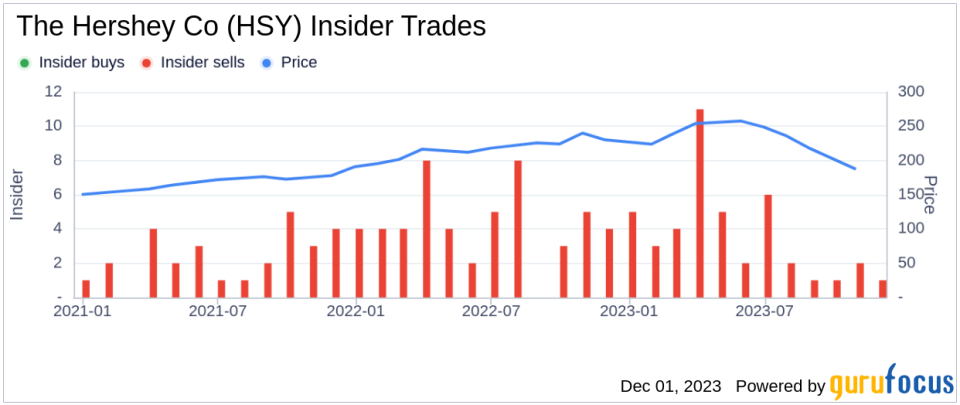

Insider trading activities, such as those of Charles Raup, can provide valuable insights into a company’s internal perspective on its stock’s valuation. Over the past year, Raup has sold a total of 5,089 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders, including Raup, may believe the stock is fully valued or potentially overvalued at current levels.

However, it’s important to consider the context of these transactions. Insider sells can occur for various reasons, including personal financial planning, diversification, and other non-company related factors. Therefore, while insider selling can be a red flag, it should not be the sole basis for investment decisions without a comprehensive analysis of the company’s fundamentals and market conditions.

The insider transaction history for The Hershey Co shows a trend of more insider sells than buys over the past year, with 44 insider sells and no insider buys. This trend could suggest that insiders are taking advantage of the stock’s performance to realize gains.

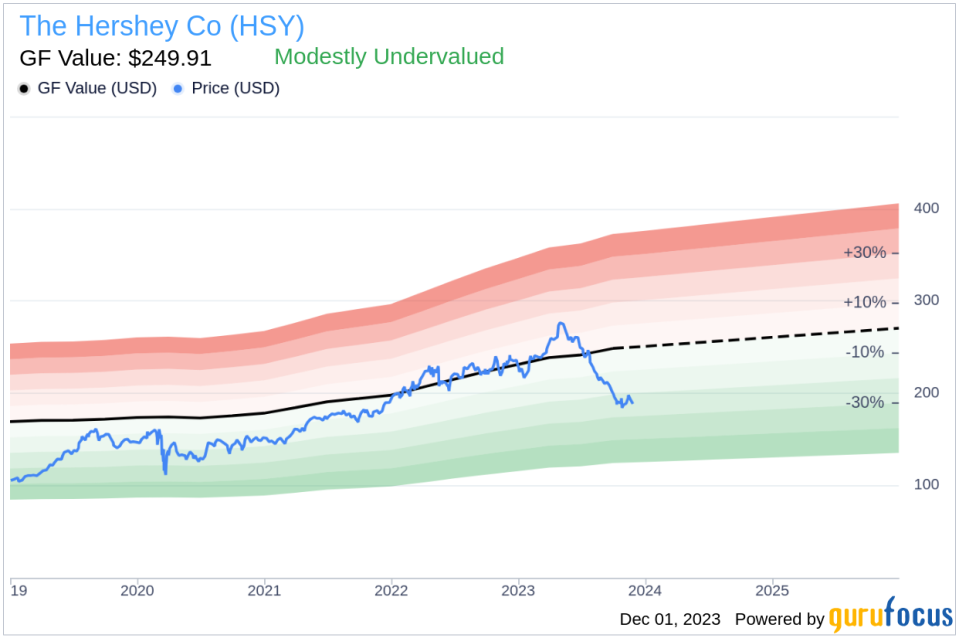

On the day of Raup’s recent sell, shares of The Hershey Co were trading at $188, giving the company a market cap of $38.429 billion. The price-earnings ratio stood at 20.27, slightly above the industry median of 18.99 but below the company’s historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to the industry, it is still below its historical valuation levels.

When examining the relationship between insider trading activity and stock price, it’s crucial to consider the company’s valuation. With a price of $188 and a GuruFocus Value of $249.91, The Hershey Co has a price-to-GF-Value ratio of 0.75, suggesting that the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current price-to-GF-Value ratio indicates that despite the insider selling trend, the stock may still offer value to potential investors.

Conclusion

Charles Raup’s recent sale of 2,065 shares of The Hershey Co is a significant insider move that warrants attention. While the insider selling trend over the past year may raise questions about the stock’s valuation, the modestly undervalued status based on the GF Value suggests that The Hershey Co could still be an attractive investment opportunity. Investors should weigh insider trading patterns alongside a thorough analysis of the company’s fundamentals, industry trends, and broader market conditions before making investment decisions.

As always, it is recommended that investors conduct their own due diligence and consider their investment goals and risk tolerance when evaluating the significance of insider trading activities. The actions of insiders like Charles Raup can provide valuable clues, but they are just one piece of the larger investment puzzle.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link