Overview

Pan Asia Metals (ASX: PAM) is the only publicly traded battery metals company with advanced lithium projects in South-East Asia, strategically located in Thailand – the largest vehicle producer in the region. With Asia accounting for more than half of the global annual vehicle production, PAM is uniquely positioned to capitalize on the soaring demand for battery minerals in the region. PAM’s dedication to producing innovative, high-value products with a minimal carbon footprint makes us an ideal partner for meeting our needs in both battery chemicals and sustainable energy. PAM is also a respected local company, with a strategy focused on developing an integrated supply chain to cost-effectively deliver relevant and in-demand products to the Li-ion battery market. PAM is rapidly advancing its Reung Kiet lithium project through pre-feasibility studies and plans to expand its global lithium resource sustainably through the Kata Thong project, also located in Thailand, and other potential low-cost projects globally.

The move toward a green economy is in full swing as automakers and world governments shift focus to electric vehicles (EVs) and other clean technologies in a global push to achieve carbon-reduction targets. Asia is at the forefront of this transition, both in terms of adoption and opportunities, and the ASEAN countries to the south are following suit with Vietnam, Thailand, Indonesia, and Malaysia positioning to attract battery and EV manufacturers.

EV adoption in mature Asian markets ranged between 1.2 percent and 16.1 percent in 2021, but emerging markets are also making strides. Thailand topped emerging market adoption at 0.7 percent in 2021. Governments are ramping up EV and emissions regulations, including China, South Korea, and Japan. Thailand’s 3030 EV Policy aims to reach 30 percent of domestic EV vehicle production by 2030. Miners within the region are poised for significant growth as Asia embraces clean technology with a focus on developing a domestic supply chain of battery metals.

Pan Asia Metals’ lithium and tungsten assets in Thailand are currently the only advanced lithium projects in Southeast Asia, creating a unique value proposition for low-cost operation and a significant opportunity to value-add its production. Pan Asia Metals is currently the only lithium explorer in Southeast Asia. The company is led by an experienced management team with direct experience in and a deep understanding of the geopolitical environment in Southeast Asia.

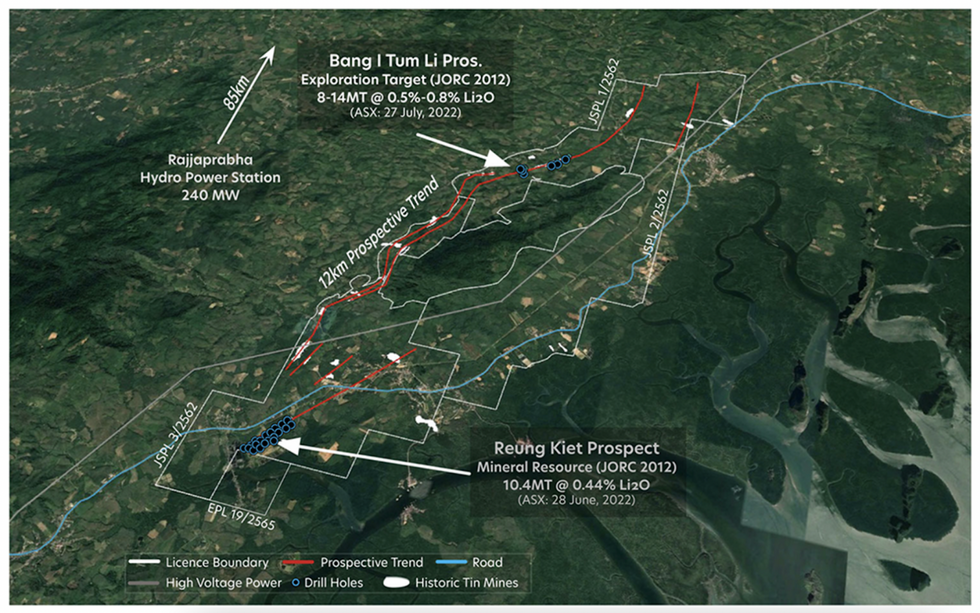

The company operates three projects in Thailand, with 100 percent ownership in each. The Reung Kiet Lithium Project (RKLP), the company’s flagship asset, comprises the aptly named Reung Kiet Prospect (RK) and the Bang I Tum (BIT) prospect. RK contains a JORC-compliant 10.4 million tonnes of lithium oxide at 0.44 percent, and PAM is completing the drill program for a resource upgrade in both tonnes and JORC category. The company is about to start drilling at BIT, which has a drill-supported JORC-compliant 8 to 14 million tonnes of 0.5-0.8 percent lithium oxide. Recent ore sorting of RK samples saw an upgrade in the feed to 1 percent lithium oxide whilst removing over 60 percent of the waste material. Recent rock chip assays at BIT increased the target area of mineralization by over 200 percent with 44 of the 64-rock chip and channel samples averaging 1.56 percent lithium oxide and over 70 percent of these >1.0 percent lithium oxide and over 25 percent >2.0 percent lithium oxide.

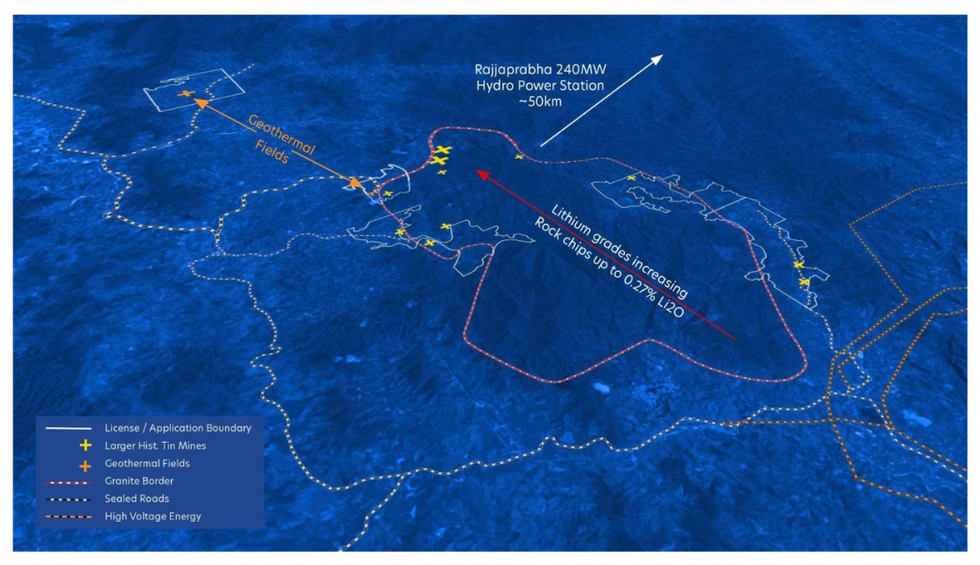

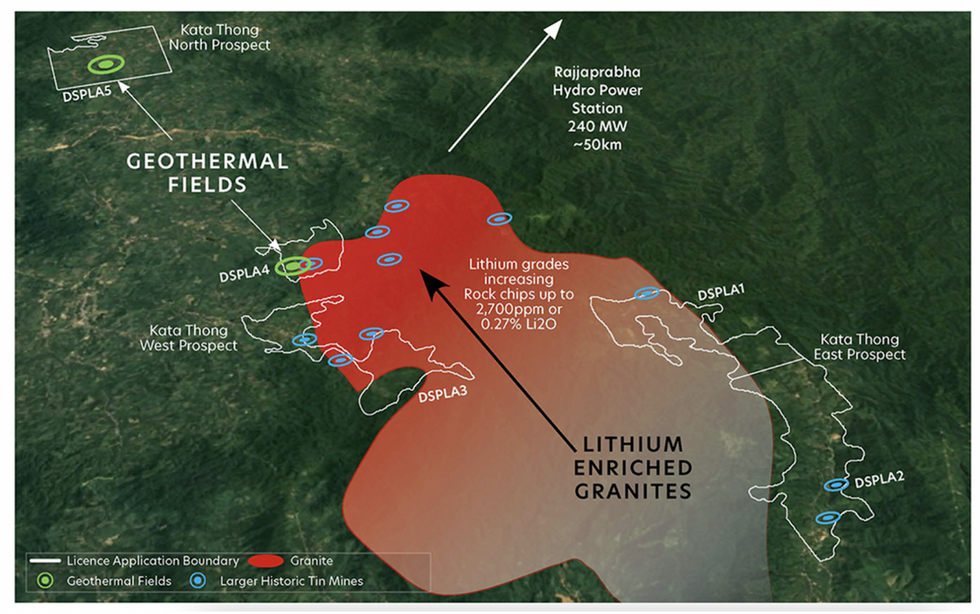

The secondary Kata Thong lithium project is Pan Asia Metal’s second project which contains five application areas with a combination of historic hard rock tin mines and geothermal fields, which are believed to be rich in lithium. The area has produced rock chip assays up to 0.27 percent lithium. Pan Asia Metals’ third asset, Khao Soon, contains tungsten deposits, a metal critical to industrial activity.

A strategic goal of Pan Asia Metals is to ‘move beyond the mine gate’ by adding more value that extends through the supply chain. The company plans to not only explore and develop assets but will also take on processing and refinement to create a final product that is ready for manufacturing lithium-ion batteries. This strategic focus enables the company to provide more immediate value by delivering a high-grade product rather than raw lithium.

Pan Asia Metals is located near the largest manufacturing hub in Southeast Asia. Three of the top Asian auto manufacturers are within Thailand and accessible by all modes of transport. Additional industrial centers are nearby in Malaysia and Singapore. The proximity of these manufacturers allows Pan Asia Metals to further reduce its costs and carbon footprint. Thailand is a low-cost environment with an advanced industrial economy, creating numerous opportunities for cost savings.

A team of experienced managers and explorers leads the company toward its goals of developing and refining critical minerals for manufacturing. In addition to directly applicable experience in the mining industry, leadership members also deeply understand the local business environment offering confidence in its ability to fully capitalize on its assets.

Company Highlights

- Pan Asia Metals is an exploration and development company with assets in Southeast Asia focusing on the critical minerals necessary for clean energy transformation.

- Beyond developing highly prolific deposits, the company wants to move beyond the mine gate by refining and processing a high-grade product ready for cathode manufacturing.

- Pan Asia Metals operates three 100-percent-owned projects in Thailand targeting lithium and tungsten deposits.

- The Reung Kiet flagship project has a JORC-compliant resource estimate of 10.4 million tonnes of lithium at 0.44 percent, with a resource expansion due soon.

- Pan Asia Metals operates two additional assets with significant hard rock lithium and tungsten deposits for future development.

- An experienced managed team with a deep understanding of the Southeast Asian market and the mining industry leads the company towards fully developing its assets.

- The company executed a non-binding memorandum of understanding with VinES Energy Solutions Joint Stock Company for the evaluation of a standalone lithium conversion facility in Vietnam for an initial annual capacity of 20-25,000tpa of lithium carbonate and / or lithium hydroxide.

- Pan Asian Metals discovered new pegmatite zones at the Bang I Tum Lithium Prospect located about eight kilometers north of the Reung Kiet Lithium Prospect in southern Thailand.

Key Projects

Reung Kiet Lithium Project

The company’s flagship Reung Kiet lithium asset is near Phuket, Thailand, and has access to essential infrastructure that will minimize development costs and provide multiple transportation options. The asset was an open pit tin mine up to the 1980s and has received no modern lithium exploration prior to Pan Asia Metals’ acquisition. The company is currently drilling exploration targets to extend known lithium deposits.

Project Highlights:

- Significant Lithium Deposits: The asset has an existing JORC-compliant mineral resource estimate of 10.4 million tonnes of lithium at 0.44 percent, with a resource expansion to be announced soon. An additional exploration target has drill-supported defined estimates of 8 to 14 million tonnes of lithium at 0.5 to 0.8 percent.

- Proximity to Vital Infrastructure: The asset is near significant transportation systems and has access to power. Available infrastructure includes:

- The 240-megawatt Rajjaprabha Hydro Power Station

- Phet Kasem Road or Highway 4 (one of Thailand’s four primary highways)

- Phuket International Airport

- Critical port infrastructure, including Phuket, Ranong Surat Thani

- Encouraging Drill Assays: A recently completed drill campaign produced encouraging results that indicate the blue-sky potential of the asset. Assays include:

- RKDD002 – 15.6 meters at 0.82 percent lithium from 55 meters, including 9 meters at 1 percent lithium.

- RKDD009 – 30.2 meters at 0.69 percent lithium from 37.3 meters, including 6 meters at 1.08 percent lithium from 38.5 meters and 4.5 meters at 1.44 percent.

- RKDD027 – 10.6 meters at 1.24 percent lithium from 28.3 meters

Kata Thong Lithium Project

Pan Asia Metals’ Kata Thong project contains the proper geologic formation indicative of rich lithium deposits. The lithium-rich Kata Khwama granite formation is a 20-kilometer-long strike up to 10 kilometers wide and has produced rock-chip assays up to 0.27 percent lithium.

Project Highlights:

- Positioned for a Zero Carbon Footprint: The ESG rating of an asset is vital when producing materials for the clean energy industry. The Kata Thong asset is near the 240-megawatt Rajjaprabha Hydro Power Station, allowing the company to leverage clean energy in its operations.

- Geologic Surveys Indicative of Lithium: There are three distinct mineralization veins within the project’s area, each with the potential to contain hard rock lithium. These formations are:

- Pegmatite dyke and vein swarms can also contain lithium-tantalum-niobium mineralization.

- Muscovite and tourmaline-muscovite alteration containing high background levels of lithium.

- Simple quartz-cassiterite-wolframite veins

- Five Special Prospect License Applications (SPLA): The company has five SPLAs from the Phang Nga Province in Southern Thailand and once approved, will be ready for exploration and development.

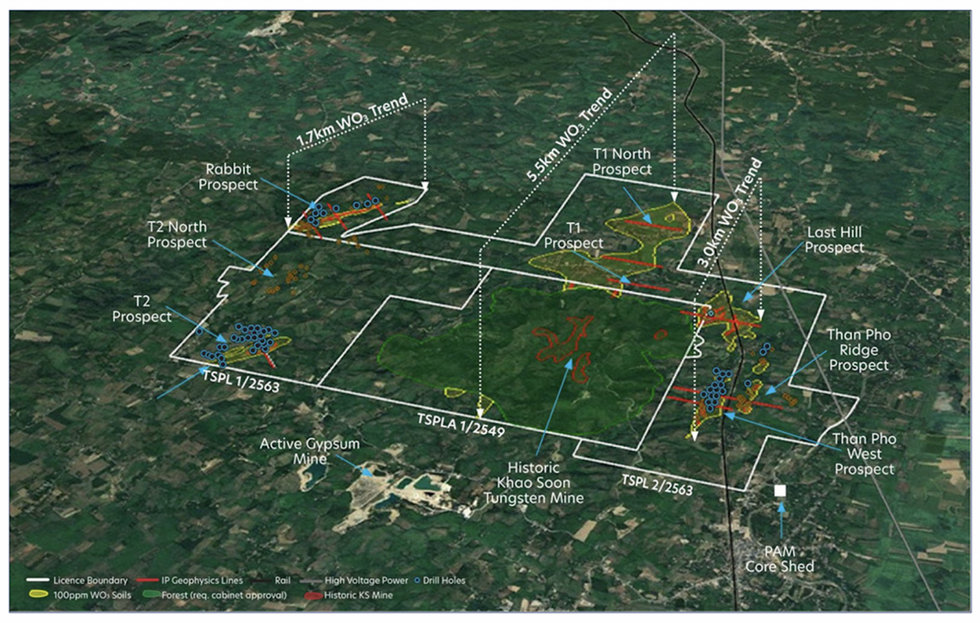

Khao Soon Tungsten Project

The company’s Khao Soon Tungsten asset has an existing JORC 2012 Drill Supported estimate of 15 to 29 million tonnes of 0.2 to 0.4 percent tungsten trioxide. In addition, the mine is a past producing mine that ceased production in 1979, creating the opportunity to apply modern exploration and mining techniques.

Project Highlights:

- A Total of 41 Diamond Drill Holes: Successful drilling campaigns drilled 41 holes totaling 3,513 meters and produced the 15 to 29 million tonnes resource estimate, indicating the asset’s potential.

- Promising Drill Intersections: Completed drilling campaigns produced several promising intersections; some of the top intersections were:

- KSDD001 – 51.5 meters at 0.50 percent tungsten trioxide from 0 meters, including 12.8 meters at 1.07 percent tungsten trioxide from 14.8 meters.

- KSDD021 – 14.55 meters at 0.47 percent tungsten trioxide from 0 meters, including 7.3 meters at 0.62 percent tungsten trioxide from 0 meters.

- KSDD024: 13.1 meters at 0.51 percent tungsten trioxide from the surface, including 4.6 meters at 0.97 percent tungsten trioxide from 8.5 meters.

Management Team

Paul Lock – Chairman and Managing Director

Paul Lock has dedicated his attention to the exploration of mineral resources in Southeast Asia since 2013. He has a background in project finance, leveraged finance and corporate advisory. Lock is a commodities trader with Marubeni and a derivatives trader with Rothschild.

David Hobby – Technical Director and Chief Geologist

David Hobby is an Economic Geologist with more than 30 years of experience. He has worked in a variety of geological terrains across Asia, Australia, Argentina, USA, and Africa. Hobby is experienced in all facets of the minerals project cycle.

David Docherty – Non-Executive Director

David Docherty’s involvement in the resource sector began in London in 1965, and he has been involved in the Thai resource sector since 1987. He was the managing director of Mining Finance Corp in 1969. Docherty is a founding member of the team who discovered Chatree.

Supriya Sen – Non-Executive Director

Supriya Sen is a former senior advisor at McKinsey, a leading strategic consultancy firm. She has a background in banking, with more than 30 years of experience at firms such as GE Capital, World Bank, Asian Development Bank and Citibank. Sen is a strategic advisor focused on financial inclusion, innovation and technology transformation, sustainability, and green infrastructure finance sectors.

Credit: Source link