Crude oil prices have been on fire this year. WTI, the primary U.S. oil price benchmark, has surged from around $70 a barrel at the start of the year to nearly $90 a barrel recently. Higher oil prices will be a boon for oil companies, which should produce a lot more free cash flow this year.

The rising tide of higher oil prices should lift all boats in the oil patch. However, Chevron (NYSE: CVX), Devon Energy (NYSE: DVN), and Diamondback Energy (NASDAQ: FANG) stand out to a few Fool.com contributors for their ability to cash in on higher oil prices. Here’s why they think that investors should check out these oil stocks.

Chevron isn’t benefiting as much; that’s good for you

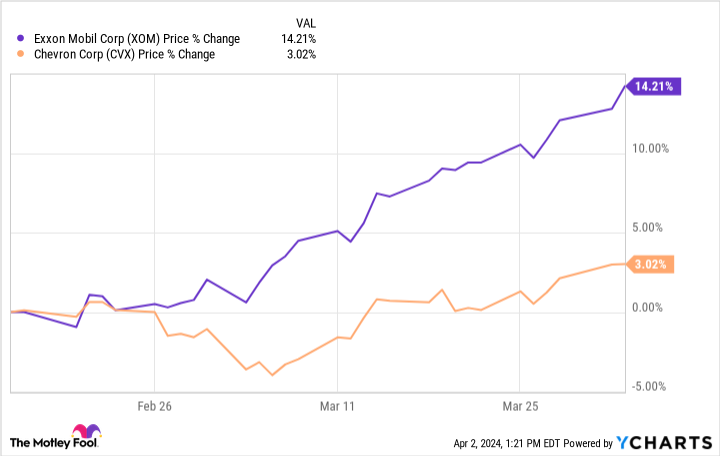

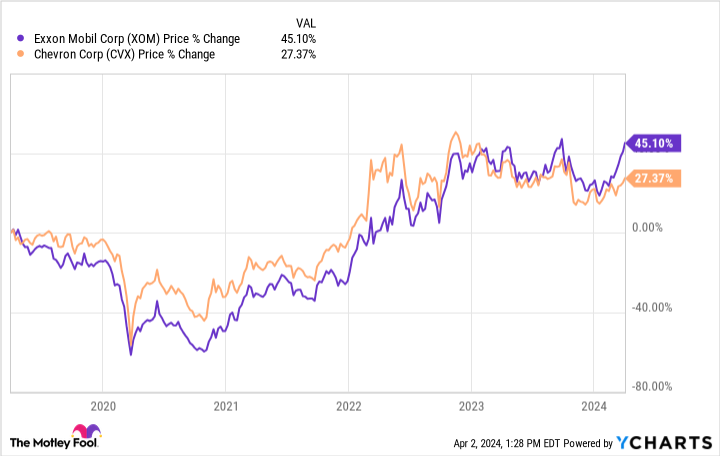

Reuben Gregg Brewer (Chevron): Chevron and ExxonMobil (NYSE: XOM) are similar in many ways. But the stocks of these two integrated energy giants have diverged of late, as Wall Street is worried that Chevron’s acquisition of Hess (NYSE: HES) could fall apart. The problem is that Exxon doesn’t want Chevron to gain a toehold in an Exxon-operated project located in Guyana. To put a number on that divergence, Chevron’s stock is up just a couple of percentage points since mid-February, when rumors of trouble started to circulate, while Exxon’s stock has gained 14%.

But because of this issue it appears that Exxon’s stock is benefiting more from oil’s recent price moves than Chevron. To be fair, the Hess deal is sizable and the Guyana project is important. But in the long run, this isn’t a make-or-break issue. Chevron is large enough and financially strong enough to do just fine without Hess.

What’s notable about this divergence is that the stock prices of Chevron and Exxon normally track fairly closely with each other over time. And divergences like this often get resolved with the laggard simply catching up to the leader. A further rise in energy prices could be just what’s needed to get investors excited about Chevron again. And even if that doesn’t happen in the near term, the performance gap is still likely to close over the longer term. You can buy Chevron while it looks relatively cheap and collect its generous 4.1% dividend yield while you wait for better days.

Devon’s variable dividends could surge with oil prices

Neha Chamaria (Devon Energy): While many oil and gas stocks pay a dividend, owning Devon Energy stock could be particularly rewarding when oil prices are going up, thanks to its flexible-plus-variable dividend policy.

The thing is, aside from paying a fixed dividend every quarter, Devon Energy also pays a variable dividend equal to up to 50% of the excess free cash flow (FCF) it generates in the quarter. Since its cash flows rise alongside oil prices, investors in Devon Energy can often expect to earn big dividends when oil prices rise. To give you an example of how Devon’s dividends can grow alongside oil prices, consider that the company’s total dividend payout (fixed-plus-variable dividend) per share jumped 57% sequentially in the third quarter of 2023 as its average realized price of oil rose nearly 11%.

Of course, Devon is an interesting dividend stock to own when oil is up because it also has the financial fortitude to support bigger dividends. The company plans to increase oil production only moderately in the near term to avoid oil price shocks and is focused on FCF generation while keeping debt at manageable levels. It also aims to return capital to shareholders consistently in the form of dividends as well as share repurchases. The fact that Devon also increased its fixed dividend payout by 10% last quarter underscores its financial strength and commitment to paying steady and regular dividends regardless of where oil prices are. With oil prices inching higher right now, you have a solid reason to consider this 4.6%-yielding stock.

Poised to produce an even bigger free-cash-flow gusher

Matt DiLallo (Diamondback Energy): Diamondback Energy spent years building a premier position in the Permian Basin. That strategy has paid big dividends in recent years. Its growing scale has enabled it to produce an increasing amount of free cash flow.

The company can produce over $2.8 billion in free cash flow this year at $70-a-barrel oil. That number will rise to $3.4 billion at $80 oil and over $4.1 billion if crude averages $90 a barrel. With oil prices rising this year (from around $70 at the beginning to nearly $90 recently), it’s on track to produce a lot more free cash flow this year.

Diamondback Energy could produce even more free cash flow this year if it closes its needle-moving acquisition of Endeavor Energy Resources. It’s buying its rival in a $26 billion deal to create a premier pure-play independent producer in the Permian. Diamondback estimates that the deal will increase its free cash flow per share by more than 10% next year.

The company plans to return half of this year’s free cash flow to investors via dividends and share repurchases. That’s down from a target of at least 75% last year because the company wants to retain additional cash to repay debt following its acquisition of Endeavor. Once it reaches its targeted leverage ratio, Diamondback could boost its capital return target. With oil prices surging this year, the company could achieve its leverage target even faster. Meanwhile, even at the current 50% level, Diamondback will produce more cash to return to investors this year.

Diamondback Energy’s rising cash flow and cash returns could help give it the fuel to produce strong total returns from here.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $526,345!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 4, 2024

Matt DiLallo has positions in Chevron. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Oil Is Up, These 3 Energy Stocks Are Set to Reward Investors was originally published by The Motley Fool

Credit: Source link