Undoubtedly, Nvidia (NASDAQ: NVDA) has already seen its stock soar. As the chipmaker became the face of the artificial intelligence (AI) revolution, its share price rose, and it’s now up by more than 600% since the beginning of 2023. Yet that wasn’t the first time the company’s market cap multiplied in a relatively short period. Between early 2020 and late 2021, Nvidia’s stock gained more than 400%.

I think it may be some time before we see the company make another run on par with either of those. To be sure, Nvidia is in a strong position to continue growing its market-leading data center segment for some time. Major customers such as Meta Platforms and Alphabet are showing no signs of slowing their massive spending on data center infrastructure. That being said, its growth will likely be slower than what fueled its most recent run.

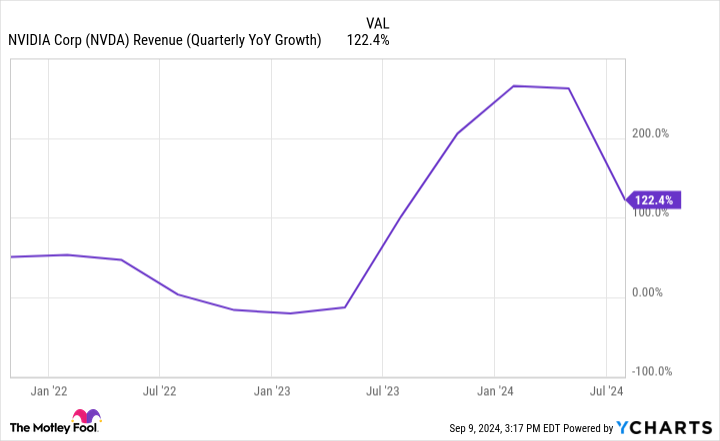

We’re already seeing this play out. As the graph below shows, year-over-year quarterly revenue growth is decelerating. Don’t get me wrong — its 122% growth in Q2 was still incredible, but it was less than half what the previous two quarters delivered, and the company is projecting roughly 80% year-over-year growth for the current quarter.

Autonomous driving will be the catalyst for Nvidia’s next big inflection point

In Q2, Nvidia’s automotive arm produced $346 million in revenue. That’s not bad, but it’s a far cry from where it could be in the future. In fact, CEO Jensen Huang believes it to be a $300 billion market. This would include the software and hardware that will be embedded both in the cars themselves and in data centers that will be integral to powering an autonomous vehicle network. Huang says he believes this will be “one of the largest AI industries in the world.”

Of course, we should take a CEO’s words with a grain of salt when they’re talking about their company’s future opportunities, but Huang’s estimation is in line with analysis from respected research firms. How long it will be before the technology matures to a point where it can really take off is the bigger question. It may be some time before we have truly autonomous cars on the road, but there has been a lot of progress toward that goal of late. I think it’s more than possible that this market will begin to explode before the end of the decade.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Prediction: Nvidia Stock Will Soar Over the Next 5 Years. Here’s 1 Reason Why. was originally published by The Motley Fool

Credit: Source link