Nvidia (NASDAQ: NVDA) stock made headlines Wednesday by becoming just the third U.S. public company to cross the $3 trillion market cap threshold. In January 2022, Apple was the first to achieve that notable feat, followed by Microsoft in January 2024. A growing chorus of investors believes that Nvidia will inevitably take the market cap crown from Microsoft at some point in the near future.

Let’s look at what drove Nvidia stock to such dizzying heights and what investors can expect from the chipmaker in the future.

Chipmaker to the stars

Nvidia has been on fire in recent years as the interest sparked by artificial intelligence (AI) has spread like wildfire. Yet it’s important to look back because it wasn’t very long ago that investor sentiment had turned decidedly against Nvidia. Consider this: Between November 2021 and October 2022, Nvidia stock fell more than 66% in the face of macroeconomic headwinds. Gamers were making do with older graphics cards, and businesses had no interest in upgrading their data centers.

“This too shall pass,” or so the old saying goes. The advent of generative AI in early 2023 caused a paradigm shift in technology, and investors soon realized that Nvidia’s data center chips were at the heart of the AI revolution.

In short, generative AI is a new branch of AI that can create original content, and it’s unlike anything that came before. These AI models can write poems, fashion new songs and music, and even create digital paintings and other images. The novel abilities of these systems soon attracted the attention of technologists who realized that these same systems could be configured to draft emails, generate presentations, create charts and graphs, and even write and debug code. These abilities could increase worker productivity, thereby saving businesses time and money — and the race was on.

The secret to Nvidia’s success is the parallel processing capabilities built into its graphics processing units (GPUs). In simplest terms, parallel processing takes massive computational tasks and breaks them down into smaller, bite-sized pieces, making short work of otherwise onerous tasks. The company had already repurposed this technology to advance earlier versions of AI, so Nvidia was ready when generative AI came calling.

However, these AI models, with trillions of variable bits of training data — called parameters — still require thousands of GPUs to complete the task. For example, to train OpenAI’s GPT-4, it took more than 25,000 of Nvidia’s top-of-the-line A100 AI processors to complete the task. Now consider that each of these A100 chips costs about $10,000, or roughly $250 million, to train just one AI model. Multiply that by all the cloud infrastructure providers, data centers, and enterprise-level businesses worldwide that want a piece of the AI action, and the size of the opportunity becomes apparent.

An enduring track record of success

Nvidia wouldn’t be where it is today without the foresight of CEO Jensen Huang. AI is viral now, but that wasn’t the case in 2013 when the enigmatic chief executive pivoted Nvidia and bet the company’s future to embrace this as yet unproven technology.

Believing that AI was the future, Huang adapted parallel processing, which originally rendered lifelike images in video games, and unleashed it to handle the rigors of AI. And the rest, as they say, is history.

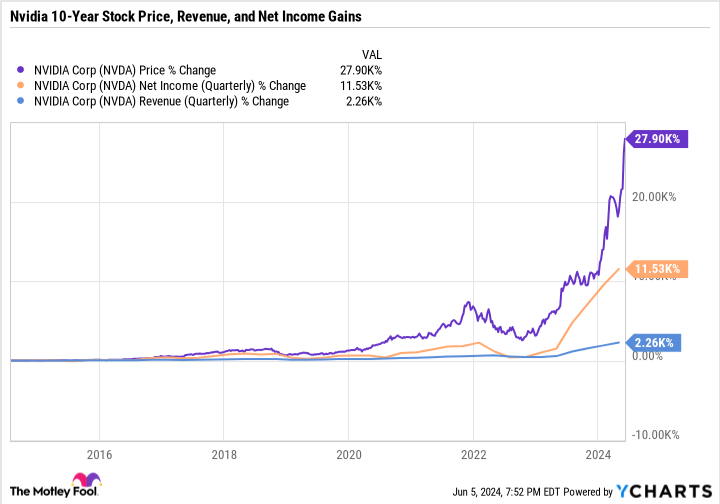

Nvidia already had a long history of success before generative AI became the belle of the ball, but AI is paying the bills now. Over the past decade, Nvidia’s revenue has jumped 2,260%, fueling net income that surged 11,530%. This has driven its stock price up 27,900%, and many believe the best is yet to come.

Nvidia’s meteoric rise is about to give way to a 10-for-1 stock split, which is scheduled to take place after the market close on Friday. Research compiled by Bank of America analyst Jared Woodard suggests that companies that split their shares tend to increase 25%, on average, in the year following the split, compared to a 12% gain for the S&P 500. This is likely caused by the same operational and financial excellence that fueled the rising stock price, resulting in a stock split.

A look at Nvidia’s most recent results paints a compelling picture. For its fiscal 2025 first quarter (ended April 28), Nvidia’s revenue soared 262% year over year to a record $26 billion, while earnings per share skyrocketed 629% to $5.98. The results were driven higher by the data center segment, which includes AI processors, as revenue of $22.6 billion jumped 427%, fueled by accelerating demand for AI chips.

What this means for Nvidia’s future

In recent months, investors have begun to question the staying power of AI, with some taking a “wait and see” approach, but the resulting lesson could be costly. One of the more conservative estimates regarding the size of the generative AI market is $1.3 trillion by 2032, according to Bloomberg Intelligence. Ark Invest CEO Cathie Wood is much more bullish, suggesting a total addressable market of $13 trillion by 2030. The reality is likely somewhere in between, but the truth is we simply don’t know how large the AI market will ultimately be.

What we do know is this. The deepest pockets in big tech are scrambling to develop a competitor to Nvidia’s gold-standard GPU, which has had limited success thus far. Furthermore, Nvidia continues to spend heavily on research and development (R&D) in order to keep its AI processors on the cutting edge. That amounted to nearly $8.7 billion last year, or 14% of its total revenue. With more than a decade-long head start and continuing large expenditures on R&D, it’s going to be tough for its rivals to “chip” away at Nvidia’s leadership. That said, the competition is coming, but the size of the market suggests there can be more than one winner.

It’s also important to note that a $3 trillion market cap benchmark is entirely arbitrary. Investors would be better served to keep their eye on Nvidia’s operating and financial results — which have been consistently stellar — for insight into the company’s ongoing prospects.

Finally, a note on valuation. The run-up in Nvidia’s stock price in recent years has driven its valuation to a level that is uncomfortable for many investors. The stock is currently selling 72 times earnings and 38 times sales, which many find egregious. However, that fails to take into account Nvidia’s triple-digit growth over the preceding four quarters, a trajectory that’s expected to continue into the current quarter. However, Nvidia’s price/earnings-to-growth (PEG) ratio — which factors in that growth — clocks in at less than 1, the standard for an undervalued stock.

Bears will argue that the threat of competition is real, the stock is expensive, and the future of AI is unknown. That said, Nvidia is the surest way to stake a claim in the windfall represented by AI. In my book, that makes Nvidia stock a buy.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Apple, Bank of America, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Hits a $3 Trillion Market Cap Ahead of Its 10-for-1 Stock Split. Here’s What’s Next for Investors. was originally published by The Motley Fool

Credit: Source link